- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Schedule 1, Part II, Adjustments to Income, Line 24z

Schedule 1, Part II, Adjustments to Income, Line 24z

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

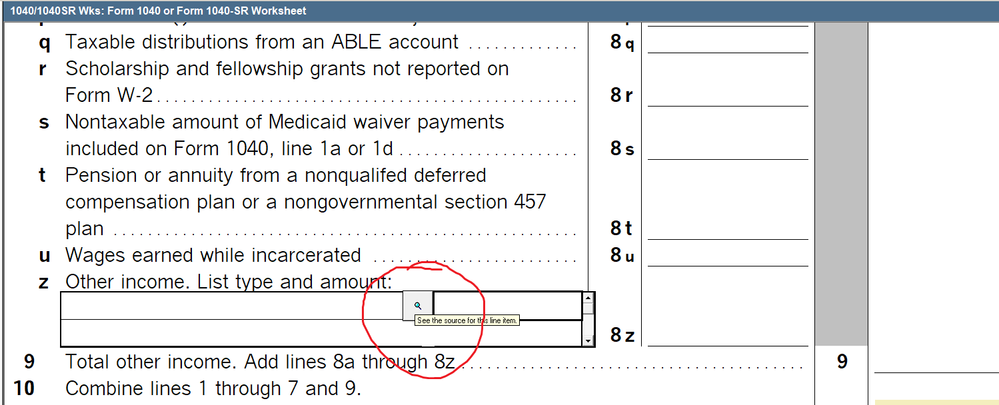

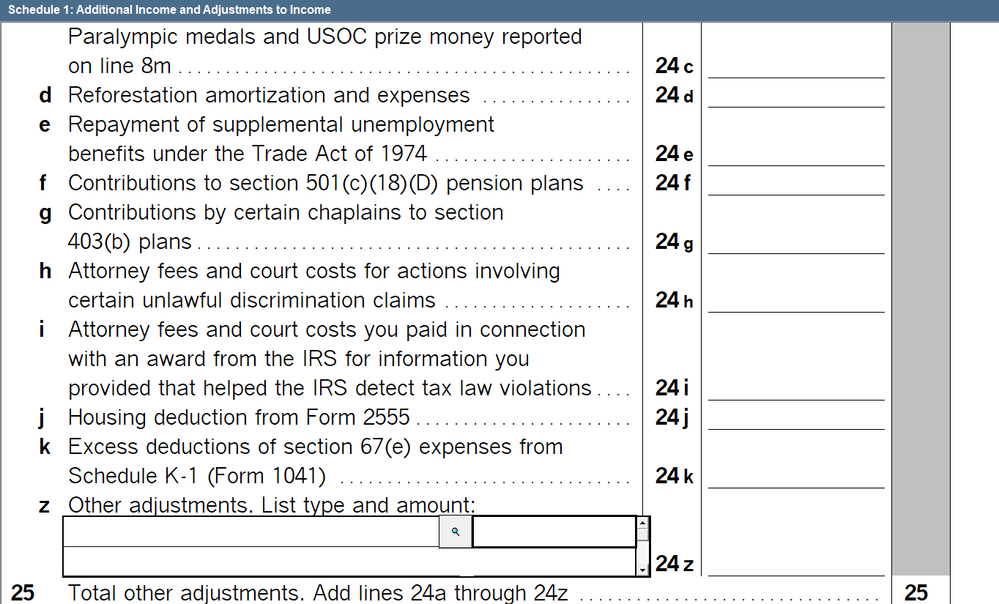

I am not able to enter any information on Schedule 1, Part II Adjustments to Income, Line 24z. Unlike Sch 1, Line 8z which has a worksheet behind it that you can enter any misc income information, the same doesn't seem to apply to Line 24z, its locked, no cross reference or linked capability. Anyone else having this issue and/or know how to utilize this field without just overriding everything? Thanks for any assistance, Dan

