How to enter and calculate the qualified business income deduction, section 199A, in ProSeries on Form 8895

by Intuit•17• Updated 1 week ago

This article will help you:

- Learn more about the qualified business income (QBI) deduction

- Help you understand how to use ProSeries to calculate the QBI deduction

There are two ways to calculate the QBI deduction: the simplified worksheet or the complex worksheet. ProSeries will automatically generate the correct worksheet after you complete the required steps. This article has all the information you need to help ProSeries calculate the QBI deduction for you.

Table of contents:

Future changes for tax year 2026

For tax years beginning after December 31, 2025, the One Big Beautiful Bill act will make changes to the make the QBI deduction permanent and increase the phase-in range. These changes will go into effect in tax year 2026.

About the qualified business income (QBI) deduction - Form 8995

The Tax Cuts and Jobs Act introduces a new deduction for non-corporate taxpayers, aiming to reduce the tax rate on qualified business income (QBI) using Form 8995. Here's what you need to know:

- Deduction: Generally, 20% of QBI from a Partnership, S-Corporation, or Sole Proprietorship.

- QBI: Net business income, excluding investment-related items like capital gains and interest income (unless allocable to the business).

- Income Thresholds: Deduction may be limited based on W-2 wages and qualified property for incomes over $157,500 (single) or $315,000 (joint).

- Eligibility: Available to trusts, estates, and specified cooperatives. Income must be connected to a U.S. trade or business.

- Calculation: For partnerships and S-Corporations, the deduction is taken at the partner or shareholder level.

If you need more background info, the requirements on when to use the Simplified Worksheet or Complex Worksheet are outlined in IRS Publication 535.

How to use ProSeries to calculate the QBI deduction with Form 8995 in tax year 2019 and beyond

- Open the clients return.

- Press F6 to bring up Open Forms.

- Type 8995 to highlight the Form 8995.

- Select OK to open the Qualified Business Income Deduction Simplified Computation.

Follow the steps for each of the relevant schedules listed below for your client's return.

Individual returns, Schedules C and F

For more Schedule C resources, check out our Tax topics page for Schedule C where you'll find answers to the most commonly asked questions.

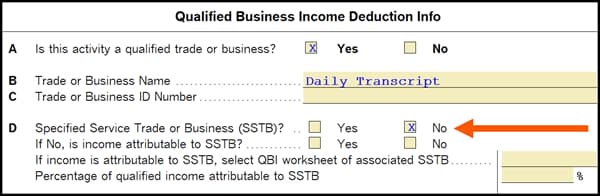

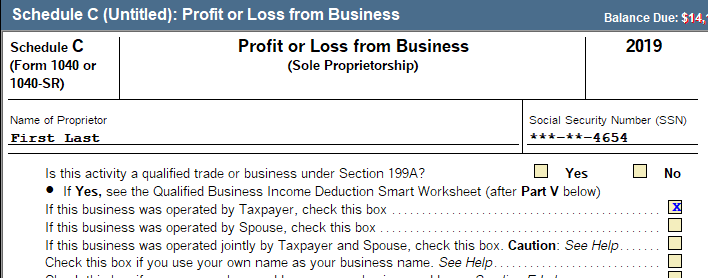

- At the top of the Schedule C or F check Yes for Is this activity a qualified trade or business under Section 199A?

- Enter income and expenses within the schedule following your normal workflow.

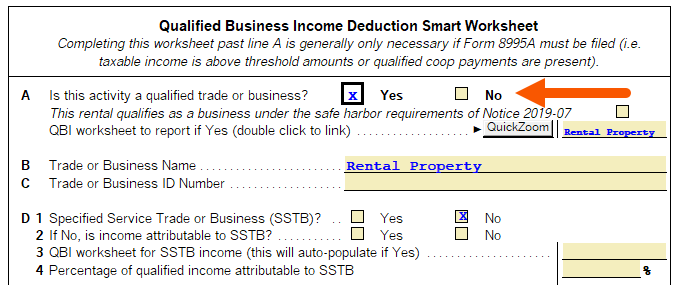

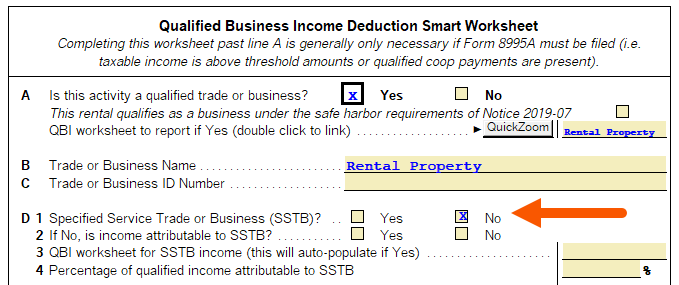

- Scroll down to the bottom of the schedule to review the Qualified Business Income Deduction Smart Worksheet.

