- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Missing W2, and using last paystub; any idea how to file in basic proseries which we do not have access to form 4852?

Missing W2, and using last paystub; any idea how to file in basic proseries which we do not have access to form 4852?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hello,

Any suggestions how to report wages off the paystub (missing W2) while using basic Proseries? Apparently, limitations on form on basic.

Thank you,

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I agree. If the W-2 is merely "missing", it needs to be found or get a replacement copy. If the employer refused to file one or the employee finds it impossible to get it, then 4852 should be used.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

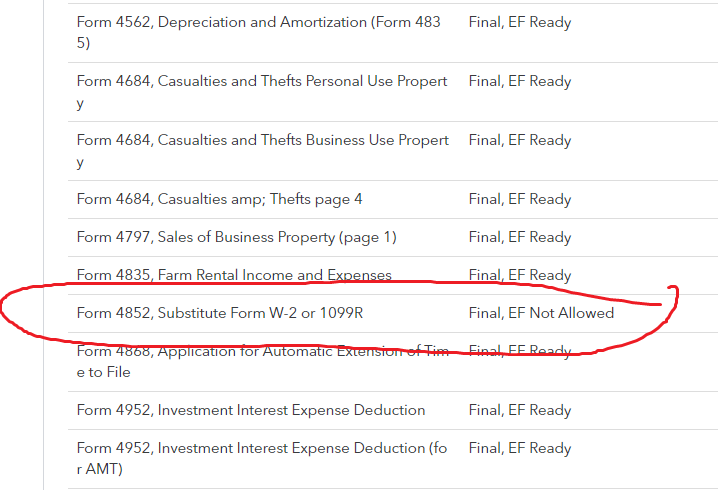

Form 4852 shows as available in Basic, you cant Efile with a 4852 though.

https://myproconnect.intuit.com/releasedates

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Download the form, prepare manually, scan and attach? (If basic allows attachments)

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

My understanding is that you should still be able to e-file a return with F.4852 but the EIN must be included. It is allowed in the Schema and that's how it works with other tax products.

If the taxpayer had a prior year W-2, he/she should be able to retrieve the EINs for federal and state.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ic. That's unfortunate.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Taking a second look, I think what it means is that these forms don't get transmitted but the return can still be e-filed. Probably should give it a try.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Have they tried contacting the employer and/or payroll company to get a copy? Has it perhaps been posted and available in the IRS transcript system (I know its early)?

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I agree. If the W-2 is merely "missing", it needs to be found or get a replacement copy. If the employer refused to file one or the employee finds it impossible to get it, then 4852 should be used.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you all for the great feedback and suggestions.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

NP, @onestop73. We're glad you found our suggestions helpful. Cheers!

Still an AllStar