- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: How do you e-file an amended return that you didn't originally file?

How do you e-file an amended return that you didn't originally file?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have a client that filed their own return and messed up. Now they want me to file an amendment. ProSeries isn't letting me e-file it because it says I need to file an original return first. How do I file an amended return for a return I didn't originally file?

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

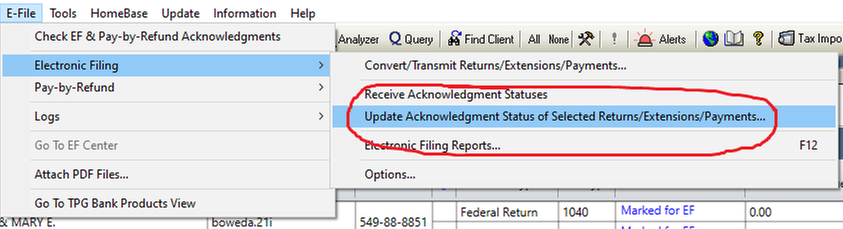

Highlight them and then instead of Receive Acks, choose Update Acks of Selected Returns, see if that pulls them in.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The original needs to have been Efiled and accepted previously, assuming that is true.....

You recreate the original exactly as it was prepared, then you activate the 1040X and then you make the changes youre amending for.

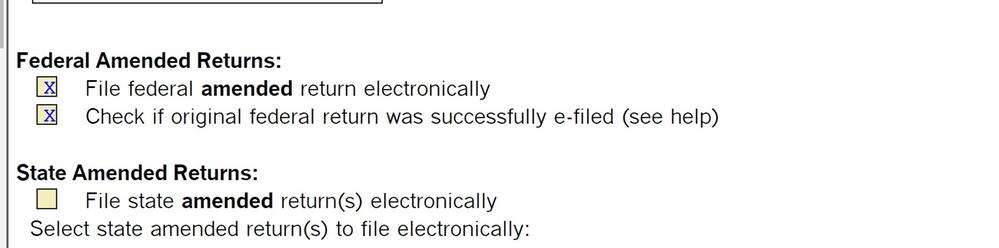

Be sure youve checked the box on the Fed Info worksheet about the original being Efiled and accepted.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

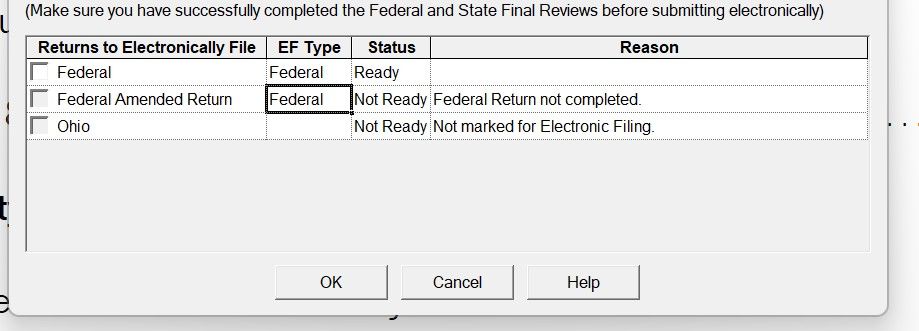

It says federal return not completed next to amendment. It says ready for original return. I checked it was filed and accepted and still isn't allowing me to e-file amendment.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Do you have the EF boxes marked for both the 1040 and the 1040X? Or just the 1040X?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Both 1040 and 1040X. That must be why? I should uncheck 1040 e-file?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

When I uncheck 1040 e-file it says the Amended EF cannot be e-filed when original return is not checked for e-file.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It's for 2021. They filed on their own in January and received their refund mid-February. So I know the original return has been processed.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I thought you can't E-File an amended return unless you E-filed the Original as the original preparer?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Intuit started out with that restriction in 2020, but eventually allowed you to e-file the 1040X on a return you did not prepare or e-file thru them by adding a check box that the original return was e-filed and accepted.

Are you sure the 2021, 1040X is ready to be e-filed yet?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, unless there is some step I am missing. I did the review and there are no errors. I checked e-file for both 1040 and 1040X. I checked that original return was e-filed and accepted.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Well I remember it was a bit of a nightmare in 2020 because Proseries changed the instructions on amending a return 3 times.

