- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- Industry Discussions

- :

- Tax Talk

- :

- Re: BYPASS8949

BYPASS8949

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hello Team,

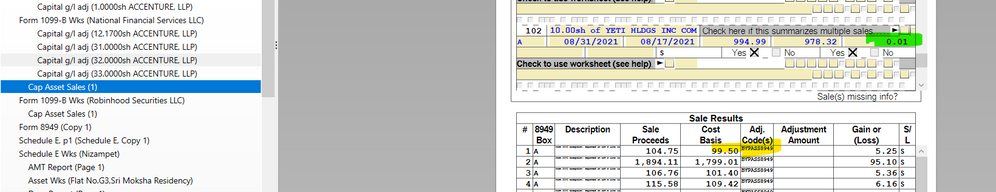

BYPASS8949 adjustment code is consolidating all my capital gains into 1040D form.

This problem has not occurred in another account from same broker, which also does n't have any wash sales. All entries from this account were copied to 8949 form as needed.

We have moved from Michigan to Texas mid year and all the gains consolidated need to be deducted from reporting in michigan capital gains & I want them to be reported in 8949 like other account - stock sales.

Adding 0.01 generates W adjustment code, but not sure if i am ok to do that.

Please advice, how to avoid this BYPASS8949 code?

Best Regards

Bhanu.

![]() This discussion has been locked.

New comments cannot be posted on this discussion anymore. Start a

new discussion

This discussion has been locked.

New comments cannot be posted on this discussion anymore. Start a

new discussion

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You seem to be lost on the internet.

You’ve come to a Peer User community for Intuit Income Tax Preparation products supporting tax preparation professionals using ProSeries, Proconnect and Lacerte Tax Preparation programs, and you may be looking for support as an individual taxpayer using TurboTax. Please visit the TurboTax Help site for support.

And try this screen, for the various topics (subforums): https://ttlc.intuit.com/community/discussions/discussion/03/302

Your sign in user info here is the same one you can use over at the TurboTax forum.

Thanks.

Don't yell at us; we're volunteers