Deferred Payment Option (DPO) information and processes

by Intuit•22• Updated 3 days ago

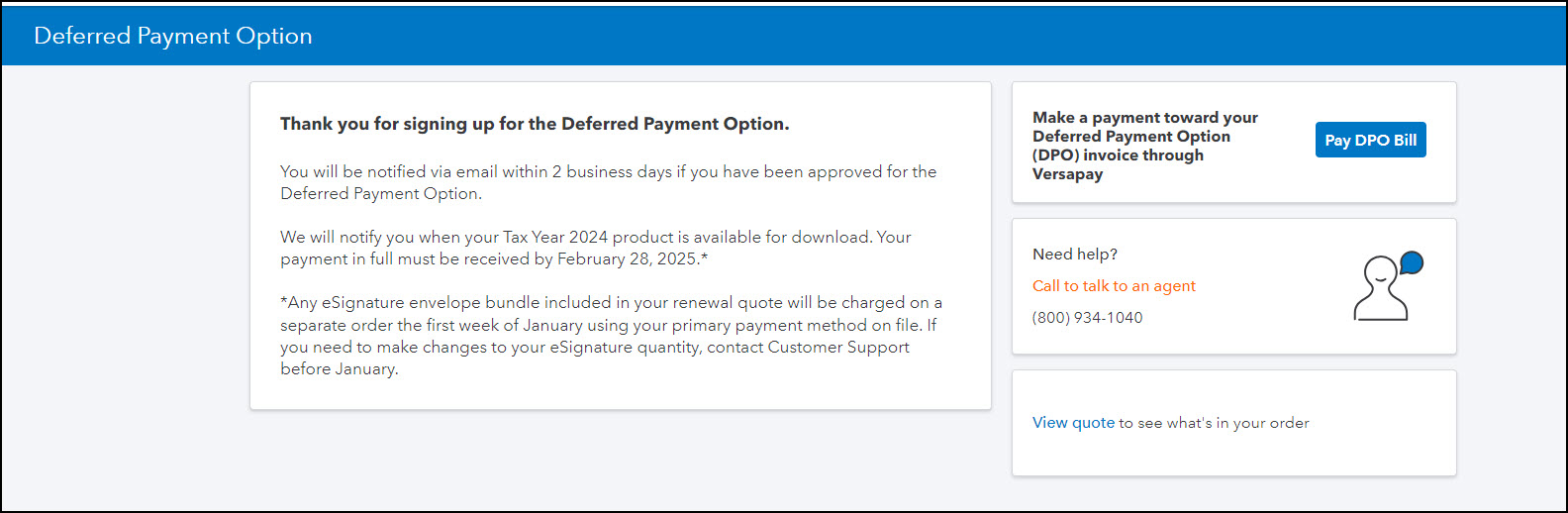

This article will help you learn about how the Deferred Payment Option works, sign up, and make payments toward your DPO plan.

What is DPO?

DPO is Intuit's Deferred Payment Option. This lets you to purchase the tax product but make payments over time.

How to sign up for the Deferred Payment Option?

How do I make a payment for the invoice due 2/27/2026?

To make a payment towards a Deferred Payment Option invoice, you can pay online 24 hours a day using MyAccount.

- Payments you make toward your Lacerte REP account cannot be applied to your DPO balance.

- DPO payments must be paid using an electronic method, such as a credit card, debit card, or EFT.

To pay online via My Account:

Note: The user associated with the email that received the DPO invoice is the one that can pay the DPO bill.

Access your invoice via Single Sign-on using My Account.

- Sign in to My Account.

- Select Pay DPO Bill.

- Select the invoice to pay by checking the box on the left.

- To Pay Now, agree to the Terms and Conditions, then select Pay Now.

- To make a Partial Payment.

- Select Edit.

- Next to the Payment Amount, select the down carrot.

- Enter the new Payment Amount.

- Enter whole numbers only. Ex 50

- Select Save.

- Select the Payment Method.

- Select a Payment Instrument or use the + to add.

- Select Submit.

- Agree to the Terms and Conditions, then select Pay Now.

- You will receive an email confirmation of the successful payment.

Who can I talk to about DPO if I have Questions?

Call Lacerte 800-765-7777 or ProSeries 800-934-1040 for assistance.

How much is the fee?

At this time, we are offering the Deferred Payment Option with no fee.

How do I make a payment?

Once the order has been placed, partial payments can be made to lower the balance due. At this time, we are only accepting electronic payments (CC/Debit/EFT). Direct debit is not offered.

- Pay via My Account. The user that received the DPO invoice can pay this way.

- Payments can't be made to the REP account.

How much do I owe?

A reminder email was sent with the amount due. If the email was not received or partial payments have been made since the email, call Intuit Credit & Collections at 800-925-8364 and choose option 2. They're open weekdays from 8 AM to 5 PM PT.

What is the due date for final payments?

All payments are due no later than February 27, 2026.

Can I get an extension?

We are not able to offer any extensions.

I paid but got a notice saying I still owe.

Call Intuit Credit & Collections at 800-925-8364 and choose option 2. They're open weekdays from 8 AM to 5 PM PT.

What happens if I don't pay?

As per the DPO Terms & Conditions, program access will be restricted until full payment is received.

Once I have paid after being disabled, how do I get access to the program again?

- ProSeries: From the Tools menu, select License Products. For more information, see How to License ProSeries

- Lacerte: From the Settings menu, select Update Preparer Information, then Download Prep File and follow the prompts. For more information, see How to download and install Lacerte prep files