When printing a tax return that contains nonfinal forms, those nonfinal forms will give you a notification that they can't be printed, meaning the form is not yet final. If the form has e-file approval, you'll be able to e-file those returns, even if you can't print the forms.

To view the status of a particular form for federal and state agencies, see the ProSeries Tax form finder. Our focus and commitment remains to have forms finalized and approved by their agencies as quickly as possible.

Viewing the return for Professional and Basic

Reviewing returns on-screen doesn't change. If a form isn't final, you'll see a red ‘Do Not File’ on the form and a yellow bar on the top of the form which will tell you when the form is anticipated to be finalized.

Print preview for Professional and Basic

When using print preview to review returns that contain a state with non-final forms, you will be able to view all forms on the screen however the ability to print from the print preview screen will be disabled

Printing the whole return for Professional and Basic

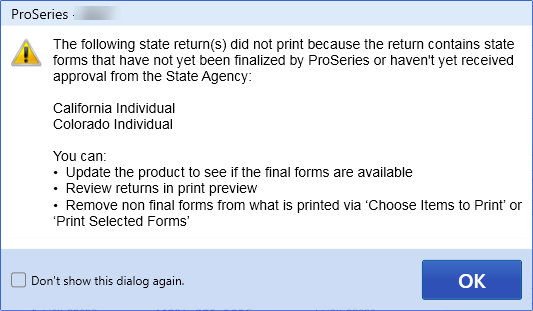

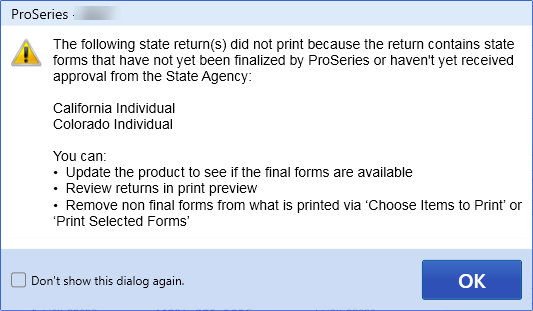

When printing an entire return that includes states that have nonfinal forms as part of the return, you'll receive a pop up warning that tells you which states didn't print. Any federal and state returns that are final, or that allow nonfinal forms to print, will be printed.

Print selected forms in Professional and Basic

You can use Print Selected Forms to print any final form and also nonfinal watermarked forms for federal returns and those states that accepts nonfinal watermarks. For any of the states in the list above you won't be able to print any nonfinal forms using the print-selected forms. If you select several forms that include nonfinal forms from these states, only the final forms will print.