- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Unemployment Compensation Exclusion effect to California EITC - Do we need to amend !

Unemployment Compensation Exclusion effect to California EITC - Do we need to amend !

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Unemployment Compensation Exclusion will reduce Federal AGI. Some of my client will qualify for California EITC (their income go below $30,000 after exclusion) and after that they may get $600 California stimulus.

Do I need to do CA amended ?

Best,

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

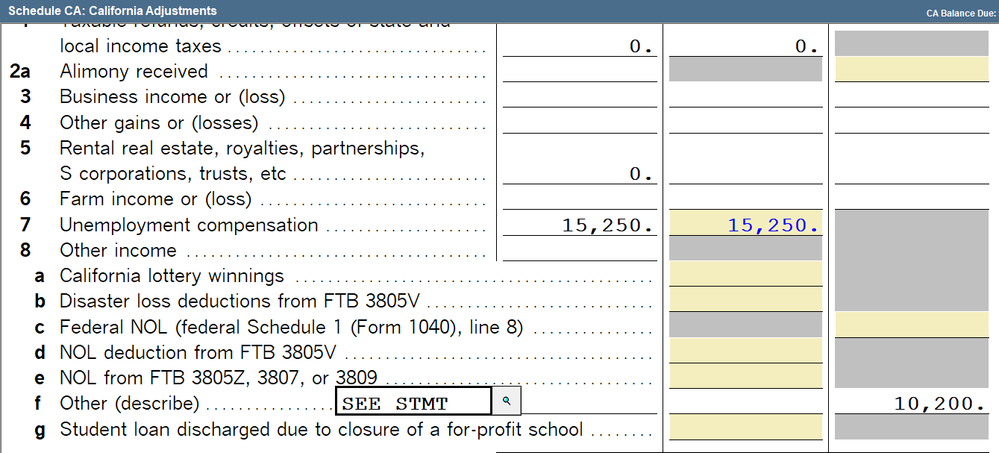

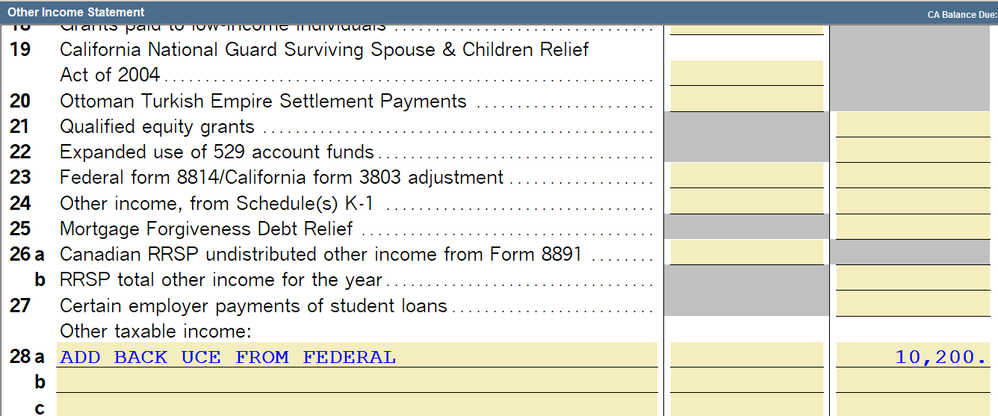

You need to add the excluded UI back to the CA return, otherwise the UI is being deducted twice, since CA excludes it already.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You add it back like this

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you Lisa!

So, would you please you instruct me how to file the right way with UCE by pro series for Federal & California right now. We need to wait for Pro series update to file UCE or we just manually deduct UCE amount in the Other Income Statement with Federal and add it back to California?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I would like to ask the same question as my client will be in this situation.

Do we amend the CA return?

Adding back the UI exclusion may affect the CA AGI but the CA EITC has to do with Federal AGI which will be affected by this UI exclusion (fall below $30,001).

Thanks!