- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: The 2020 change in ProSeries to Schedule D Entry is awful

The 2020 change in ProSeries to Schedule D Entry is awful

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

When keying in stock sales on Sched D in the 2020 ProSeries software, if the basis needs to be corrected you can no longer VERY SIMPLY TYPE IN THE CORRECTED BASIS ACOUNT. Instead, you now need to actually calculate the required adjustment and key that in on the worksheet. It was soooooo much easier to just key in the corrected basis dollar amount in the 2019 software and let ProSeries calculate the adjustment. Am I missing something here or was this just a really stupid change the programmers made this year to the Sched D worksheet? Why not just let me simply key in the corrected basis amount instead of making me calculate the adjustment amount separately (more work).

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If it ain't broke, they'll fix it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ugh, I havent even looked at Sch D yet 😕

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I like to refer to these things as dehancements.

I saw a post where they provided a new "enhancement" to print preview where you could select which pages would print. This is something that I think was dehanced 5 or 6 years ago (that year that they broke printing, half the HPs didn't work anymore and there were a bunch of complaints about it) so really they're just bringing it back.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It is possible that the program is not updated completely for that schedule. I don't work on any client files until notified that the IRS is ready to accept efiling. Then I make sure my program updates are current.

Especially in Presidential election years when the tax laws are so subject to change. No sense in doing input when the law will no longer apply. Look what happened when Obama took over. The delay due to new tax laws was ridiculous.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Haha - I wish that were the case, but it's not. In typical Intuit fashion, something is working just fine...we get used to the ease of preparing a return a certain way....and so it's time for Intuit to change it for absolutely no reason whatsoever. For some reason, Intuit had changed the Sched D input format multiple times in the past 10 years.

And this change to the CORRECTED COST BASIS data entry is totally unnecessary. There was absolutely no change in the law that precipitated the change on that worksheet. Now, we will have to prepare a separate calculation for the "adjustment" instead of just letting me literally enter the corrected cost basis (no separate calculation necessary).

Might be up there as one of the dumbest totally unnecessary changes in the 2020 software. Intuit needs to revise the 2020 Sched D input to allow preparers to simply enter the corrected cost basis - just like it was in the 2019 software. Who is reviewing these beta software tests??

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Ephesians3-14 wrote:Who is reviewing these beta software tests??

People who download and install the software in November are the Beta testers. And no, the developers from Intuit don't look at the complaints about the software on this forum.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I don't mind it so far. I'm happy to see a 1099-B worksheet in the program actually and can't wait to try it out more. It will make things in my office so much easier when reviewing returns to be able to have things sorted by 1099-B.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I broke down and opened a dummy return to see this mess.

When you are on the 1099-B w/s, the NEW (and improved!) way to enter stock sales, enter the name, dates, sales price and cost, but DO NOT ENTER THE ADJUSTMENT* AMOUNT HERE.

Instead, double click on Adjustment Amount* box and go to Capital Gain(Loss) Adjustments w/s. Go to Part III and enter correct basis.

Then the correct adjustment will appear on Sch D and 8949.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

From what I read in the instructions while in my dummy client, you can enter the adjustment amount right on the 1099-B worksheet line for adjustments. Only certain codes are not supported by that line and have to be entered on the capital gains/losses work sheet.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

When I double click on the adjustments line and go to the worksheet, that doesn't solve the problem either because it still requires you to enter the cost basis (NOT the corrected cost basis). I'm not following what you're suggesting as the solution (and I have been using the program for 25+ years).

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

OK I see what you're saying now...but what a major hassle having to click through and then scroll down and enter the info. Sooooo much easier just enter the corrected cost basis right under the regular cost basis as it was on the 2019 software.

More unnecessary steps, more unnecessary clicking, more unnecessary scrolling. JUST LEAVE THE DATA ENTRY THE SAME AS 2019 - ABSOLUTELY NO NEED TO HAVE MADE THAT CHANGE MAKING IT MORE TIME CONSUMING TO ENTER CORRECTED COST BASIS DATA.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Where's the list of adjustment code descriptions were supposed to input? I see the help file shows which letters are acceptable, what do those letters stand for though?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It's in the help but you have to really look for it.

