- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: electing to tax a portion of non taxable scholarships to allow client to take advantage of credit and reduce tax liability

electing to tax a portion of non taxable scholarships to allow client to take advantage of credit and reduce tax liability

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi,

I have client who was kid with 1098-T of approx 4 k in box 1 and 10 k in box 5

in pub 970 and other sources. Taxpayer has the right to elect to use a portion of non taxable scholarships and make them taxable and non -qualified expenses,. The rules get into alot of specifics about the particular scholarship guidelines allowing them to be used for strictly qualified or not etc..

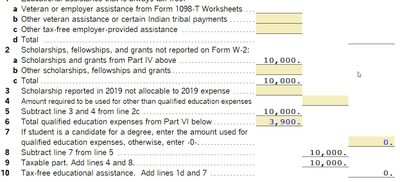

My question is that lets say the can be allocated and you can use portion of the scholarship to be used for these non qualifying expenses. the system shows you in student info worksheet part V where you can allocate this i believe and even shows you the taxable part, on line 9 but it doesn't tax it.

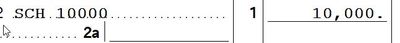

Pub 970 says that this taxable portion ... should be included in income on line 1 ( pub 970 pg 6)

Pro series does not seem to automatically tax this income. I suppose you could put it on line 21 other income with description " elected taxable portion of scholarships from 1098 t box 5 " . But I am wondering if anybody has used this and what methodology have they used.

Thanks in advance

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It is working for me.

Have you checked Line 1 of the 1040? Have you gone through the error check on the tax return?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes I have.. it is not adding it in there. Not sure why. But maybe something else in how I filled things out . Thanks for the reply I will test your printout on blank return

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Wait a second ... it dawned on me what your problem might be. The taxable income goes on the KID'S return, not the parents' return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

are you sure about that? Does that mean that the parents cant report the income on their returns and take the credit on their returns? Is this ONLY available to the student if someone tries to take advantage of the treatment of non taxable scholarships as taxable income and if so then is it true that they ( the student ) are NOT allowed a refundable credit if the student tries this.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The INCOME goes on the student's return. It was the student that received it, so it does not go on the parents' return.

Assuming the parents are claiming the kid as a dependent, the parents claim the Educational Credit.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I finally got it to tax the portion, but IN THIS YEAR'S PROGRAM UNDER THE STUDENT INFORMATION WORKSHEET. BUT I CANNOT GET IT TO LET ME ADD IT FOR THE CREDIT. 😞 I DID LAST YEAR.) IF I PUT IT WHERE THE EXPENSES GO IT JUST LOWERS THE AMOUNT IT CARRIES TO THE 1040.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It is carrying to line with wages and putting it as scholarship income now, but how do I get it to let me take it as a credit for AOC. as IRS allows. If I put more expenses on expense line. Then it lessons the amount of income it takes as taxable income. I need the taxable income left alone. So . . .

Only place allows education expenses takes it off of taxable income

Solution? Thanks

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

(1) Please keep your related comments to ONE thread. It is very difficult for anybody to help you if you keep posting all over the place.

(2a) Is the student a dependent?

(2b) If so, are you preparing the dependent's return, or are you preparing the parents' return?

(3) Using rough numbers, how much is for qualified tuition (usually Box 1 of the 1098-T plus any other qualifying expenses)?

(4) Using rough numbers, how much are scholarships/grants (Box 5 of the 1098-T)?

(5) Please confirm which software you are using.