- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Why is ProSeries not calculating the rental income on the EIC worksheet? My client had $3962 in rental income and the system gave my client EIC.

Why is ProSeries not calculating the rental income on the EIC worksheet? My client had $3962 in rental income and the system gave my client EIC.

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You shouldn't be inputting personal use days unless they used it personally AFTER it became a rental.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can you give a more complete account of the other income/loss on the tax return?

Im guessing you've followed the money through the EIC Worksheet, right? Which part isnt making sense?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

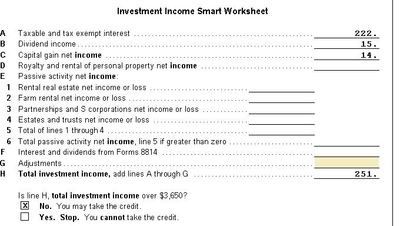

The client had $27,142 in taxable wages, $222 interest, $15 dividends, $14 capital gain, $21,409 Sch C income and the $3,962 in rental income for an AGI of $50,951. Standard deduction & QBI of $3,979 for a taxable income of $22,172. The system calculated $496 of EIC. The IRS is disputing the EIC.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The rental income does not flow through to the EIC worksheet. This is what I'm trying to figure out. Why isn't it?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The profit should land on Line 5 of Sch 1.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

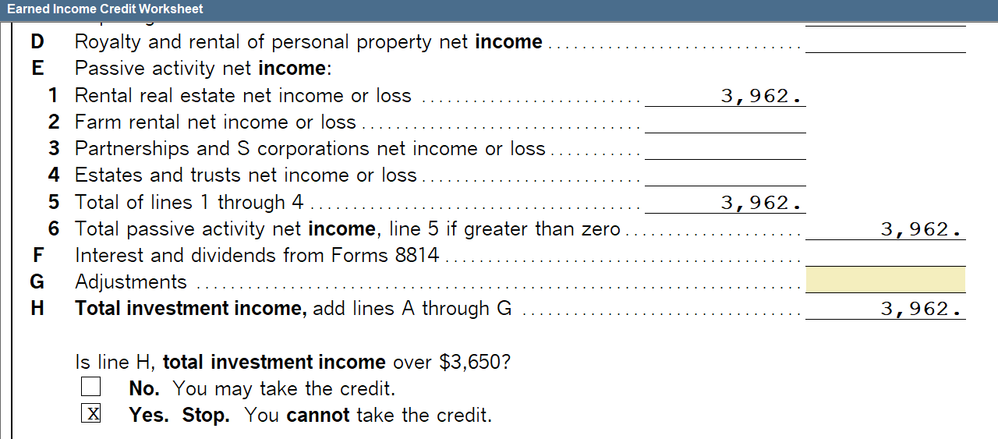

Investment limit for EIC 2020 is $3650. your client had rental income of $3962 (passive rental income is investment income). No EIC

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes it is reported on Sch E and it does flow through to Line 5 on Sch 1 but it doesn't show up on the EIC worksheet.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hmmmm....when I put $3962 profit on Sch E, right under Line 7 on the EIC worksheet looks like this...yours is blank?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Just-Lisa-Now- sorry was reading eic disallowed by IRS, and it should have been. Hope the program is not at fault, and it is an input error somewhere

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

IRS is disallowing it, but WHY is ProSeries is allowing it is the mystery.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Correct

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

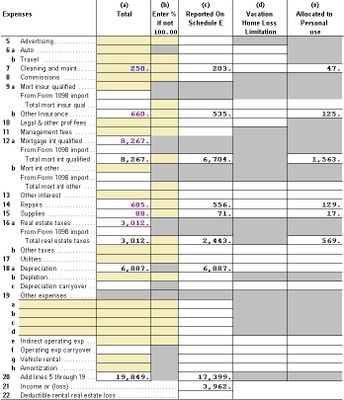

This was their main home for the first 69 days of the year then they rented it out for the rest of the year.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you've got a profit on the Sch E worksheet and an amount on Line 5 of Sch 1, I dont know why its not appearing on Line E1 of that worksheet and disallowing EIC.

@TaxGuyBill youre really good with this kind of stuff, does anything jump out at you that would cause this?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You shouldn't be inputting personal use days unless they used it personally AFTER it became a rental.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@jllong you may want to file an amended return, entering personal use days will reduce your expenses....if your deductible totals arent correct, and your profit is lower, your client may very well qualify for EIC.

Might be worth looking into.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

As Lisa pointed out, if it was 100% personal use then converted to 100% rental use, you DON'T enter any personal days. And you only enter the expenses that were incurred DURING the rental period (don't enter the full-year expenses).

Entering the personal days (which is wrong in your case) makes it non-passive income, which is why ProSeries is not treating it as Passive income that disqualifies EIC.

However, the law says that Passive Income can disqualify EIC, but so can "rents or royalties not derived in the ordinary course of a trade or business". Although rental income for a house would SEEM to be "rents", the program seems to interpret "rents" as rental of non-real estate, and I don't remember if that is correct or not.