- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: IPPIN-didn't sign up for one, so why is proseries asking for one?

IPPIN-didn't sign up for one, so why is proseries asking for one?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Taxpayer has an IPPIN, but proseries is saying spouse pin is missing. Spouse never got a pin (never signed up for one). So she went and signed up for one so we could efile. It's rejected again, now saying the dependent pin wasn't entered (dependent never signed up for a pin). What the heck is going on???

This family is adamant that only the taxpayer signed up for an IPPIN. So why is proseries saying the whole family has one?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is it being rejected by ProSeries, or is it being rejected by the IRS?

If it is merely ProSeries rejecting it, you could disable error-checking when you e-file it.

If it is the IRS rejecting it, that is something the taxpayer needs to discuss with the IRS, not ProSeries.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

ProSeries doesnt police IPPins, did the return get rejected by IRS?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

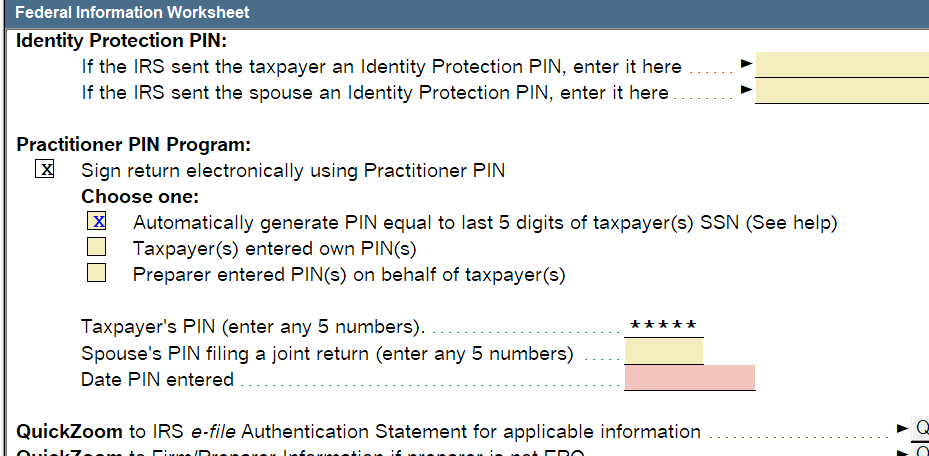

"proseries is saying spouse pin"

That is different than an IPPIN. Taxpayer and spouse need PINs for efiling. Dependent doesn't.

IRS will reject efiled returns if TP, SP, or dependent IPPIN is missing or invalid.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Doesnt everyone use the automatic Practitioner PIN method?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Maybe not. I do.

The more I know the more I don’t know.