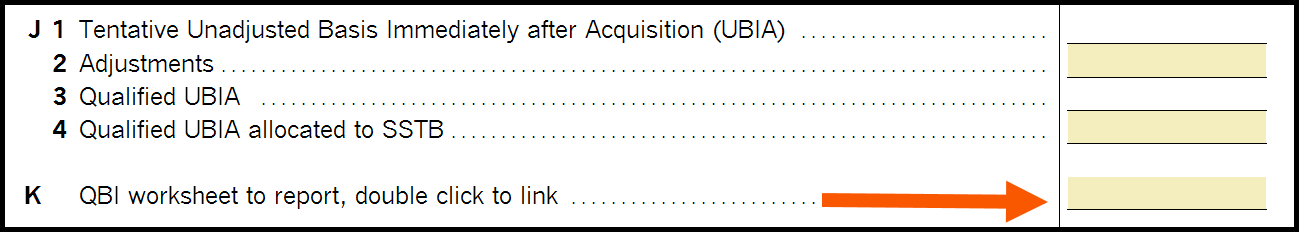

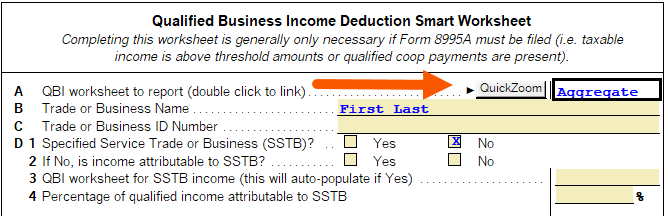

- A QBI worksheet will automatically generate, but if you are aggregating this activity with others on your return in QBI Worksheet to report (double-click to link) choose the combined QBI Worksheet.

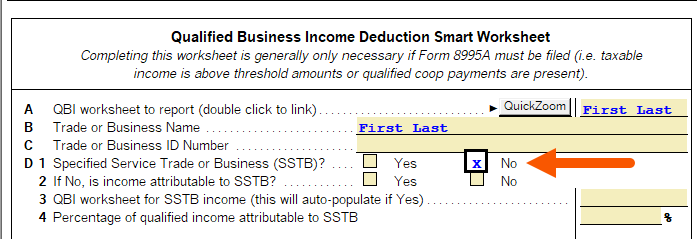

- Check Yes or No if the business is a Specified Service Trade or Business.

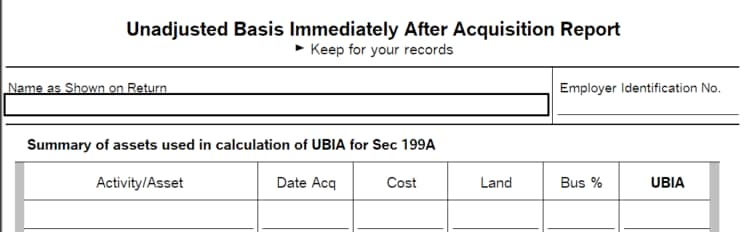

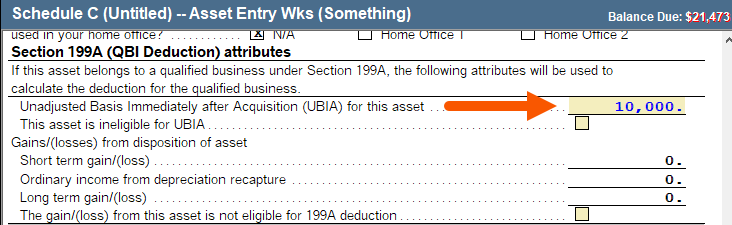

- If you have any adjustments to Unadjusted Basis Immediately after Acquisition for Depreciable Assets enter them in the new Section 199A (QBI Deduction) attributes section of the bottom of the Asset Entry Worksheet.

- Other Adjustments to income are still entered on line J2 of the Schedule C and F Qualified Business Income Deduction Smart Worksheet.

- Enter any applicable agricultural coop information on lines K1-4.

Individual returns, Schedule E

- Enter income and expenses within the schedule following your normal workflow.

- Scroll down to the bottom of the schedule to review the Qualified Business Income Deduction Smart Worksheet.

- Check Yes to Is this activity a qualified trade or business to activate the QBI Calculations.

- A QBI worksheet will automatically generate but if you are aggregating this activity with others on your return in QBI Worksheet to report (double click to link) choose the combined QBI Worksheet.

- Check Yes or No if the business is a Specified Service Trade or Business.

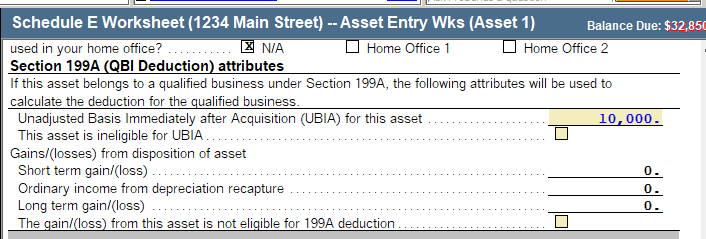

- If you have any adjustments to Unadjusted Basis Immediately after Acquisition for Depreciable Assets enter them in the new Section 199A (QBI Deduction) attributes section of the bottom of the Asset Entry Worksheet.