B - incorrect basis on 1099-B

C - collectible

D - accrued market discount

E - sales fees/expenses

L - disallowed losses

N - nominee sales

O - other adjustments and ordinary sale from Section 1242 stock

Q - qualified small business stock

R - deferral of rollover gain

S - ordinary loss from Section 1244 stock

T - incorrect holding period

W - disallowed wash sale loss

X - DC zone or qualified community assets exclusion

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do you enter an asset sale on Schedule D now? For example, sale of a vacation home (never rented) or some other asset that isn't stock reported on a 1099-B??? Am I missing something here or did Intuit forget that these things happen? Not all asset sales are reported on a 1099-B!!!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

steve, looks like you use the 1099B entry screen, just skip over all that junk at the top about brokerage, scroll down to the somewhat normal looking Sch D entry lines.

Not sure why they titled that button 1099B worksheet, should just say Sch D entries or something more generalized..

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

A colleague brought this thread to my attention recently, so I thought I'd hop on to share some of the reasons we decided to "fix what wasn't broken" 🙂

The investments area has been problematic for many users for many years for a variety of reasons. You may or may not have noticed there were actually THREE different entry points for investment sales (the table on the Schedule D for very simple sales, the Capital Gains (Losses) Detail Entry Worksheet for slightly more complex sales and imported sales, and finally the Capital Gain (Loss) Transaction Worksheet for the most complex sales). These three separate entry points were the source of endless user frustration and contacts to customer support. So the first problem we fixed was making a single point of entry for investment sales.

(As an aside on the name, calling it the Form 1099-B Worksheet is simply following the naming pattern that Proseries has used for decades. Income types that are *usually* reported on particular form -- interest on 1099-INT, dividends on 1099-DIV, etc -- get a worksheet named after the form where they're usually reported. Of course, tax pros know those types of income won't always be reported on the official IRS form, but for decades pros haven't seemed to have much trouble with the idea that interest goes on the 1099-INT worksheet -- even if not on an official IRS 1099-INT -- and so forth. So the naming decision was simply to follow what we generally do with worksheet names.)

The second big issue we wanted to address was difficulty with reconciling multiple accounts statements. Previously, all sales, even if from multiple accounts, went into a single table, making reconciliation quite difficult. You could get a proceeds summary by account, but only if you entered the name of the broker and/or account for each and every sale -- a real hassle if trying to enter multiple accounts with dozens (or hundreds or more) of sales each. The new design makes the entry worksheet multi-copy, so you can create a separate copy for each account, and automatically get a complete summary of basis, proceeds, and adjustments by 8949 category that should closely align with the statement clients get from brokers. This is tremendously valuable when dealing with clients that have a lot of trading activity. Unfortunately it also means we can't put the table on the Schedule D since there can only be one copy of that. But it's just two clicks of the mouse from Schedule D to create the new worksheet. Of course, if you're dealing with a client with only a few trades and you don't care about reconciling the statements, then throw all the sales on a single worksheet if you want to. It's a tremendously valuable tool in some situations, but you don't have to use it if that's not your client's situation.

