"Section 179 on multiple activities being limited" error message on Individual return

by Intuit•3• Updated 1 year ago

For more Schedule K-1 resources, check out our Tax topics page for Schedule K-1 where you'll find answers to the most commonly asked questions.

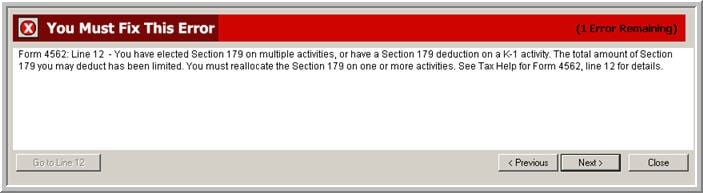

When preparing a Form 1040 return where Form 4562: Depreciation and Amortization is involved, you may received the following error message in Final Review:

"You have elected Section 179 on multiple activities, or have a Section 179 deduction on a K-1 activity. The total amount of Section 179 you may deduct has been limited. You must reallocate the Section 179 on one or more activities. See Tax Help for Form 4562, line 12 for the details"

ProSeries generates Form 4562: 179 Limitation if the taxpayer has Section 179 deductions for multiple activities, or has pass-through Section 179 deduction entered on a Schedule K-1, be it for a Partnership or an S Corporation.

Follow the steps for your activity below:

More like this

- How do I fix the error on Form 4562 Section 179 Summary: Error Line 12 in 1120S and 1065 in ProSeriesby Intuit

- Limit passive loss allowed on Form 8582 to property being disposed in ProConnectby Intuit

- California Section 179 limitationsby Intuit

- Calculating section 179 business income limitation in ProConnect Taxby Intuit