- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- MN Grant for Child Care Providers 1099G

MN Grant for Child Care Providers 1099G

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

MN has a grant that was given to childcare providers to help through COVID, they were issued a 1099G, on line 6 Taxable Grant. Now I understand this grant is suppose to be taxed on the Schedule C, but the program only puts it on the 1040.

1) Is this grant suppose to go on the Schedule C?

2) If yes, is there a fix to get it to link to the Schedule C?

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Don't enter it at all on the 1099G worksheet, as that is for unemployment, and state refund. If what you say i correct, then MN should have issued 1099NEC. It really doesn't matter, as you just fill out schedule C. 1099's don't get sent to IRS anyway

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

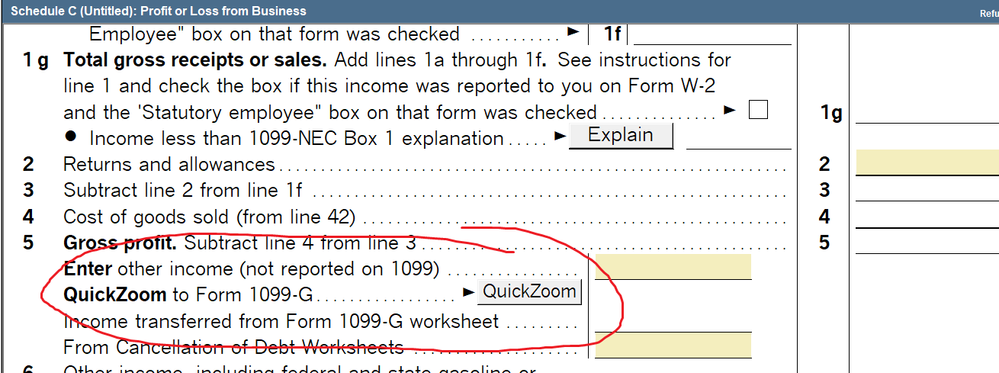

Ive never had one of these so Im not sure about the logistics, but I see a Quickzoom button on Line 5 of the Sch C to go to the 1099g worksheet, so it seems like you should be able to link from there? (assuming of course that the grant iIS subject to SE taxes, I know some of them aren't)

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Tried this it won't let me as that is only for box 2.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Are you sure the IRS won't try to link the 1099G to the return? ?

If you don't put a 1099 NEC on they will send a CP 2000 letter saying it wasn't reported even though it is on the C.

I have contacted the state, they say ask the IRS as they don't know and said it is a IRS form so ask them.

Even the people that issue the form don't know.

Anyone else from Minnesota here that has any idea?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ahh, ok.

@IRonMaN Youre in MN, have you seen this type of grant before? Is it subject to SE?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes MN,

whether is belongs on the C or 1040 is the other part of my question, I have contacted the people that give the grant and they do not know. This was a special COVID grant from MN to keep the daycares open.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The program says only line 2 can go to the C, which is strange because line 2 is state refunds.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The whole CARES act stuff and free money stuff from PPP has muddied up the waters a bit this year. If it was any other year I would enter it on schedule C and not think twice about it. Without any additional divine guidance, I guess I would go back to pre COVID thinking and add it to the schedule C. And I always manually enter totals on schedule C so I don't tend to worry about how 1099s are going to tie into the form.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What does 52 seconds mean?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So this form is not linked to the IRS computers yet? Because the 1099 NEC is. thanks!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In over 25 years Ive never entered a 1099 for NEC income into the program, I always enter the clients total business income on Line 1 of Sch C.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Terry53029 "1099's don't get sent to IRS anyway"

I don't think you mean what that sounds like it means. The state certainly sends the 1099-G to IRS, and it is part of the automated underreporter program mix.

But I'm not sure who decided this has to go on Schedule C. Where do we research the law of taxation of government grants?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Suesabell wrote:So this form is not linked to the IRS computers yet? Because the 1099 NEC is. thanks!

I think you may be confusing what happens with 1099NEC within the tax program and what IRS does with 1099NEC mailed in with F1096. Yes IRS does match the mailed in Form 1099s (MISC, INT, NEC, G, etc) with tax returns. No IRS does not match the 1099s that have been entered in the tax program with what's been mailed in.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There is an interesting Tax Court case from 1981 involving business interruption insurance and a fire down at the Piggly Wiggly in Colquitt, Georgia. The issue was whether private insurance proceeds paid to the owners, who closed the store, were subject to self-employment tax. IRS said they were. The Tax Court ruled otherwise.

https://www.leagle.com/decision/198151776ajtc4411482

Why did Minnesota use CARES Act funds to bail out daycare providers? Were those businesses shut down completely? Or did the children just stop coming because parents and schools stayed at home, and the owners needed money to tide them over until things returned to normal?

If you ask IRS if self-employment tax should be paid on this grant money, their knee-jerk reaction will likely be the typical “if it moves, tax it.” But what if you ask them if your client qualifies for another few thousand dollars in EIC because it’s on a Schedule C?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

From someone that works with legislatures on the subject of childcare taxes.

This is a state grant, I wondered the same thing, do you know somewhere I go to know for sure if this grant is taxable on the C?

I am so frustrated.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I don't think this was part of the CARES ACT, it was from the State of Minnesota No they were not shut down.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I assume this is the money we are talking about.

FAQs: Peacetime Emergency Child Care Grants (myminnesotabusiness.com)

The State was paying providers money to keep their doors open so that essential workers with kids could go to work. That kinda sounds like they were paying to provide a service, so I would go with putting it on schedule C.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Meanwhile, the parents were still paying the daycares for services they were providing. If Minnesota instead had made this a refundable tax credit, would it count as income? It will probably take a few years to resolve the question of whether this is self-employment income. Is childcare considered a combat zone? Does Minnesota qualify for foreign earned income exclusion?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"Is childcare considered a combat zone?"

Yes - at least as far as I am concerned. Those folks don't get paid near enough for what they do. Why do folks that take care of our most vulnerable (kids and the elderly) appear on the low end of the pay spectrum? But someone that can dunk a basketball or throw a baseball 90 mph is on the other end of the pay spectrum?

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sorry no they are not, but they are considered essential, and were given a lot of help form our state.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Another topic just posted led me here:

"This is a state grant, I wondered the same thing, do you know somewhere I go to know for sure if this grant is taxable on the C?

I am so frustrated."

This is a moving target. Yes, it's all taxable as regular business income (excluding SBA money), but now MD has changed their law, and other States might follow.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Agree that the link does not work from the 1099G worksheet to the Schedule C. The 1099G is issued to the company EIN.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"The 1099G is issued to the company EIN."

Yes; these are Business Grants. Unless that specific grant is specifically named in some law that exempts it, it is Business income and subject to tax reporting the same as any other business income.

"Agree that the link does not work from the 1099G worksheet to the Schedule C."

And you don't try to Link it. Informational Reporting of business income can include 1099-G and 1099-NEC, neither form is entered into your business tax return, but Both of which are a part of the business income to be reported for that business.

The same thing applies even if there was never a 1099 issued at all. You still report all Business income for the business return.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Put the 1099G income on Schedule C, line 5