Finally, with respect to what fields were included on the main worksheet vs what fields required clicking through to the new Adjustments worksheet, this was a straight-forward data driven decision. Clicking through to the supporting worksheet to enter a value takes somewhere in the rough ballpark of 50 times longer than simply tabbing through a field on the primary worksheet. So it logically follows that if a field is needed by significantly less than 2% of investment sales (i.e. 1 in 50), then it will be faster for pros if we move the field off the main entry worksheet (where they would always have tab through the empty field even though it rarely applies) to the supporting worksheet. So with corrected cost basis, for example, we found that about 0.5% of investment sales reported a corrected cost basis. So for every sale with corrected cost basis that now takes ~50 times longer than simply tabbing to the field on the worksheet, there are about 199 sales that can be entered a little bit faster because there's not an unnecessary field to tab through. The net result is pros should spend about 1/4 as much time, on average, in navigation connected to corrected cost basis (whether it's navigating to make an entry in this field on another worksheet, or tabbing through an unneeded field for the >99% of sales that don't need it). The lowest use fields that made it onto the primary worksheet were the adjustment amount and code fields, which are actually used just under 2% of the time. We decided to include them even though they're just under the 2% threshold because we think their use will become more common now that fewer adjustments are handled on the main entry table. The adjustment codes are all listed right below the entry table, and we suspect many pros will get comfortable with using these codes for some of the simple adjustments rather than navigating to the Adjustments worksheet. (e.g. putting a C in the adjustment code field is much quicker than navigating to the Adjustments worksheet) Unfortunately, while we would have liked to put all the codes in a simple dropdown, our current system doesn't provide a way for us to do a dropdown that supports multiple selections. (e.g. it's entirely possible to need to make a B and an O adjustment for the same sale, which wouldn't be possible with a dropdown)

Obviously it's tough to adapt when something changes that you're used to. And of course there will be some specific situations where the new approach does take a little more time. But I just wanted to give the background so you can see pretty much every concern raised here was already considered, and the decisions we made were driven entirely by data around what types of entries our pros actually need to make and how to make that as efficient as possible *on average*. For the overwhelming majority of your clients, we think you're going to find the new approach is significantly more straight-forward and efficient.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Wow thats a lot of explaining up there....

so maybe you can answer, where does someone key in the sale of a second residence?

Does that go in the 1099B worksheet?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yep. Any asset sale, unless it's connected to a business or rental property, goes on the 1099B worksheet. (Assets used in a business or rental are reported on the depreciation worksheet for that asset, or on the worksheet for nondepreciable property for that rental or business.)

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Somehow Devin has made War and Peace appear to be a short story 😬

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I just went through it for the first time, and it looks good to me. Yeah, it will take a little getting used to, but it is very similar to what it was before.

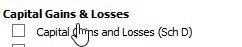

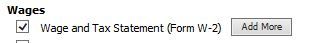

@Intuit_Devin I don't know if this is your department or not, but at least in ProSeries Basic, GETTING to the 1099-B worksheet is annoying.

The main income screen we check the box for the Schedule D worksheet. We then need to Quickzoom a 1099-B worksheet and then name it. So it take 2 extra steps just to start. Wouldn't it makes sense to be able to go immediately to the 1099-B worksheet? And then be able to 'add another' 1099-B worksheet if we want to (similar to a W-2)?

And the green "Where Do I Enter?" box and the "Open Form" box doesn't seem very friendly for finding the 1099-B worksheet. I enter 1099-B and it doesn't really get me to the 1099-B worksheet.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I don't know about Proseries Basic, but in Proseries Professional the 1099-B is listed under the subset of Schedule D. And at the top of the 1099-B we can open another copy of 1099-B.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@taxshack wrote:I don't know about Proseries Basic, but in Proseries Professional the 1099-B is listed under the subset of Schedule D. And at the top of the 1099-B we can open another copy of 1099-B.

Right, but why do we need to go to a non-fillable Schedule D first, THEN go to the form that we need to use to actually enter data? That is just taking extra steps to even start anything.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

