What's new with Lacerte

by Intuit•32• Updated 4 months ago

What's New with Intuit Lacerte for Tax Year 2025

Intuit Tax Advisor

Create custom tax plans in minutes that deliver clients more savings—all thanks to built-in advisory strategies automatically generated inside every Lacerte tax return (Now fully integrated.)

- Quantify tax savings in client-friendly reports

- Leverage a whole new additional revenue stream

- Eliminate data entry and streamline scenario planning

See what's new in Intuit Tax Advisor here.

Automated dependent returns

Instantly generate a new tax return for a dependent directly from the parent's return. All relevant information is carried over automatically, boosting your firm's efficiency and ensuring data accuracy. See how to use this new feature here.

Automated K-1 delivery

Streamline K-1 package delivery by sending all partners a secure email link simultaneously, automating the entire distribution process, ensuring timely and accurate K-1 delivery with minimal effort.

Coming Soon Disclaimer: This information is intended to outline our general product direction, but represents no obligation and should not be relied on in making a purchasing decision. Image provided for illustrative purposes; actual product screen may vary. Additional terms, conditions and fees may apply with certain features and functionality. Eligibility criteria may apply. Product offers, features, functionality are subject to change without notice.

Previous Years

We’re dedicated to continuously improving the overall quality and security of your tax software to help you have a better tax year.

From key workflow tool improvements and the most comprehensive e-filing library you can count on Lacerte to help make tax work more efficient and impactful.

Intuit Tax Advisor included with Lacerte

Intuit Lacerte now includes Intuit Tax Advisor built in at no additional cost so offering client-friendly tax planning reports to all your clients has never been easier. Create custom tax plans in minutes and show your clients valuable savings using tax strategies automatically generated from your client’s tax return.

For tax year 2024, all customers will have access to create a new plan or open an existing plan for all their clients directly from the client dashboard.

Background updates

No more interruptions or reboot downtime due to product updates - Lacerte will now autocheck for product updates and have downloads ready for installation when you are. Preview what’s included in the release and choose to install now or later.

Effortlessly stay up-to-date with the latest Lacerte version! Learn more about Background updates.

Multi-year access

Save time by accessing multiple years of Lacerte without additional logins. Sign in once and have instant access to up for up to three prior year versions of Lacerte.

Import Trial Balance from QuickBooks Online

You can import your clients Trial Balance information from QuickBooks Online utilizing Lacerte's Trial Balance Utility. Learn how here.

Partnerships Integrations

Protection Plus Business Returns

Now you can cover both your individual and business return clients with Protection Plus. Dedicated EAs and CPAs will provide your business clients (1065, 1120, 1120-S) with the same notice and audit resolution services that saves you time from waiting on hold with the IRS or dealing with the tedious back and forth from state entities. As a bonus, Protection Plus comes with identity theft restoration services in the event that your client falls victim to identity theft. Learn more on our website.

SafeSend integration

The SafeSend, Lacerteintegration sends your clients’ returns to SafeSend directly from the Lacerteclient grid with one click–no downloading and uploading needed. Once one-click action is set up, Lacerteautomatically sends the most recent version of the return to SafeSend. You no longer need to keep track of edited versions outside of Lacerte.

SafeSend automates the entire tax process from taxpayer document gathering to tax return delivery with secure and compliant engagement letters, file transfers, organizers, e-signatures, tax return assembly and delivery, and a new AI-driven gathering capability which renders the need to upload traditional organizers a thing of the past. Learn how to turn on one-click. Or Schedule a demo with SafeSend

Quick Employer Forms Accountant

Under the new IRS rules, filers of 10 or more returns of certain files (including W2 and 1099s) for a calendar year generally will need to file electronically with the IRS. Previously, electronic filing was required if the filing was more than 250 returns of the same type for a calendar year. With Quick Employer Forms Accountant, you can create and e-file an unlimited number of W-2s and 1099s for your clients’ employees and contractors. You can e-file and print forms within a business and across multiple businesses individually and in bulk. It supports Forms W-2, 1099-NEC, 1099-MISC, 1099-INT, and 1099-DIV. You’ll also get W-3 & 1096 forms for your records automatically. Learn more on our website.

