- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Middle Class Tax Refund

Middle Class Tax Refund

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have a client who filed a 2020 tax return (zero income) she filed just to get the recovery rebate in 2020. She is asking me if she qualifies for the Middle Class Tax Refund.. and according to the qualifications one of them says as long as you filed taxes, lived in CA for 6 months or more and made less than 75,000 you qualify. But she didn't have any income so does she still qualify?

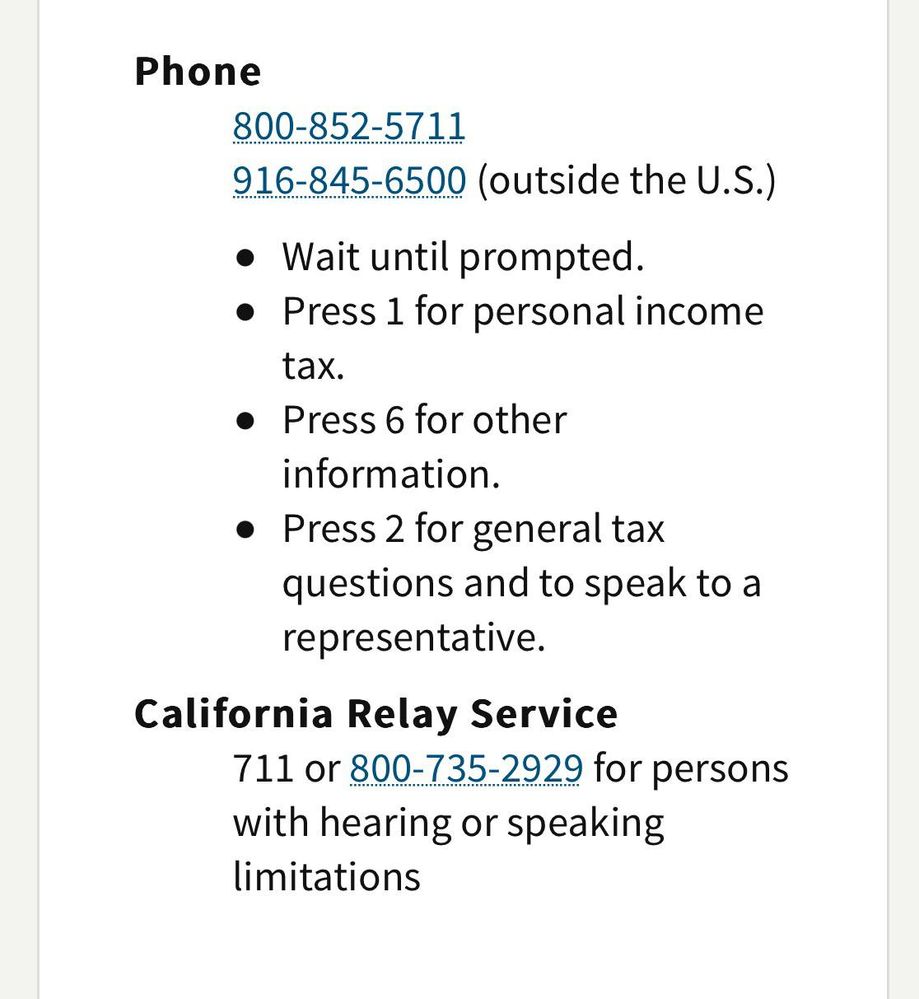

I usually tell them to call the MCTR# but they dont answer the phone so is it ok to have them call the franchise tax board?

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did she have a CA refund in 2020? Oh wait, did she even file a CA tax return in 2020?

If she didnt file a CA 2020 return, shes not eligible for it.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If she filed her/his tax return 2020 by the extension time and did not pass limit income she was eligible to get that. If she got a refund