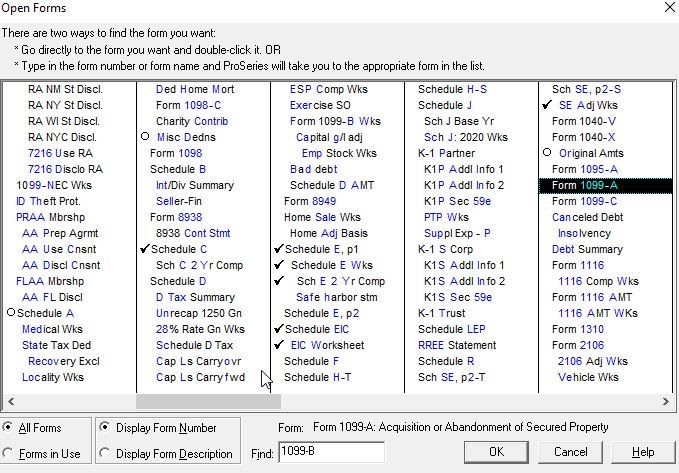

I don't know why you have to. I can open Select Forms (Ctrl+F) in Proseries Professional and a few forms below Schedule D it shows 1099-B Wks and I can just click on that and open it up.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Also, if I open Select Forms (Ctrl+F) I can type FB in the box and it takes me to where it is in the forms list. They highlight the letters in blue on the Select Forms list that you use to search for the forms.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi @TaxGuyBill , thanks for the feedback.

First, make sure you've updated to the latest release. The "add another" option on the 1099-B worksheet has been in place for at least couple of releases now, so you should be seeing that. And just an FYI, it's optional to add a name for the worksheet, so you can skip that step when opening it from Schedule D if you don't need to reconcile multiple account statements. Also, if you use "Find Form", you can locate the Form 1099-B Wks under the list of Schedule D form, or by just typing "FB" as pointed out below for Proseries Professional Edition. (The "FB" method works for Professional and Basic.)

Regarding the "Where Do I Enter", as well as the "Checklist" of "Income" forms, thanks for bringing that to our attention. Those should show the 1099-B worksheet as well, but I just tried it now and see that they are not. We'll need to do some investigation into why these two navigation elements don't seem to be working.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you, but I think you are missing some of my points.

(1) You might have caught on to this one, but on the main screen, you should be able to go directly to the 1099-B (ideally, without needing to name it, as that is an extra unnecessary step in most cases), not to a non-fillable Schedule D.

(2) Also from the main screen, if you really do want to have multiple 1099-B worksheets that you need to name (again, that is just creating extra work for us), then like the W-2, you should be able to "add more".

(3) We have a paper copy of a 1099-B in front us. ProSeries wants us to use the "1099-B Worksheet". I should be able to click "Find a Form" and type "1099-B".

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for clarifying and including the screen shots. I think I got points #1 and #2, but my response wasn't clear enough.

You are correct that the 1099-B worksheet should be on the main screen in your screenshots. (I'm referring to that as the "checklist" as that's the name of its tab at the top.) And it was actually our intention that it should be there, which is why we'll need to investigate why that's not showing up in production. I apologize I'm not super familiar with that screen as it's a navigation screen unique to Proseries Basic and I work more in the form design and calculations that are shared across our products. But I do know the 1099-B worksheet should have been added, so we'll be looking into why that's not showing up and then adding the 1099-B worksheet - with an "add more" option - to the Capital Gains & Losses portion of the checklist.

Regarding item #3, the functionality you're looking for - the ability to type a complete form name and have us populate form(s) that match it - is found in the "Where Do I Enter?" tool. It's the green button with a question mark. The screenshot you have in #3 - the "Find Form" tool - is a tool to allow users to quickly pull up a specific form by typing a specific, short code for that form. The code for each form is the letters in blue. So if you look two columns to the left of what you have highlighted, you'll see "Form 1099-B Wks" listed with a bunch of other forms related to Schedule D, and the "F" and "B" are in blue as the clue that those two characters are what you use to quickly pull up that form. The "Where Do I Enter?" tool is for searching for all possible locations you might want to enter certain information. The "Find Form" tool is for quickly bringing up a specific form when you know the shortcut code.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Form 1099-B is listed in your screen shot in the third column as the third item down.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Since you were helping with changes, I have another question about data entry on the 1099B worksheet:

Why does the 1099B worksheet no longer "remember" names of assets? If a client has both a ST and LT transaction entry, you have to re-type the entry. ProSeries used to bring up a list of assets in the capital gains worksheet to allow you to choose a name you have already typed.

