- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Utah electronic funds withdrawal not available.

Utah electronic funds withdrawal not available.

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Pro Series allowed me to choose electronic funds withdrawal for Utah balance due. The electronic filing instructions showed that was the payment method. And, no errors showed on the return screens for Utah.

Utah balances due can be paid online, by mail, or in person only. Nowhere on the TC-40 is there a place for the state of Utah to withdraw the funds.

Since my two clients ended up paying late once they realized that the withdrawals had not actually happened, they had to pay penalties and interest.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Direct Debit is only for Efiled returns, so you wouldn't see anything on the actual tax form itself for direct debit...is that what youre stating?

If you look at a federal 1040, you wouldn't see anything on it for direct debit either.

Double check the routing and account numbers that were entered, have the client contact their bank, was a debit attempted at all? If the info you entered was correct but UT just didnt do what they were told to do, Im not sure what more you could have done.

I try and get my clients to make their debit dates a week prior to the due date, ,just in case it doesnt happen for whatever reason, theyve still got a few days to get payment made in time, if they want to wait for the very last day, they can go online and make it themselves.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Utah state doesn't do Direct Debit. So, even if there was a way to tell Utah that you wanted direct debit, it wouldn't happen because they don't allow that option.

No attempts were made for either client. It should be an error or not an option for the state of Utah return in the software. The Electronic Filing Instructions says "Paying balance due by electronic funds withdrawal." But, again this is not an option with Utah so the software shouldn't claim that it is.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So on the UT information worksheet ProSeries allows you to set up the Direct Debit option but UT doesnt allow it?

Wow, that needs to be fixed!

@Anonymous can this be looked into?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This is the first report we've seen of this. Are you sure that you have all the appropriate boxes checked?

Here's the link for Utah income tax payment options.

Please call into support so we can look into your client files to ensure everything checks out.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

FYI - I have one Client I prepare UT returns for many years. We checked electronic withdrawal for 2021 return that was filed on 10-13-22. They took the electronic payment on same day.

Here is what I did - even thou the "do not want electronic withdrawal for state payment is checked on the State return, I entered the bank info and date of withdrawal. they took the payment!

for 2022 return - I didn't want to take the risk so I went on UT State website and made the payment. it was simple when using the e-check pay.

I hope this helped!

Lena

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I agree.

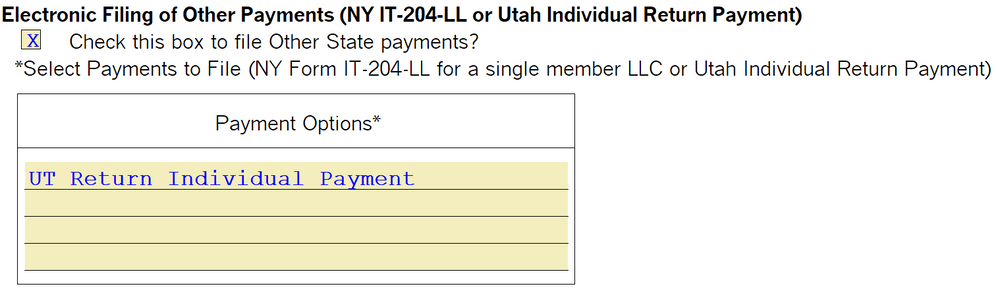

Under Electronic Filing of Other Payments you must check the box.

With me, I also had to select UT Return Individual Payment in the Payment Options* box.

I wonder if some preparers are only check the box and not selecting the drop down.