- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: NEW JERSEY RENTER CREDIT

NEW JERSEY RENTER CREDIT

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

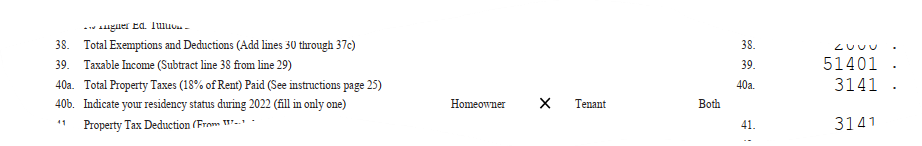

Hi to all. This the first time I am going to file for a new client from New Jersey. I was googling and here to find out how to calculate the renter credit. Which I found out that if a renter paid 365 days in New Jersey for monthly payment $1450, client can take a credit for 12* $1450=$17400 so $17400*18%=$3132

This credit reduces tax liability. If I am right, let me know. This is a huge credit, can not believe it. I do not have any objection about that why this is a lot, just correct me if I am wrong.

The courtesy of a reply would be appreciated.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I don't do NJ, but a quick look at the rules state Homeowners and tenants who pay property taxes on a primary residence (main home) in New Jersey, either directly or through rent, may qualify for either a deduction or a refundable credit when filing an Income Tax return.

I don't know for sure but I would think if you use the 18% it would be a deduction and not a credit, but you need to look up the rules yourself.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks, this is what I found out, but my question is about the mount which I calculated based on what you said and I did.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Who can help me please from NEW JERSY!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The best way to know if you and the software are correct, and to learn, is to get the forms and instructions and fill it out manually.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

For me it is enough that a tax prep from New Jersey just confirms : yes, and renters can get 18% of rent which they paid. Assume if I paid $36000 rent for 2022 in NEW JERSEY I can get 18% of $36000 ($6480) as tax liability relief that it is a huge deduction. Make sense?!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You started this post yesterday. It's now today, not yesterday. In that time you could have read the instructions multiple times. And then read them again another multiple times. Folks here don't mind pointing other folks in the right direction but sometimes it is frustrating when someone won't take the initiative and do a little work on their own instead of waiting to be spoon fed.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks, as of one week ago I started to think about I did read a lot. I would like to know am I right? I explained before I searched a lot and I shared my insight. NOT ENOUGH SELF CONFIDENCE MAY BE

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What I want to explain it is that when I enter all the amount of rent for 2022 system calculated 18% of whole mount. Instruction says like this but 18% of for example, $36000 is going to be $6480 that is a huge deduction to reduce AGI so that I never seen it in other states.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

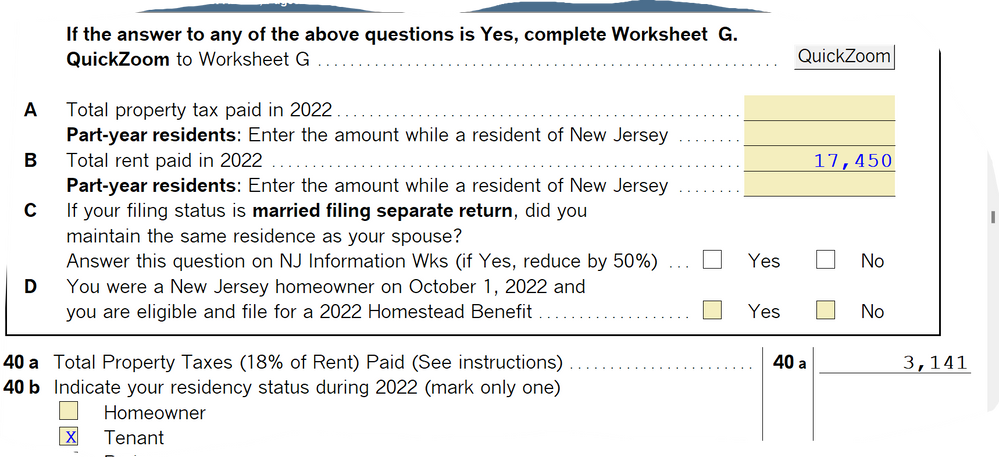

On page 2 of the NJ return there’s a series of questions about. Lived in more than 1 residence.. shared with someone other than spouse, etc. (if you answer any other than no, it will trigger another schedule to fill out).

complete the questions. Below them are fields to enter total rent, property taxes….

For renters it works fine. Can get more complicated for property owners with with multi family or multiple owners or part year renters/property owners

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Deduction. It is only a credit of $50 if the tax savings value of the deduction is less than $50. Then you get the $50 credit.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

We are both NJ preparers. If you are not required to complete schedule G, then both you and the software have done it correctly.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you very much Skylane I really appreciate it.

Accountant-man said: It is only a credit of $50 if the tax savings value of the deduction is less than $50 then you get the $50 credit; but $50 would not be for all situation I mean there is other option 18% rent paid if all answers are NO. Client is a tenant and all about above answers are NO so she can take 18% of whole the rent amount. ( her mom lives with client and her husband, I should mention it)

For me it was very strange since most of the time I see for other state something like $60, for couple $120 or $50 ....as Renter Credit.

Now, I see a tax deduction in NEW JERSEY around $3000 that is why I was shocked.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hope, the 3141 is not a tax credit. It only reduces taxable income.

if the tax rate is 3.5% then 3141x 3.5% = what you actually get

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If rent is $250 a month times 12 = 3,000 times 18% = 540 deduction times 1.5% = $8.10.

I'd rather have a $50 credit than a $540 deduction, in this case.

BTW, you enter the total rent amount, the software calculates 18%.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks, got it. Could you please help me where can enter $50 instead, I mean what line or which area on return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You don't. Just enter the rent like you did in your snapshot above ($17K), answer the questions and the software will do the rest.