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

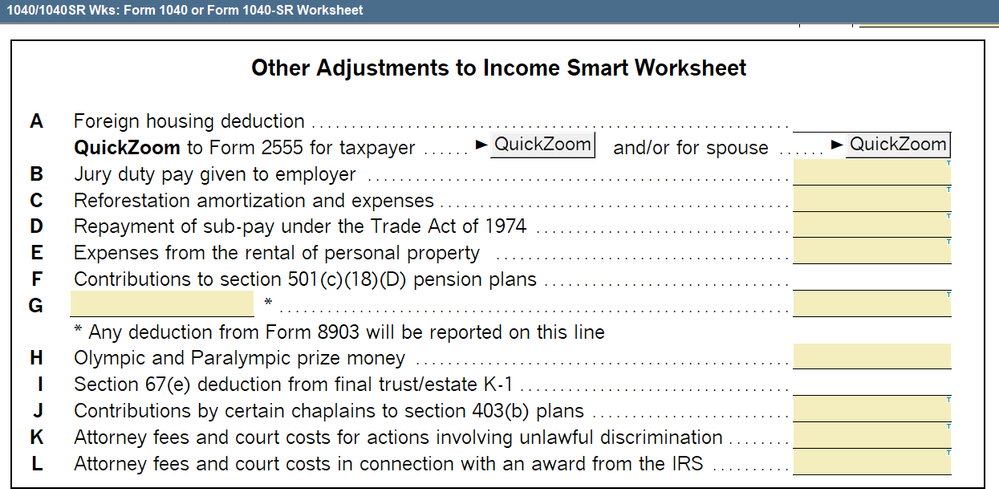

I think you want this smart worksheet area on the 1040/1040SR worksheet, I think these lines flow to 24z.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for the reply, I did see this earlier, what is you need to add something that is not listed, there isn't a place or line for write in items, like we have with Line 8z.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have a client that received a 1099-G for Unemployment that is part of a Fraud claim. The Dept of Labor was notified 9 months ago but still produced the 1099-G with these fraud funds included. My client is trying to get through to them to correct but having a hard time. To make it more complex, she did end up getting unemployment for part of the year so part of the funds reported on this are taxable. Currently, I was thinking of reporting the full amount on the unemployment line to match with the IRS computers then back out the fraud component; was looking at using line 24z, could also use line 8z with a negative amount.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Youd just back it out on the Other Income line 8z, not where youre trying to get to.

But IRS said NOT to report the fraudulent 1099g, I realize your situation is kind of different since some of it is legitimate.

https://www.irs.gov/identity-theft-fraud-scams/identity-theft-and-unemployment-benefits

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you again for all of our assistance, still debating about just showing the taxable amount and not reporting the Fraud component at all but also trying to avoid an automated IRS letter, still so difficult to get things resolved like this if you have to call or send a written reply. Maybe I will just report correct amount and attach an 8275 to explain the fraud component. Thanks again, Dan

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you all for your solutions which entail making modifications and additional work on our part. Instead of enabling a sub par software system we should expect ProSeries/ Intuit make Line 24 z of Schedule1 operable This affects many adjustments and will make us look unprofessional when the IRS letters arrive in a year or two. We are paying for a PROFESSIONAL tax program and think they should live up to their standards and the amount they charge!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Adjustments to income are by legislative grace and enumerated in IRC section 62. I think the IRS form design folks did a pretty good job of including them on the new 2021 Schedule 1 Part II. This isn't an area where you can just make up your own stuff. If you're fudging numbers to match bad 1099 forms, all of the fudge should be above the line, not below it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Seriously. "fudging" numbers? There are numerous occassions when the numbers reflected on a 1099K are adjusted and this cannot be accomplished when ProSeries has the IRS approved adjustment line inoperable. Case in point AirBNB 1099K for a 14 day rental. It is not taxable., but the 1099K must be reported and then an adjustment made. Schedule E can't be used because it is less than 15 days. Another case in point making adjustments for foreign treaties. Venmo and paypal transactions that are actually reimbursements. I could go on and on. Other tax programs have Schedule 1 line 8 z for other income is operable. Line 24z for "other adjustments" is inoperable on Pro Series. FYI IRS did a great job on Schedule 1 AND THEY PROVIDED LINE 24 Z FOR OTHER ADJUSTMENTS. Pro Series has not made it operable on their program.

