Resolving 601ERRV errors received during electronic filing in ProSeries

by Intuit• Updated 1 year ago

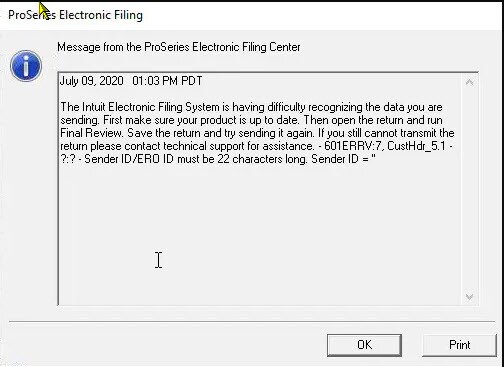

When transmitting a state tax return the error message being received is:

"The Intuit Electronic Filing System is having difficulty recognizing the data you are sending. First make sure your product is up to date. Then open the return and run Final Review. Save the return and try sending it again. If you still cannot transmit the return please technical support for assistance - 601ERRV:7, PARSE_3 - ?? - Bad Transaction Summary body length. Expected 0 but found 65534."

How do I resolve this error?

If the error occurs when attempting to follow an extension:

When working with extensions, this error may occur when bank products are already part of the file. Remove the bank product worksheets and try to electronically file again.

If the error occurs when attempting to follow an extension:

There's a conversion-related problem with the state, and the e-file system is unable to recognize the data you are sending. Print the "Filing" copy of the state return (PDF is acceptable). Later, you'll use the copy as a reference to aid you reconstruct the state return. The steps outlined below will guide you through the rest of the process to successfully transmit the state return.

- Open the tax return.

- From the File menu, select Remove State/City...

- In Remove State window, choose the state and click Remove.

- A prompt asking "All data associated with the

return will be deleted. Are you sure?" will appear. Click OK. - From the File menu, select Save.

- Go to the File menu again and select State/City.

- In the Go to State window, choose the state return and click OK it add to the return.

Reference the state return you printed earlier and make sure the state return is accurate and complete. When you're ready, e-file the state return as normal.

More like this

- Resolving Return Conversion Failed errors during e-file in ProSeriesby Intuit

- How to resolve validation failure during Lacerte e-file: 601ERRV:8 Malformed Databy Intuit

- Troubleshooting ProSeries Installation Issuesby Intuit

- Resolving "No valid EF Center Record Exists for this SSN/EIN" when receiving e-file acknowledgments in ProSeriesby Intuit