- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Re: 3rd pasrty designee

3rd pasrty designee

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Unable to change 3rd party designee for permission to discuss tax return even after changing in tools miscellaneous options. Does anyone know how to change this to yes.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

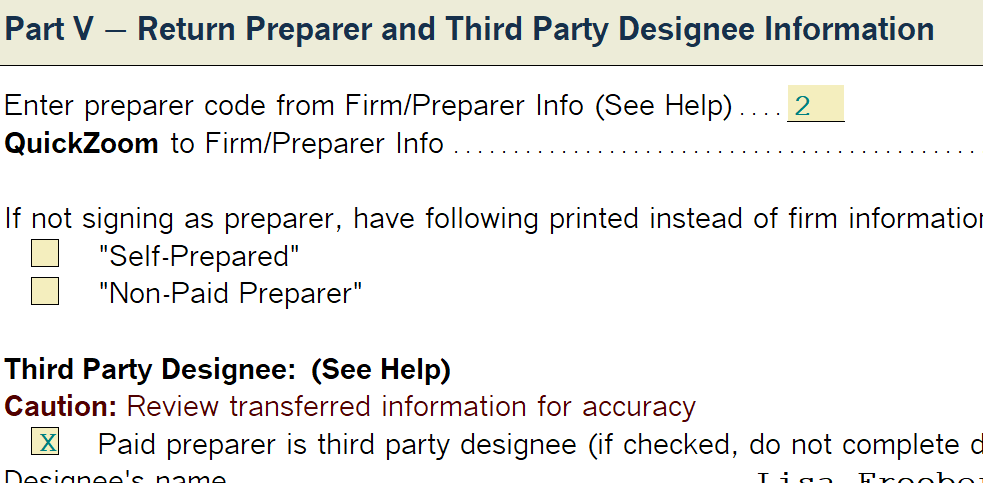

Try using the information worksheet.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you, as the tax preparer, are naming yourself as the 3rd Party Designee for all returns under Tools, then you are automatically designated that in the return when it's e-filed.

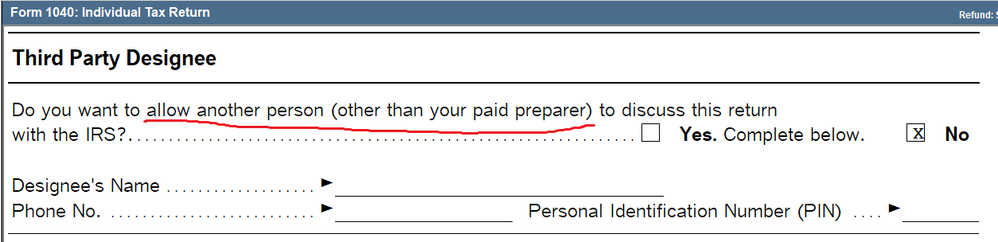

It's confusing because in previous years it was printed on the 1040 that you were the designee, however, now the 1040 states "Other than tax preparer" under the 3RD Party Designee area and also includes, "Do you want to allow another person (other than your paid preparer) to discuss this tax return with the IRS? see instructions. There is a YES box to check for that somewhere, probably the 1040 worksheet and it should allow you to enter another name.

If it's just you, the NO box auto-fills, which tells the IRS, the preparer is the 3rd Party Designee.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It wont let you assign someone other than the preparer?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Everyone is crazy. Calling IRs on client issues and need 8821, asked about being preparer and they say the 3rd party designee box not checked can't talk to me, ...There is no way to overide check box on 1040 as some say..So what is the trick to populate 3rd party designee...Thanks

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Just for everyone's info, if you hit the F1 (help) when in box for third party designee. The help screen says if you check this box, then the preparers name will print in third party designee on the 1040, but it does not. If there is no name on the return, then no one will be able to discuss the return with IRS, but client. If you uncheck box, and type your name, it will go on the return, but I thank you will have to do that for all Returns

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Fed info worksheet check box make the 3rd party designee box get check for the preparer.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Lisa, What I said is the program is not printing the preparers name on the return under third party designee. Even if it says in the third party designee, except your paid preparer. The IRS will not talk to you. I was on phone with IRS last week about 2018 return, and he would not talk to me, and said my name was not on third party designee. If you read the help screen it says that very same thing.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

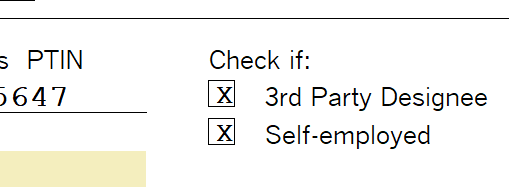

But the 3rd party designee box is checked next to the preparer name in both the 2018 & 2019 returns, you name doesnt get shown again anywhere else as 3rd party designee.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

And that is the problem, the agent told me if my name was not on the return as third party designee he would not talk to me. As I said earlier the help screen says it will print the preparer name, but it does not print it on the return, it only shows on the info worksheet, but does not print

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

After I talked to IRS again today , they would not take me as the preparer to talk to them, as was stated by Pro Series and everyone else of the new regs on the 1040 form..I called Pro Series to see if any way to populate the 3rd party screen, with my info..There is no way...So now just get a Form 8821 and fax in when talking IRS..Someone needs to get something together...Miffed

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So instead of checking the box that the paid preparer is the 3rd party designee, we have to type our name and info in there to get it to populate? Dumb!

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@IntuitAustin can you get someone from development to read this thread? Can they make the Paid Preparer info flow over to the 3rd party box automatically....I dont think it should need to, but IRS seems to think it belongs there.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Trouble is, over 1/2 season over...Oh yeah not yet, extending Ha