- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Industry Discussions

- :

- Tax Talk

- :

- The Postcard Keeps Growing

The Postcard Keeps Growing

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Remember when we were promised a tax form that was so simple it could be filed on a postcard?

For 2018 returns, the postcard turned into a full sheet of paper on just one side, at least if you printed out the software version. I don't think IRS received any half-sheet returns filled out on both sides.

For 2019, IRS tacitly admitted defeat. The 1040 took up about 2/3 of both sides of a full sheet, with room to doodle at the bottom. It was not known whether doodles were also subject to penalty of perjury.

Now it's 2020, and there is much less room at the bottom. The first page of the 1040 has grown from 11 lines, to 15. The second page ends at Line 37, not Line 24.

(I do like the idea of having separate lines for withholding from W-2s and 1099s.)

I'm not taking any bets on how 2021 will look, because I don't want to take anyone's money. I know it will be back to the 2017 look.

![]() This discussion has been locked.

New comments cannot be posted on this discussion anymore. Start a

new discussion

This discussion has been locked.

New comments cannot be posted on this discussion anymore. Start a

new discussion

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That was a David Copperfield illusion to start with anyway, only less convincing. Like in the old days when sending postcards was more common, they can always squeeze in more content by using tinier prints /s.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

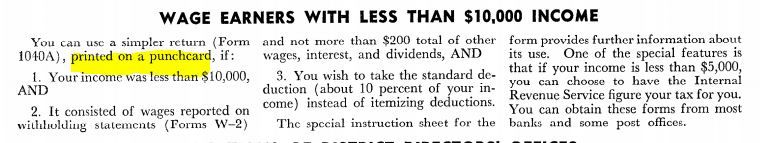

The 1963 form 1040A was printed on a punch card, so it could more quickly be processed in the new modern equipment.

https://www.irs.gov/pub/irs-prior/f1040a--1963.pdf

(Yes, I filed on a punch card - back in the day)

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

First, who in their right mind would send sensitive tax information (SSN, income information, etc.) on a "postcard"? Also, why was this necessary, given the fact that virtually all returns filed in this country are filed electronically? Does it matter how big the 1040 is? No one thought this was a good idea, at least no one being serious about this conversation. And even though the IRS technically created a tax form that fit on one half of a piece of paper, it wasn't functional at all and/or helpful.

So, now, you're seeing the gradual shift back to the two page tax form. I just hope we get there sooner rather than later. I'm tired of having a dozen "supporting schedules" just so the 1040 can be less than two pages.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I wouldn’t say “virtually all” returns were filed electronically when IRS received 16 million paper returns.

The population of Pennsylvania is only 13 million, and we know how important that state can be.

Speaking of 13 million, did you know that IRS issued that many refunds to people in separate payments to taxpayers that received their refund earlier in the year without interest? The amount of interest paid was nearly $249 million. I don’t think they got a letter signed by the President, explaining what it was.