- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Will the 7/15 extension allow my S-Corp client to increase his 2019 SEP contribution to the maximum allowed (allowed 21K, he only pd. in 12K).

Will the 7/15 extension allow my S-Corp client to increase his 2019 SEP contribution to the maximum allowed (allowed 21K, he only pd. in 12K).

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you already filed the return the new extended deadline is a moot point. 12K stands

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

But, could you file a superseding return and claim the larger SEP contribution?

I think so.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Put me in the "disagree" column. If the taxpayer filed his 1120-S return prior to the Original due date but DID NOT request an extension prior to the original due date then he can not file a superseding tax return.

Also remember, the change to July 15 does NOT cover returns due March 15th. They were still due March 15th.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@msmith7305 You are correct.

The extension was for returns due after April 1.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Check out Notice 2020-23

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@sjrcpa interesting.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I would point you to www.irs.gov/newsroom/filing-and-payment-deadlines-questions-answers.

Several things to note:

1. The FAQs do incorporate Notice 2020-23

2. The FAQs were last updated or reviewed May 27, 2020

Specifically look at Question #7 under Eligibility:

Q. Are the filing deadlines for partnerships and S-corporations whose returns were due to be filed on March 16, 2020 postponed?

A. Notice 2020-23 does not postpone any return filings that were due on March 16, 2020. If a fiscal year partnership or S-corporation has a return due to be filed on or after April 1, 2020, and before July 15, 2020, that filing requirement has been postponed to July 15, 2020. For information about additional relief that may be available to partnerships in connection with the CARES Act legislation, please see Rev. Proc. 2020-23 (PDF).

This follows the general statement in Q #1 under Eligibility

Q. Who is eligible for relief under Notice 2020-23?

A. Any person with a Federal tax payment or return (or other filing) due on or after April 1, 2020, and before July 15, 2020, that is described in section III.A of the Notice is eligible for relief under Notice 2020-23. In addition, any person with a specified time-sensitive act due to be performed during the same period is also eligible for relief. The specified time-sensitive acts that are postponed until July 15, 2020, include filing a petition with the United States Tax Court (Tax Court), filing for review of a decision rendered by the Tax Court, filing a claim for credit or refund of any tax, bringing suit upon a claim for credit or refund of any tax, and all of the acts listed in Rev. Proc. 2018-58, 2018-50 IRB 990 (PDF). The term “person” includes any type of taxpayer, such as an individual, a trust, an estate, a corporation, or any type of unincorporated business entity.

The operative language is "due on or after April 1, 2020 and before July 15, 2020"

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In general (unless you are the SBA) Q&A are not authoritative. An IRS Notice is more authoritative than its Q&As.

I'll grant you that the language in Notice 20020-23 was conflicting.

I had not seen that Q7 until today.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

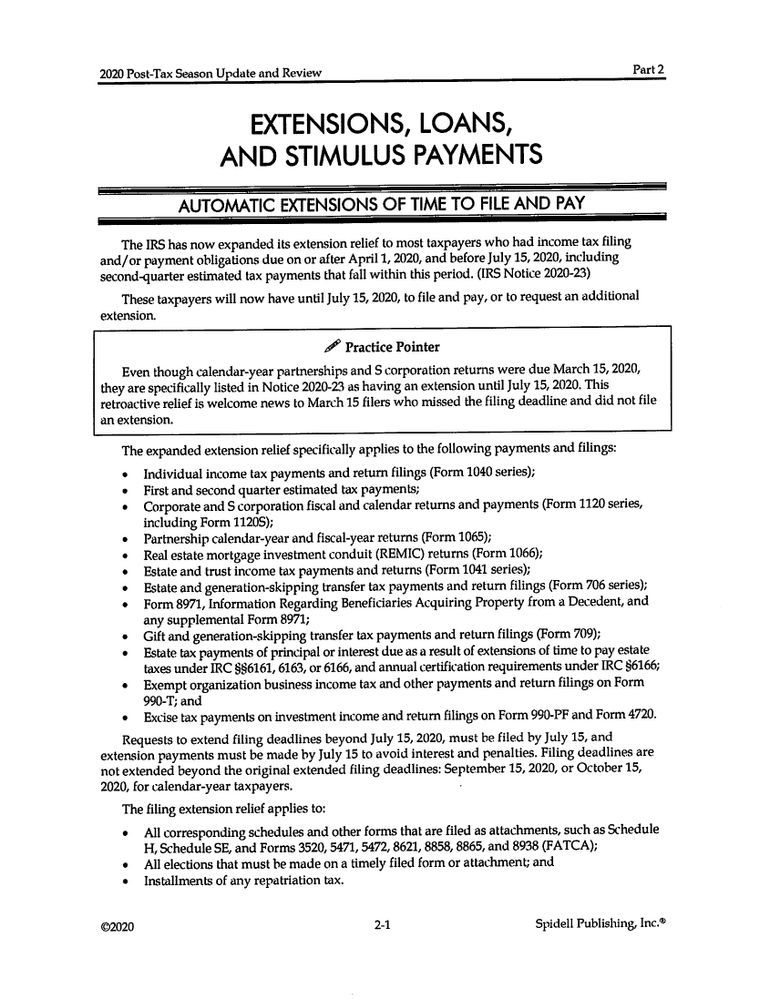

Im in a webinar right now and its saying that Partnerships and SCorps due 3/15 are extended to 7/15 as well.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Notice 2020-23 is confusing, but how do you reconcile this in the notice under, III. Grant of Relief, A. Taxpayers Affected by Covid-19 Emergency

"a Federal tax return or other form filing obligation specified in this section III.A (Specified Form), which is due to be performed (originally or pursuant to a valid extension) on or after April 1, 2020 and before July 15, 2020"

Under that terminology a calendar year S-Corp does not fit, however, a fiscal year S-Corp could.

I believe that the notice, therefore, limits the relief to any forms listed in the paragraphs following this statement to those that meet the qualifying language above of those due on or after April 1, 2020...…..

Just my thought. Thankfully, I don't have to make that call with any of my clients!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I agree but in this webinar they specifically said that Partnerships and Scorps due 3/15 qualified as extended to 7/15...this doesnt apply to any of mine either, they all have extensions to 9/15 filed before the 3/15 due date so I havent thought much about it.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