- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Not showing as being filed

Not showing as being filed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

EDIT: 4 times now. 3 owe. 1 gets a refund. When we check on the irs site for the return with the refund, it says it is being processed. So, I guess the returns are actually being submitted, but I want my efile confirmation number!

This has happened twice now. I am curious if anyone else has had it happened or if anyone knows what is going on.

I submitted a return for efile, and it all seems to be going well. Then, when I try to check on the status, it acts like I haven't ever submitted it. It says "marked for EF." I think I must have accidently canceled it or something, so I try to EF it. Then, I get the red thumb saying that there is a duplicate number and suggests that I am trying to file a return twice. This error happens right away, it isn't getting bounced back from the IRS as a duplicate. Both of the returns that this has happened to are to clients who owe money. Therefore, I can't ask them to check the status through "where's my refund."

Any ideas? Are the returns filed? One of them was to have an auto-draft of the amount due, one was going to send in a check.

Thanks!

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

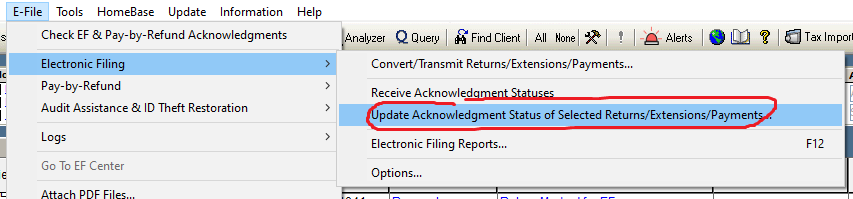

highlight the file and use update acks, see if that pulls the status in

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It is all greyed out as if it hasn't been submitted.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Are you on a network of some kind?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Network license, but it is just a couple workstations. It doesn't matter if I used the server or a workstation to file or to look for an update.

The first time it happened was a couple weeks ago. The other 3 were within the last couple days.

If I open the return, that form for acknowledgement is not there.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"Both of the returns that this has happened to are to clients who owe money. Therefore, I can't ask them to check the status through "where's my refund.""

Yes, they can use that to check the Status of their return.

"The Where's My Refund? tool gives taxpayers access to their tax return and refund status anytime. All they need is internet access and three pieces of information:"

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks! I didn't know that. I thought since the third item was refund amount, and they owed, that they couldn't check. I will have them check on their status, but I still want to know what's up with the software.

Is there a place to report this? I probably just need to call support, huh?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Are you signed up for IRS e-news to your email? There are a lot of government newsletters you can select to get. For instance, I get payroll, retirement, NFP, local government, IRS, CFPB, etc.

This came in yesterday:

COVID Tax Tip 2021-39: Here’s how taxpayers can track the status of their refund

And here it is, on the web:

https://www.irs.gov/newsroom/heres-how-taxpayers-can-track-the-status-of-their-refund

"Taxpayers can start checking on the status of their return within 24 hours after the IRS acknowledges receipt of an electronically filed return or four weeks after the taxpayer mails a paper return. The tool's tracker displays progress in three phases:

- Return received

- Refund approved

- Refund sent"

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, I knew of the "where's my refund" feature on the IRS page. I was mistaken in that I thought it was only for refunds. Since my clients owed, I didn't think it would be useful. I found out that I was wrong. I asked the client to try using the tracker. First, he used a negative number for refund amount (third item they ask for), but it turns out that if you owe, you are supposed to put a 1 in the "refund amount" box.

So, we were able to confirm that the returns were received. I just wish that the software would give me the correct information: show that it was accepted and give me the electronic tracking number, etc.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I am actually dealing with this situation myself. 16 clients. They were all accepted by the IRS when I do the Status update, but nothing being updated in their files. I've done the Efile update acknowledlement status (multiple times now), but it doesn't update anything. And I have no 9325 form with the the submission ID for any of them. All of their returns were accepted between Mon 3/22 and Fri 3/26.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So we had found that if we deleted ( (ie moved them to a mem stick just in case) the cache files of the clients who wouldn't update their e-file status, opened each file individually and resaved, it corrected the situation.