Check the How to amend a 2021 return instructions, if you haven't already, and see if there are any new changes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It says Marked for EF.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you highlight it and hit the EFNow button, and choose Convert, will it convert for Efiling?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It said return conversion was successful.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Looks like youre ready to EF it! EF from within a client return doesnt always work as intended, the EF Center seems to be a much more reliable place to transmit from.

Highlight it again, hit EFnow and choose Transmit.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Okay I have never e-filed from EF Center. Always from within return. The EF Status currently says Ready to Transmit. Do I highlight again, then hit EF Now, and select transmit selected returns? And it will be submitted completely?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Oops sorry I missed the last part of your post. Ignore my previous post.

Thank you for your help.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have another question about EF Center. I have 2 clients that I filed 3 weeks ago. They both have not moved from Pending. Their EF Status says Transmitted. How come they are not showing as Accepted?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Highlight them and then instead of Receive Acks, choose Update Acks of Selected Returns, see if that pulls them in.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yep, that worked. Thank you 😊

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

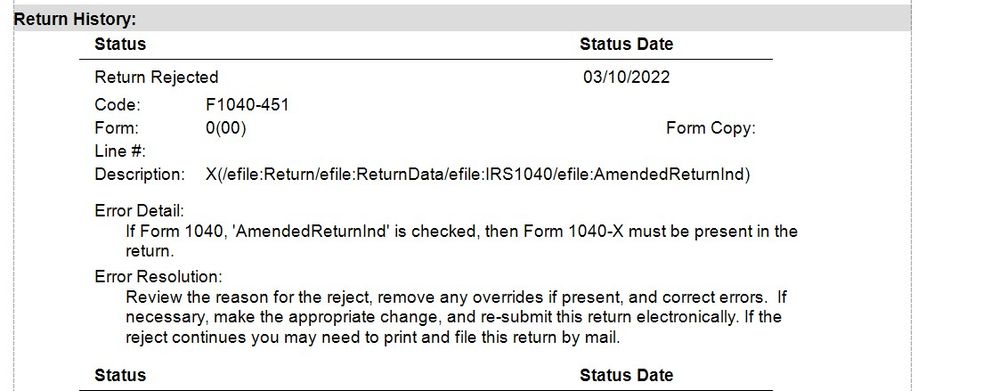

Ive heard of several people that end up with this message, Im not sure what it means or why it happens.

The EFCenter showed the Return Type as Federal Amended Return, right?

Your new 8879 shows the updated figures that are on the 1040X?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Just checked and it says Federal Return not Federal Amended. The 8879 has the refund amount from the 1040X. So, it's using the amendment total but filing as an original return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, marked both boxes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ive seen other people mention this same situation, I honestly dont understand what causes it.

What is it your amending for, are you just correcting a monetary amount or are you changing dependents or filing status? Im wondering if the reason for the amendment has something to do with it.

@Anonymous or @IntuitZacharyG you guys have any ideas?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am adding childcare expenses.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did you EF the original return? If so, are you using the same original file for the amended return? or did you make a copy and used the copy for the amended?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

No, I did not e-file the original return. The client filed on their own.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, the client said they received their refund.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, 2021. Is it possible it's too early to file it?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did you ever get this resolved to be able to efile an amended return you did not prepare? I have the same situation and I'm receiving the same errors.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Unless the rules have changed, you can't efile an amended when you did not prepare and efile the original. Has to be mailed. Check current rules.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Rules have changed

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If the rules have changed, how can I file an electronic amended reutrn?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I FINALLY had success with this. The thing I did differently was merely try to e-file the amendment while in the return. I usually only do it from the EF Center so I can ensure I'm highlighting the right line item with "amended" in the return type just to be sure. When I tried to e-file while in the return, the amended version allowed me to check the checkbox to file that one. To be sure it wouldn't change on me, I exited out of the return and THEN "amended" showed up in the return type, whereas it did not before. It seems I had to trick the system into e-filing the amendment where the original was not filed by me.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Congratulations! and welcome to ProSeries 🙂

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Level her up!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I also have the same situation - reading through feedback, but even the staff at Proseries has not been successful in trying to process the return - they go through a specific process of unchecking and checking boxes, but everytime the return fails, which is really frustrating based upon what we pay for software. It continues to say there needs to be an amendment, but its there. Any other ideas?