- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: Passive Schedule C income not included on Form 8960

Passive Schedule C income not included on Form 8960

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

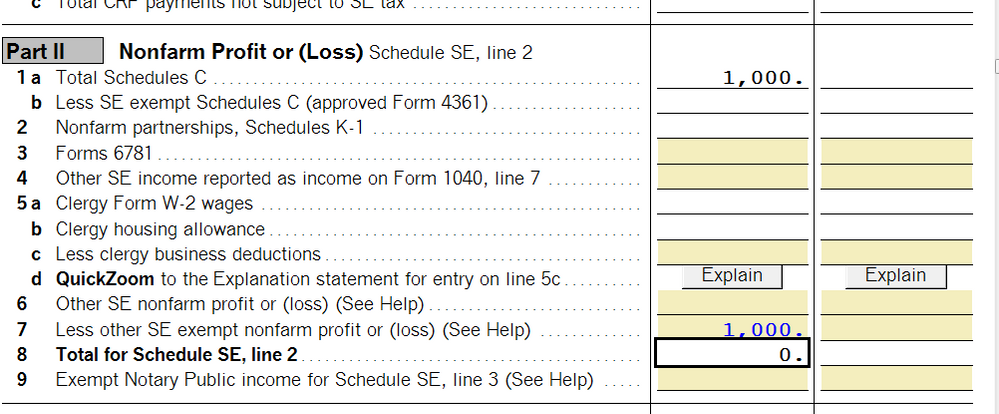

A client has Schedule C that is passive. I checked Sch. C question G re: material participation NO. I reported the profit on Sch. SE Adjustments Worksheet Part II line 7 so it is not subject to SE tax.

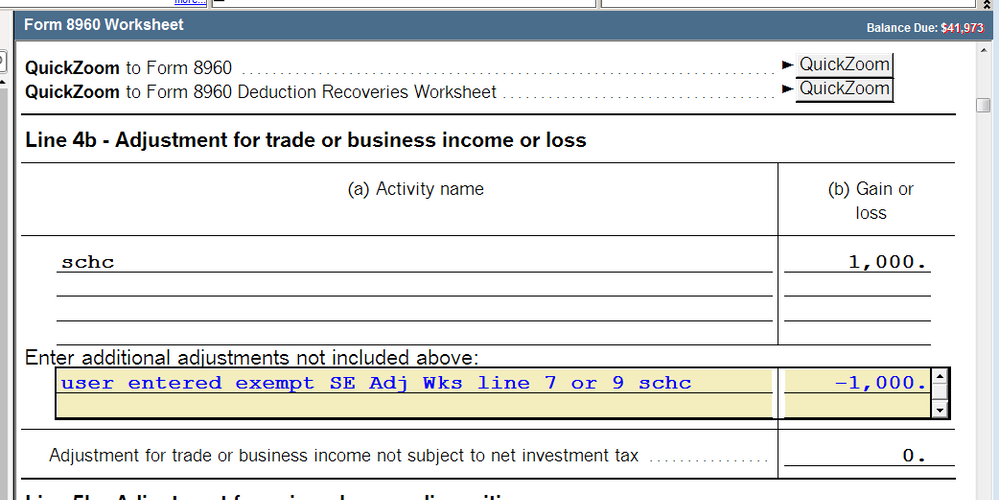

The profit is being shown on Form 8960 Line 4a and again on Line 4b so it is not being subject to the NII tax. I believe this is incorrect.

I have called Tech Support 3 times and spent hours on the phone with them. Issue has not been resolved.

Is my thinking correct? If so, did I not enter something somewhere? Or, is the software wrong.

Thank you.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ive never heard of passive Sch C income, whats the situation?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

A single member LLC business in which the sole member does not actively participate in the day to day operations.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

But theyve hired someone that does, right? I dont understand how this can be considered passive.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The 85 year old owner lives in Florida. The business is in NY. It is run by employees there.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

and? Its still treated like a sole prop for tax purposes. . Whether the owner does the work or hires someone else to do it, I dont see how this wouldn't be subject to SE

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I agree with Lisa on SE tax.

I agree with OP that it is passive.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

We both know something fishy is happening here, but we could spend all night guessing at what it is. Did the old guy ever operate the business? Or is this a way for his kids to support Dad in his dotage, while avoiding some New York taxes? I don't want to know the whole story because it would involve telling the rest of the world too much client information that should be kept confidential.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you dont materially participate your losses may be limited, Ive never heard of SE tax avoidance for this.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I agree with everyone else's input. You cannot be in business and yet not be in business. Being as the income is from a business, and this is a sole proprietorship (not set up as an investment), then it is subject to SE, even though you might have a retired owner (as an example).

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Here's some feedback I received:

In this scenario (a manual ‘SE Exempt’ entry on the SE Adj Wks lines 7 or 9 and not the Schedule C activity itself ), you will need to make a corresponding manual entry on the 8960 Wks Line 4b user entry table that offsets the calculated entry by the program in the table above. See screen shots below.

We hope this helps!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I realize it is possible to offset the reduction on the 896 worksheet. But a manual entry should not be needed.

The cross reference for Line 4B on Form 8960 Worksheet says:

From Schedule C, Activity Summary Smart Worksheet, line1 if the box is checked indicating the activity is a nonpassive trade or business not subject to net investment income tax.

Checking Line G NO on Schedule C makes the activity Passive on the Activity Summary Smart Worksheet. So nothing should transfer to Line 4B.

Note that the 2021 program was incorrect in that it did not pick up income from Schedule C on Form 8960.

It seems to me there is a programming error.