Intuit Select Pro Staffing

Find staff easily with this new outsource provider program. We’ve partnered with credentialed hiring solution providers so you don’t have to. These providers will match you with expert outsourced staff trained that are already on your software, so you can grow your business the way you want with staff custom fit for your firm. Learn more on our website

SmartVault

SmartVault is a secure online file sharing and document storage program that offers unlimited data storage capabilities so that you can store and access documents safely in the cloud. Get features built for business, including selective sharing, group security management, custom templates, audit reporting and a robust view in browser capability. Plus, create a custom-branded client portal to access, manage, and securely share all your files and documents. SmartVault integrates seamlessly with Lacerte, creating a seamless, interconnected workflow that allows you access files from any computer, browser, or mobile device anywhere, at anytime. Learn more on our website.

Workflow enhancement suggestions

Looking for specific forms or filing types? Final list will be available by November and reflected in our online forms finder tool.

Use our online forms finder

For more updates on Lacerte, visit Lacerte Tax News and Updates.

As you work in different parts of Lacerte, you’ll occasionally receive recommendations on tools that can help you streamline certain processes in your workflow.

CD Availability

Beginning with 2024, CDs will no longer available for tax year 2024. Please see here for more information.

If you need to create a backup installer for Lacerte, see here for more information.

What's New With Intuit Lacerte Tax for Tax Year 2023

We’re dedicated to continuously improving the overall quality and security of your tax software to help you have a better tax year. From key workflow tool improvements to 20 new e-file capabilities, you can count on Lacerte to help make tax work more efficient and impactful.

Looking for specific forms or filing types? Use our online forms finder

Form Help

Form Help provides additional in-product information to help you determine how a line is calculated.

To turn the Form Help on in Lacerte, check the Form Help box located at the top of the screen while viewing the Forms tab.

Once the Form Help checkbox is marked, this feature is turned on. You’ll notice several lines appearing with a blue question mark icon. Note: By default this checkbox will remain unchecked until you decide to check it.

End of support: Windows Server 2012 and Windows Server 2012 R2

As of October 10, 2023, Microsoft will no longer provide security updates, non-security updates, bug fixes, technical support, or online technical content updates. At Intuit, security of your data is a top priority, so we encourage our customers who are running Windows Server 2012 and Windows Server 2012 R2 to upgrade to Windows Server 2016 or higher. Visit the Community for the complete list of system requirements

SafeSend integration

Send your clients’ returns to SafeSend directly from the Lacerte client grid–no downloading and uploading needed, so you can more efficiently assemble, deliver, and e-sign completed tax return packages. Learn more here.

Simplified Intuit Tax Advisor plan creation

Now you can start tax plans for your 1040 clients more efficiently with a quick click from your client grid. This will open AND sign you into Intuit Tax Advisor, so you can immediately start working on that client’s tax plan.

Quick Employer Forms Accountant

Under the new IRS rules, filers of 10 or more returns of certain files (including W2 and 1099s) for a calendar year generally will need to file electronically with the IRS. Previously, electronic filing was required if the filing was more than 250 returns of the same type for a calendar year. With Quick Employer Forms Accountant, you can create and e-file an unlimited number of W-2s and 1099s for your clients’ employees and contractors. You can e-file and print forms within a business and across multiple businesses individually and in bulk. It supports Forms W-2, 1099-NEC, 1099-MISC, 1099-INT, and 1099-DIV. You’ll also get W-3 & 1096 forms for your records automatically. Learn more on our website.

Intuit Select Pro Staffing

Find staff easily with this new outsource provider program. We’ve partnered with credentialed hiring solution providers so you don’t have to. These providers will match you with expert outsourced staff trained that are already on your software, so you can grow your business the way you want with staff custom fit for your firm. Learn more on our website

Workflow enhancement suggestions

As you work in different parts of Lacerte, you’ll occasionally receive recommendations on tools that can help you streamline certain processes in your workflow.

Security

Two-factor authentication

While not required, the IRS and we at Intuit highly encourage you to enable two-factor authentication to help protect against unauthorized access to the sensitive data in your possession.

End of support: Windows 8.1

As of January 10, 2023, Microsoft will no longer provide security updates, other updates, or support for PCs running Windows 8.1, making computers running on Windows 8.1 more vulnerable to security risks and viruses. At Intuit, security of your data is a top priority. Beginning with our first release of the 2022 tax software, you will not be able to install Lacerte if you are running Windows 8.1. Please upgrade to Windows 10 or higher. Visit the Community for the complete list of system requirements.

