- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Special Dpreciation

Special Dpreciation

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

My client uses 100 % of 2019 Jeep Grand Cherokee for construction business. He bought in 2022 for $95,316. Can he use the full purchase price of $95,316 for special depreciation in 2022 ?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, he has mileage log with all his business usage, and it's 100% business use

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Have you Googled if it is a qualifying 'truck' with the GVWR of over 6000 pounds?

If it is, then yes, it would all qualify for Bonus depreciation.

But then the next question is if it is in the best interest of your client to take the full cost in one year, versus spreading out the cost over six years.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, it's a qualifying SUV with GVWR > 6,000lbs.

He has a lot of income ($240k+ including special depreciation), so it's best to write it off in one year.

Thanks for your help

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

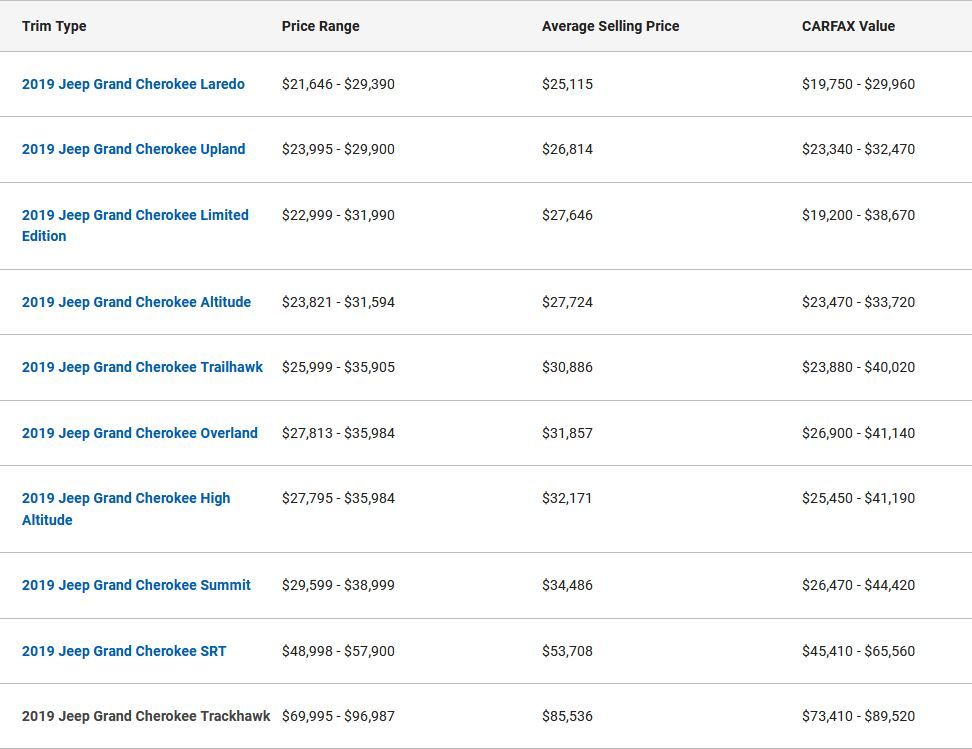

From today's Kelley Blue Book:

"For reference, the 2019 Jeep Grand Cherokee originally had a starting sticker price of $35,040."

Your number seems high. A three year old car at $95,316?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Isn't it more like a 4-year-old car, since most 2019 models were built in 2018? The current 2023 models include the "Summit Reserve" priced at $70,435. I also notice the GVW is 6,050. I wonder what they had to add to get it over 6,000.

Maybe this one has a snowplow attachment. There was a Tax Court case recently where the judge didn't allow the vehicle expense because there was no mileage log. But he allowed the full cost of the snowplow attachment, because you don't have to keep a log for that. Or maybe he allowed 90% of it, because the taxpayer used it occasionally to clear his neighbor's driveway. You could look it up.

And I noticed your edit to correct "Kelley Blue Book."

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Invoice: 2019 Jeep Grand Cherokee, body type: Trackhawk 4X4, mileage: 26,587

price: 85,495

service: 2,165

others: 829.97

sales tax: 6,826.36

total = 95,316.33

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No trade-in. $80K financed

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It is interesting how the "Trackhawk" model/trim is so expensive.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Trackhawk is the $90k vehicle.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I rarely have seen a vehicle that is 100% business use unless the vehicle is housed in a garage at the business location and never driven to the owner's home. (Mileage between home and the office is personal use.) Obviously, the taxpayer must also have another vehicle that is used 100% for personal use.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, if the business office is in the taxpayer's home and the taxpayer never once drives the vehicle for personal use, and the taxpayer has another vehicle that is used for all personal mileage, then under those circumstances the vehicle could be 100% business. But in my experience, that is never the case. The business vehicle is driven for personal use at times. It is more like 80% or 90% used for business.