This is different than the Schedule B worksheets where Pro-Series will "remember" account names that show up when you start typing a name! Add this to 1099-B worksheet please! I would rather by a tax analyst than a typist.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am trying to enter something and it is Absolutely Horrible!!! Who ever thought of this needs to be fired! What a joke! And yes I am very frustrated! 😠 Garbage!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I just did and it is Absolutely Horrible! who ever thought of this needs to be fired! What a joke! And yes I am very frustrated! 😠 Garbage!

Please direct me to where to find instructions on how to enter information on this sheet. (total/subtotals etc.) How and where do you enter Asset sales, that are not stocks, quickly on the schedule D???

Please send valuable information on how to use this vs defending why you did it.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think it is interesting why there are so many complaints about it. To me, it is very similar to what it was before.

The only major problems/annoyances that I've noticed so far is (a) it does not show the gain/loss for each transaction (I really hope they change/correct that), and (b) the worksheet is erroneously called "1099-B", even though it is for ALL 8949/Schedule D transactions, regardless if there is a 1099-B or not. The other changes will just take a while to get used to.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I appreciate this forum. I was also stumped having to report a 1099-S with all proceeds as Nominee and not taxable. You guided me in the right direction and I was able to fill it in following the directions after clicking the "?" button. It gives very detailed instructions for the form, for a variety of needs, after double clicking 'Adjustment Amount' . Thank you for all your participation.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I used it for the first time today. I was expecting to have to spend the next three days trying to figure it out after all of the complaining that I had seen here. After using it, my only question is - what's the big deal?

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That was my thought too.

As I mentioned before, the only troubles/annoyances I see is that it doesn't show the gain/loss on the worksheet and that name of the worksheet doesn't make sense (it should be called something like "Capital Transactions" or "Form 8949/Schedule D Worksheet")

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I agree with the showing the gain or loss issue, but I don't care if they want to call it the Intuit House of Horrors, the name doesn't bother me.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I also agree - I miss the gain/loss per transaction. But the name doesn't bother me.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@IRonMaN wrote:

I don't care if they want to call it the Intuit House of Horrors

That is Intuit's internal code name for ProSeries. 😀

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

And where do you enter the # of shares sold? (I am assuming the description line???)

PS: To name all sales of assets to be entered on a "1099-B" is incorrect, as not ALL Assets sold are reported on a "1099-B" period!!! It makes someone who has prepared taxes for 30+ years cringe. It is NOT the correct standard for this industry, unless you do not know what you are doing. 🤔

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Mitx wrote:

It is NOT the correct standard for this industry, unless you do not know what you are doing. 🤔

That is exactly what the name is designed for ... TurboTaxers.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Don’t worry, the cringe feeling will go away after a few more years. I’ve been doing this for 40+ years and I don’t feel the slightest cringe. As long as the ending tax liability comes out correct it ain’t a big deal.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

and being paid by intuit?.......

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yeah, everybody that posts here is getting extremely rich from those Intuit checks. Haven’t you started receiving your checks yet🙄

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

🤣😂

got ya😆 made my night!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

They made this form harder to use! No explanation, even in their "Tax Readiness" online presentation on schedule D - nothing of value!

For a summary line, why doesn't the code, D, E or F tell the program that no sale date is required! Very frustrating. Looks like the programmers are asleep at the wheel. This should have been corrected a long time ago!!!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Too bad you didn't get more feedback before launching this!

Any idea why the summary of transactions requires a sale date. The codes D, E and F define the long term nature of the transaction. Now the worksheet asks for a sale date. When the summary is hundreds of transaction long with a variety of sales dates, there is no single date that works. The end user knows this, but you don't.

Sure looks like you guys fixed something that was working well. Training would have been nice. Please post something constructive and useful on this. I keep looking for a fix, but it's been a month and still no fix.