Product enhancements

Forms Help

Get more information about a specific tax form or calculation while you work, without leaving that form. Press "Forms Help" at the top of the form or after right-clicking a calculated field to open a Community article and get instant answers to your questions.

Intuit Tax Advisor integration

Sync your clients' returns with Intuit Tax Advisor to build custom tax-savings plans in

minutes. Select from over 25 strategies that will help you make a difference in your clients' lives. Claim 3 free credits through the Integrations tab in Lacerte.

Reduced timeouts

We’ve removed 30-minute inactivity timeouts, so you can leave Lacerte running for up to 12 hours without getting automatically signed out.

Product enhancements: Streamline your operations

- Verify your EFIN in Lacerte

- Tax accuracy notifications (COMING SOON)

- New billing profile

- Easier onboarding to Hosting for Lacerte

- Lacerte Actionable Steps for Error Resolution (LASER)

- Lacerte 200 Federal 1040 enhancements

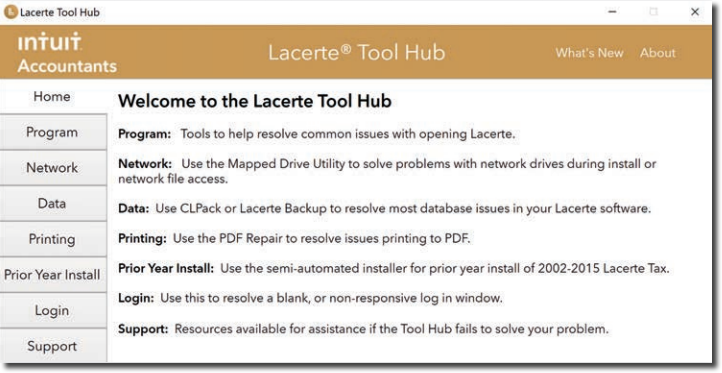

Lacerte Tool Hub

The tool hub enables you to quickly resolve common system issues and errors , so you can get back to serving your clients. Find this handy tool by searching for “Tool Hub” in Lacerte, and use it for issues including:

• Desktop alerts

• Repair updates

• Mapped Drive tool

• Component Repair tool

• Backup Utility

• Networking errors

Enhanced customer support, with one-on-one and self serve options...

Get product support on your schedule: We know your schedule can be hectic, so now you can request a support appointment or have the support team call you back.

Intelligent voice assistant: We’re helping you get what you need faster with a new listening tool that directs you to self-serve solutions so you don’t have to stay on hold to talk to an agent.

The Lacerte Tax Idea Exchange: Help us make the product enhancements that are important to you. Vote for the ideas you like most, then get updates on their status, whether they are under review, accepted, or implemented. Find it in The Community

Take advantage of the 120 forms and 46 e-filing types across 27 states.

Print and e-filing capabilities for the following forms (120):

Forms

- Federal

- Individual

- Form 9000, Alternative Media Preference

- Form 8915-F, Qualified Disaster Retirement Plan Distributions and Repayments

- Individual, Corporate, S-Corporate, Partnership

- Form 14039-B, Business Identity Theft Affidavit

- Individual, Fiduciary, Corporate, S-Corporate, Partnership, Fiduciary, and Exempt

- Form 5471 Sch G-1, Cost Sharing Arrangement

- Partnership

- Schedule K-2, Partner's Distributive Share Items - International

- Schedule K-3, Partner's Share of Income, Deductions, Credits, etc. - International

