- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- NJ 1040ES - Efile Reject

NJ 1040ES - Efile Reject

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

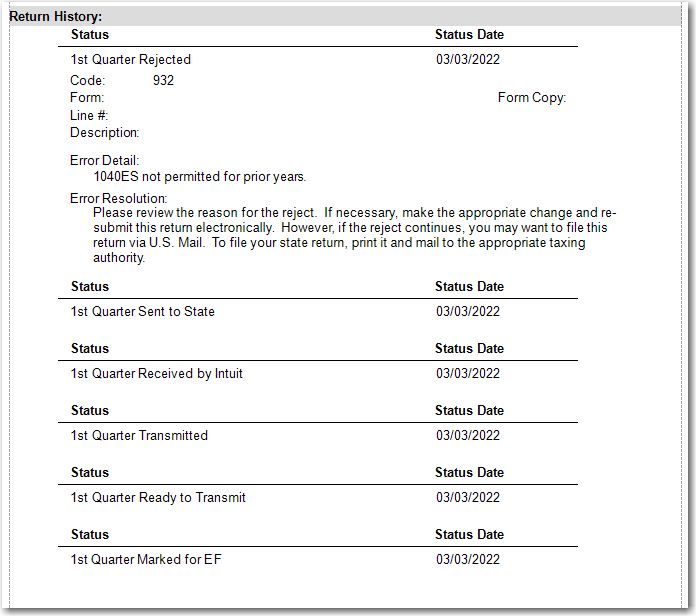

Is anyone familiar with why I would receive this rejection of a 1040ES efile for New Jersey. The rejection code is 932 and is indicating "1040ES not permitted for prior years". The coupons are reflecting the correct due dates for the payments. I know there was an issue earlier in the season with the due dates being for last year, maybe that has something to do with the rejection?

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

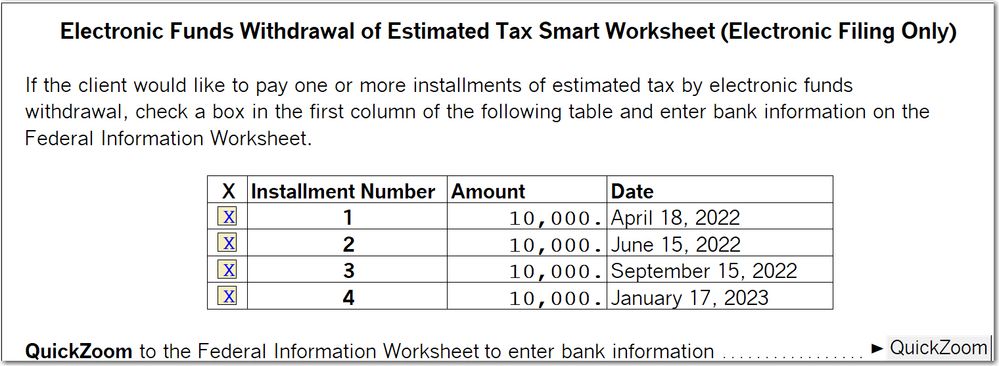

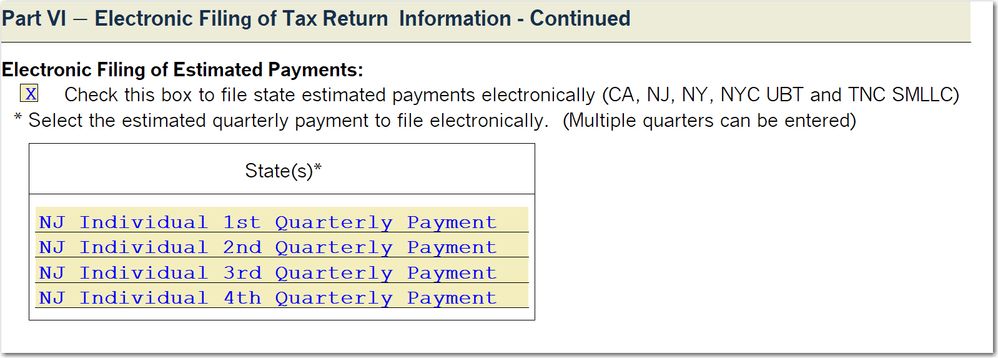

Being new to PS, this is the first efile I have with estimated payments being pulled electronically. This is how I set it up:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Weird. Im not familiar with NJ, but thats how I would have set it up as well.

Im in CA and our ES payments get scheduled in the ES worksheet just like the federal, they dont show up out in the EFCenter like NJ ES payments do.

@IntuitZacharyG @Anonymous

Any words of wisdom here? Is this a programming glitch?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I connected with ProSeries Customer Service last night. They indicated the New Jersey reject was due to me efiling all four coupons at once and that I should have efiled just the first coupon. After the first coupon is accepted, I can efile the 2nd coupon, once that is accepted, I can file the third...and so on. Does this sound coorrect? My previous program allowed me to simply efile everyting at once.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can someone on this forum affiliated with Intuit respond? I sat with customer support for an hour. They swore my efile for New Jersey was rejected because I efiled all four coupons when transmitting. We deleted three, and I only efiled coupon 1 for New Jersey. That was rejected as well. The message I'm receiving is

"1040ES not permitted for prior years"

I know in the beginning of the season there were issues with dates being incorrect on the coupons. Is it possible incorrect dates are being transmitted?