I am not referring to bad 1099s, I am referring to 1099s that have EXCEPTIONS!

Think and know what you are talking about before you accuse individuals of "fudging" not very professional.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am wondering how you resolved this. Clearly there will be a lot of this this year. I already have a client who sold personal items for a loss on eBay and received a 1099-K. The IRS rules are very specific on how to report it but I can not understand how to get line 24z to work. Even if I override it, the total amount doesn't flow to line 25. Any help would be appreciated. Really uninterested in spending forever on hold getting someone who doesn't know the answer to help me.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I solved it. No response required. Thank you

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@gabjo00 wrote:

I am wondering how you resolved this. Clearly there will be a lot of this this year. I already have a client who sold personal items for a loss on eBay and received a 1099-K. The IRS rules are very specific on how to report it but I can not understand how to get line 24z to work. Even if I override it, the total amount doesn't flow to line 25. Any help would be appreciated. Really uninterested in spending forever on hold getting someone who doesn't know the answer to help me.

Yeah, Intuit screwed up and won't let us enter numbers there.

However, selling personal items can be reported on 8949, so that that is what I would suggest for your situation.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Use the 1040/1040SR Worksheet (not the 1040) and scroll down down down to Page 4 and you should be able to QuickZoom right to the entry screen, see my screen shot

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Lisa, oh, did they fix that now? When I tested it a week or two ago you couldn't do it.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think it lands in the right sport, same place we would manually adjust for the 2014-7 excludable income, right?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In prior years 2014-7 was on line 8 as a negative number. But I haven't checked if they want that on line 24 now or not.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ohh, Im in the wrong spot. They need to stop jacking all the lines around! It gets worse every year!

Sorry, I guess Im wrong....you cant get into any of those Line 24 spots, $%#^@&* stupid! WTH?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No you cant get in at all. Literally a line that is useless because it can not be accessed.

However, what I have figured out is the form 1099-K worksheet has new boxes to check that will flow a positive and a negative on line 8z on schedule 1 when the sale is related to personal property sold at a loss.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Oh wait, yes you can, but from Sch 1, not the 1040/1040SR worksheet. NO YOU CANT, it dumps you nowhere!

Id love to smack a programmer right about now.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

OK, I posted this somewhere that maybe someone with Intuit will see it quicker than in this board...I just started seeing clients this week, I havent had to use Line 24 at all yet, but thats just sloppy programming leaving it like that.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You should be able to enter the line 24 information for the 1099 K at the bottom of the 1099K screen

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I saw another post that its giving and error for that line of the 1099K

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes it is, trying to see if they have when it will be fixed. Just thought I would let people know how to get to it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This worksheet is missing and must be on top of Line 24 in Sch 1 Part II, not in Form 1040 Worksheet. I had a hard time looking for the link also and began thinking of override, but then I found this solution.

Thanks, Just-Lisa-now !!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This field fools you into thinking you can make an entry but when you select the field, it dumps you to an inoperable field. I saw numerous posts about fixing a 1099-K but I'm trying to enter a Section 481(a) adjustment from a change in accounting application, Form 3115. In my research, I read that this adjustment does not directly go on Schedule E, but without line 24z of Schedule 1 working, I have no choice but to enter the adjustment on Schedule E. Any other ideas?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If the adjustment relates to a Schedule E rental property, I put the 481(a) adjustment on the Sch E for that property.

The more I know the more I don’t know.