- Individual

- ALABAMA

- Individual

- Schedule ATP, Additional Taxes & Penalties

- Schedule HBC, First Time Second Chance Home Buyer Deduction

- S-Corporate and Partnership

- Form PTE-E, Pass-Through Entity Election Form

- Form EPT, Electing Pass-Through Entity Payment Return

- Schedule EPT-K1, Electing Pass-Through Entity K-1

- Schedule EPT-C, Electing Pass-Through Credit

- Schedule PTE-AJA, Alabama Jobs Act-Investment Credit

- Individual

- ARKANSAS

- Individual

- Form AR2441, Child and Dependent Care Expenses

- Individual, Corporate, S-Corporate, Partnership, and Fiduciary

- Form AR8944, Preparer e-file Hardship Waiver Request

- Individual

- GEORGIA

- Individual

- Form IND-CR 213, Adoption of a Foster Child

- Individual

- INDIANA

- Individual

- Form IN-40PA, Indiana Post-liability Allocation Schedule

- Partnership

- Schedule IN-EL, Tax Computation Form Electing Partnerships

- Fiduciary

- Form IT-41 Schedule 1, Other Income

- Individual

- KANSAS

- Individual

- Schedule A, Itemized Deductions

- Individual

- MINNESOTA

- Fiduciary

- Schedule M1MB, Business Income Additions and Subtractions

- Schedule M1LOSS, Minnesota Limitation on Business Loss

- Partnership and S-Corporation

- Schedule PTE, Pass-Through Entity Tax

- Fiduciary

- NEW YORK

- Individual

- IT-203-F, Multi-Year Allocation Form

- IT-221, Disability Income Exclusion

- IT-237, Claim for Historic Homeownership Rehabilitation Credit

- IT-6-SNY, Metropolitan Commuter Transportation Mobility Tax for START-UP NY

- Individual and Fiduciary

- IT-112.1, NYS Resident Credit Against Separate Tax on Lump-Sum Distributions

- Individual and Partnership

- IT-239, Claim for Credit for Taxicabs and Livery Service

- IT-501, Temporary Deferral Nonrefundable Payout Credit

- DTF-630, Claim for Green Building Credit

- Individual, Fiduciary, and Partnership

- IT-211, Special Depreciation Schedule

- IT-212-ATT, Claim for Historic Barn Rehabilitation Credit and Employment Incentive Credit

- IT-236, Credit for Taxicabs and Livery Service Vehicles Accessible to persons with Disabilities

- IT-238, Claim for Rehabilitation of Historic Properties Credit

- IT-246, Claim for Empire State Commercial Production Credit

- IT-248, Claim for Empire State Film Production Credit

- IT-252, Investment Tax Credit for the Financial Services Industry

- IT-253, Claim for Alternative Fuels Credit

- IT-261, Claim for Empire State Film Post-Production Credit

- IT-602, Claim for EZ Capital Tax Credit

- IT-605, Claim for EZ Investment Tax Credit and EZ Employment Incentive for the Financial Services Industry

- IT-613, Claim for Environmental Remediation Insurance Credit

- IT-633, Economic Transformation and Facility Redevelopment Program Tax Credit

- IT-634, Empire State Jobs Retention Program Credit

- IT-636, Alcoholic Beverage Production Credit

- DTF-621, Claim for QETC Employment Credit

- DTF-624, Claim for Low Income Housing Credit

- DTF-626, Recapture of Low-Income Housing Credit

- Fiduciary

- IT-230, Separate Tax on Lump-Sum Distributions

- Partnership

- IT-250, Claim for Credit for Purchase of an Automated External Defibrillators

- Individual

- NORTH CAROLINA

- Partnership and S-Corporation

- Form NC-PE, Additions and Deductions for Pass-Through Entities, Estates and Trusts

- Partnership and S-Corporation

- OREGON

- Individual

- Form MC-40, Multnomah County Preschool for All

- Form MC-40-NP, Multnomah County Preschool for All

- Form MET-40, Metro Supportive Housing Services

- Form MET-40-NP, Metro Supportive Housing Services

- Corporate

- Form METBIT-20, Metro Supportive Housing Services Business Income Tax Return for Corporations

- Fiduciary

- Form METBIT-41, Metro Supportive Housing Services Business Income Tax Return for Trusts and Estates

- Partnership

- Form METBIT-65, Metro Supportive Housing Services Business Income Tax Return for Partnerships

- S-Corporation

- Form METBIT-20S, Metro Supportive Housing Services Business Income Tax Return for S-Corporations

- Individual

- SOUTH CAROLINA

- Individual

- Schedule TC-38, Solar Energy or Small Hydropower System or Geothermal Machinery and Equipment Credit

- Individual

E-Filing Capabilities

- Main Return

- Hawaii Partnership and Fiduciary

- Indiana Fiduciary

- Kentucky (Louisville) Individual, Corporate, S-Corporation, and Partnership

- Massachusetts Grantor Fiduciary

- North Carolina Fiduciary

- Amended Returns

- Arkansas Individual

- Colorado Individual

- Connecticut Individual

- District of Columbia Individual, Corporate, Fiduciary, S-Corporation, and Partnership

