- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: IRS Letter 5138 and 5025 - EITC Due Diligence Requirements

IRS Letter 5138 and 5025 - EITC Due Diligence Requirements

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi Everyone,

Just received the IRS 5138 and 5025 letters which basically states that I have am not been meeting the EITC due diligence requirements. I have tried to reach the IRS to ask them what are the specific issues they have encountered with my tax returns. Their response is to read the guidelines and no further information can be provided.

I wanted to know if anyone else has received these letters and how have they handled this situation.

Thanks.

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You may want to go through and see how the questions on the 8867 are being answered, make sure youre not misreading any of them and answering incorrectly.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You may want to go through and see how the questions on the 8867 are being answered, make sure youre not misreading any of them and answering incorrectly.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@IRonMaN wrote:

Since the are saying that without an office visit, I agree with Lisa. Out of curiosity, how many EIC returns do you prepare?

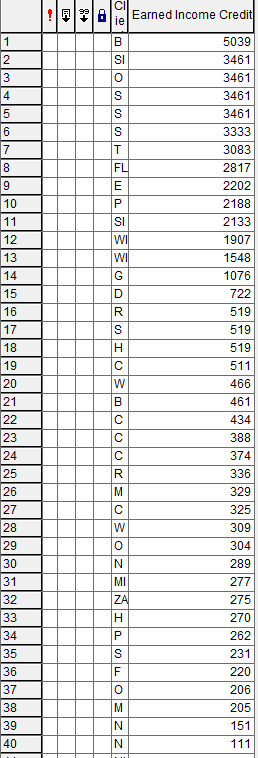

Ohh, that reminds me, I wanted to see how many EIC returns I file....looks like 40 out of approx 600 clients in 2018.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

These two letters are simply warning letters to alert you to a POSSIBLE problem with the returns you are filing. I would suggest you start to gather more documentation for any EITC return you do. Get copies of birth certificates. Get a copy of a school record. CAREFULLY READ the Instructions and make sure you are in compliance. We did have one user a couple of years ago that was hit with something like $50,000 in penalties. They never came back to post a resolution, but I do see they are still in business.

IRS operates a honesty system based on FEAR.

https://www.irs.gov/pub/irs-pdf/i8863.pdf

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@George4Tacks wrote:

These two letters are simply warning letters to alert you to a POSSIBLE problem with the returns you are filing. I would suggest you start to gather more documentation for any EITC return you do. Get copies of birth certificates. Get a copy of a school record. CAREFULLY READ the Instructions and make sure you are in compliance. We did have one user a couple of years ago that was hit with something like $50,000 in penalties. They never came back to post a resolution, but I do see they are still in business.

IRS operates a honesty system based on FEAR.

https://www.irs.gov/pub/irs-pdf/i8863.pdf

I remember that one, scary stuff! Didnt she have like 90 EIC returns she had marked that she had some kind of records for, but she didnt have them.... at $500 penalty each.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This might help with what you should have access to https://www.irs.gov/pub/irs-pdf/f886he.pdf

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm guessing that lady isn't going to be coming back to update us because I'm guessing she is no longer filing returns.

Out of curiosity, I did go back and see that I had 20 of those cursed little returns out of roughly 500 returns filed

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@IRonMaN wrote:

I'm guessing that lady isn't going to be coming back to update us because I'm guessing she is no longer filing returns.

Out of curiosity, I did go back and see that I had 20 of those cursed little returns out of roughly 500 returns filed

I just dug a little deeper to see how much in total dollars of EIC was given to my 40 clients, over 48,000! Holy moly, thats a lot of free cash being given away.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

But that is only $1200 per client --------------------------- you can do better than that ![]()

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Only had a few handfuls over the $1000 mark, I think Im fairly small potatoes for IRS to go after and want to snoop around.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm on it. I will re-check the 8867 to see if I'm doing something incorrectly.

It's funny how the IRS cannot give us (tax preparers) 5 minutes so we can do a better job of meeting our requirements but it has no problem spending 2 to 3 hours answering taxpayer questions on the phone.

I wanted to thank you all for your remarks and suggestions.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How can I customize report in Proseries with Earned Income Credit?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

if you're (un)lucky, maybe IRS will call you. This is what their website says:

We send letters to preparer's clients to inform them their return may contain errors claiming the above tax benefits.

We make telephone calls to preparers who have received one of our letters and continue to appear to file returns with errors claiming the above tax benefits. We review due diligence rules and discuss possible consequences for not meeting those rules.

The calls are exempt from directives on IRS not contacting taxpayers by telephone. We will ask questions to confirm the preparer's identity, but we will [I think they left out "not") discuss specific client information or ask the preparer to disclose client information.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In Professional, you can Run a Query for all returns with EITC

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Please can you show the step how to run a query in proseries?