How to resolve an activity total error on the 199A Supplemental Worksheet in ProSeries

by Intuit• Updated 4 months ago

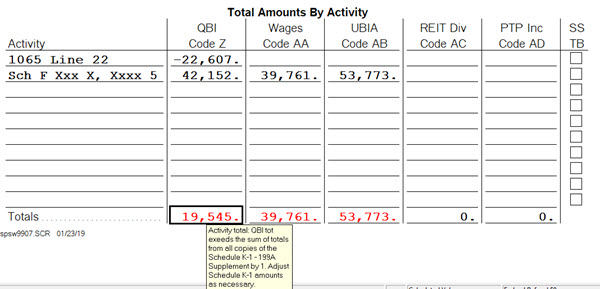

While completing a partnership, S-corporation, or fiduciary return, you may see an error on the 199A Summary Worksheet stating:

"Activity total: (Activity) total exceeds the sum of totals from all copies of the Schedule K-1 - 199A Supplement by (amount). Adjust Schedule K-1 amounts as necessary."

or

"Activity total: (Activity) total is less than the sum of totals from all copies of the Schedule K-1 - 199A Supplement by (amount). Adjust Schedule K-1 amounts as necessary."

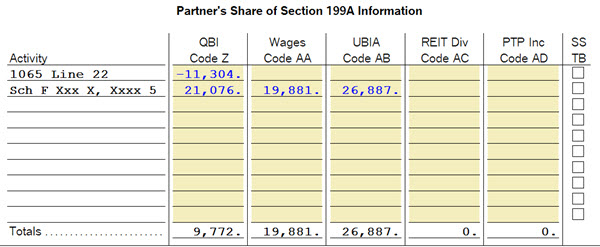

This is often caused by the way the amounts distributed to each Schedule K-1 199A Statement are rounded. To resolve the error, manually change the amounts on the Schedule K-1 199A Statement for the affected activity to reconcile with the totals on the 199A Summary Worksheet.

In the example screenshots, each partner is receiving $19,881 share of Wages Code AA, which totals to $39,762 ($1 more than the total on the 199A Summary Worksheet). Adjusting the amount of a partner's 199A Statement by the difference will reconcile the total on the 199A Summary Worksheet.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Intuit Accountants users.

More like this

- How to enter and calculate the qualified business income deduction, section 199A, in ProSeries on Form 8895by Intuit

- "Section 179 on multiple activities being limited" error message on Individual returnby Intuit

- Resolving 601ERRV errors received during electronic filing in ProSeriesby Intuit

- How to resolve ProSeries failure to license error code 4-1by Intuit