- Hawaii Individual, Corporate, Fiduciary, S-Corporation and Partnership

- Indiana Fiduciary

- Iowa Individual

- Kansas Individual

- Kentucky Individual

- Maine Individual

- Mississippi Individual

- Missouri Individual

- Montana Individual

- New Hampshire (BT Sum) Individual

- New Hampshire (DP-10) Individual

- New Mexico Individual

- North Carolina Individual

- Oklahoma Individual

- Rhode Island Individual

- South Carolina Individual

- Utah Individual

- Virginia Individual

- West Virginia Individual

- Extension/Estimated Payments

- Extensions - Kentucky (Louisville) Individual, Corporate, S-Corporation, and Partnership

- Estimated Payments - Virginia Individual

Get the most out of Lacerte with free training...

Anytime is a great time to sharpen your skills and learn more about your Lacerte 2020 software, which is why we provide a variety of free training opportunities throughout the year.

Lacerte Webinars

See the exciting new features and improvements coming to Lacerte for Tax Year 2020 from by watching one of our live or pre-recorded webinars. Deepen your knowledge, get great software tips, and stay ahead of the industry with free webinars catered to tax professionals like yourself.

View upcoming Lacerte webinars >>

Lacerte Training Portal

Prepare for tax season with our Training Portal, with relevant and personalized content recommendations on the features you use.

Check out the Training Portal >>

Time-Saving Features Learning Center

The average Lacerte user only knows about 48% of the basic time-saving features! What might you be missing? Discover new ways to work more efficiently in our Time-Saving Features Learning Center, created from ratings and surveys from your peers.

Product enhancements: Helping save you time

Streamline document collection and collaboration: For tax years 2020 and 2021, we’re reviewing all of the existing collection and input tools, and making meaningful improvements to collection and collaboration to keep preparers moving quickly. For example, we will enhance the Intuit Link client login experience with options in addition to a password. These include one-time passwords (OTP) using authentication identifiers, such as their email address or phone number to seamlessly access their account. This reduces your need to provide IT support to clients.

Automatically track time by return for all tax types: You can quickly assess how much time has been spent to make better decisions calculating billing, return on investment, and time allocation by staff. Learn more

Multiple performance upgrades: Platform enhancements and database upgrades help ensure higher quality, reliability, and alerts to help preparers stay on track.

New e-file capabilities boost your efficiency

New e-file is now available for the following:

- Returns

- Indiana Corporate

- Kentucky Individual, Single Member LLC

- Rhode Island Fiduciary

- Extensions

- Virginia Individual

- Estimates

- Alaska Corporate and S-Corporation

- Arkansas Individual, Corporate, S-Corporation, and Fiduciary

- Colorado Individual

- District of Columbia Individual, Corporate, S-Corporation, Partnership, and Fiduciary

- Kansas Corporate

- Kentucky Individual

- Nebraska Individual, Corporate, S-Corporation, and Partnership

- North Carolina Individual & Corporate

- North Dakota Individual, Corporate, and Fiduciary

- Ohio Individual

- Oklahoma Individual, Corporate, S-Corporation, Partnership, and Fiduciary

- Oregon Individual

- Vermont Individual

- Amended returns

- Indiana Corporate, S-Corporation, and Partnership

- Maryland Individual

- Massachusetts Individual

- New Mexico Corporate

- Ohio Individual

- Pennsylvania Individual

Customer support: Providing one-on-one and self-serve assistance

Intelligent voice assistant: When you call us for help, a new listening tool will be able to route your call to the right agent much more quickly.

Optional workflow tools: Helping you do even more

Intuit Practice Management*: Intuit Practice Management powered by Karbon gives you confidence that everyone in your firm is working on the right projects so nothing falls through the cracks. You get real-time visibility to progress across your practice, all from one place.

eSignature*: New 1-click functionality lets you quickly send 8878 and 8879 requests from inside Lacerte.

Hosting*: Get up and running with updated software as soon as it is released through Hosting for Lacerte. No need to download and install using traditional methods. In addition, the improved onboarding experience get your whole firm up in running in just days.

The available business application add-on (additional cost) allows you to house over 50 supported apps along with Lacerte, so you can move your entire office to the cloud, all in one convenient place. We recently added Citrix Sharefile and looking to continue to add more in the future. In addition, EasyACCT is now supported in the hosting environment.