- Other adjustments to income are still entered on line J2 of the Schedule E worksheet Qualified Business Income Deduction Smart Worksheet.

Individual returns with Partnership or S Corp Schedule K-1 Income

Before you start there are some important changes for tax year 2019:

- Due to standardized guidelines published by the IRS, the K-1 Other Information will only contain one code for QBI. The K-1 Recipient should receive an attachment containing the information needed for the QBI calculation. If you are using the K-1 Import feature this additional statement will not import into the K-1 and need to be manually entered per the below steps.

- Enter K-1 information following your normal workflow.

- On the Other Information (K-1 Partnership line 20, K-1 S-Corp line 17) enter the code for Section 199A (Code Z for Partnerships and Code V for S-Corps) information. This code will generate an error stating: Box 17 Code V (or Box 20 code Z) has been selected but no Section 199A income has been entered on Statement A. This error will be cleared when you complete the next steps.

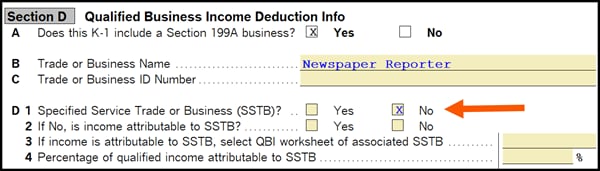

- Scroll to the bottom of the K-1 to review Section D: Qualified Business Income Deduction - Statement A Information

- In tax year 2019, the taxpayer should receive a statement with the K-1 that has been standardized by the IRS and will match the date entry available in this section. Enter the data exactly like it is listed on the statement received.

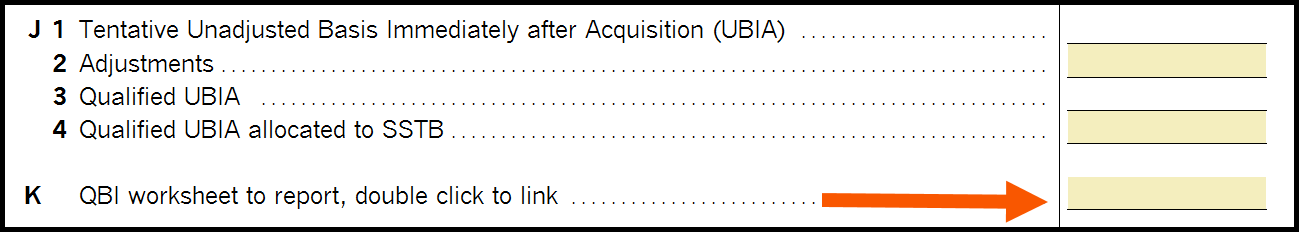

- Scroll down to Section D2 Qualified Business Income Deduction Info. A QBI worksheet will automatically generate but if you are aggregating this activity with others on your return in QBI Worksheet to report (double click to link) choose the combined QBI Worksheet.

- Enter any adjustments as needed.

Business returns (Partnerships, S Corps, and Fiduciary)

- Enter information following your normal workflow.

- Press F6 on your keyboard to open the forms menu. Type in 199a, then press Enter.

- To activate the 199A worksheet select Yes to Is this activity a qualified trade/business?

- Check Yes or No if the business is a Specified Service Trade or Business.

- Enter any adjustments to wages or Unadjusted Basis Immediately After Acquisition.

Each activity will be summarized on the 199A Statement A Summary and Schedule K-1 Statement A - QBI Pass-through Entity Reporting for each partner, shareholder, or beneficiary. This replaces the additional codes on the K-1 Other Information that was used last year. If you use the K-1 Import feature to import into the taxpayer's 1040 return Statement A won't import with the K-1 data and will need to be manually entered.

Fiduciary returns with Schedule E income

If the trust has taxable income, ProSeries will calculate the Qualified Business Income Deduction for Schedule E activities.

- Enter information on Schedule E following your normal workflow.

- At the bottom of the Schedule E, review each property in the Qualified Business Income Deduction Info smart worksheet.

- Link each property to a QBI component worksheet by double-clicking in box B. You can link multiple activities to the same QBI component worksheet to aggregate them.

- Review the QBI Simple or QBI Complex worksheet that's generated.

- Review the QBI Deduction Summary worksheet. The Total QBI Deduction will appear at the bottom.

- Manually enter the total QBI deduction on Line 20 of the 1041.

Once you've completed the steps in each of the relevant schedules for your client's return, you're done.

ProSeries will automatically generate the simplified or complex QBI Worksheet based on what's required for your client's return.

ProSeries will also produce a QBI Component Worksheet where you can review your entries by activity, and a QBI Deduction Summary Worksheet showing the net amounts from all activities.

You can find these worksheets and the deduction summary in the Forms In Use.

More like this

- Calculating the qualified business income deduction, section 199A, in ProConnect Taxby Intuit

- Lacerte Complex Worksheet Section 199A - Qualified Business Income Deduction for tax year 2018by Intuit

- Entering and calculating QBI Deductions (Section 199a) in Lacerte on Form 8995by Intuit

- Understanding qualified business income (QBI) reductionsby Intuit