Welcome back! Ask questions, get answers, and join our large community of tax professionals.

- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Manual Tax Calculation - $3 Difference

Manual Tax Calculation - $3 Difference

Options

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

Level 8

02-23-2024

06:13 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

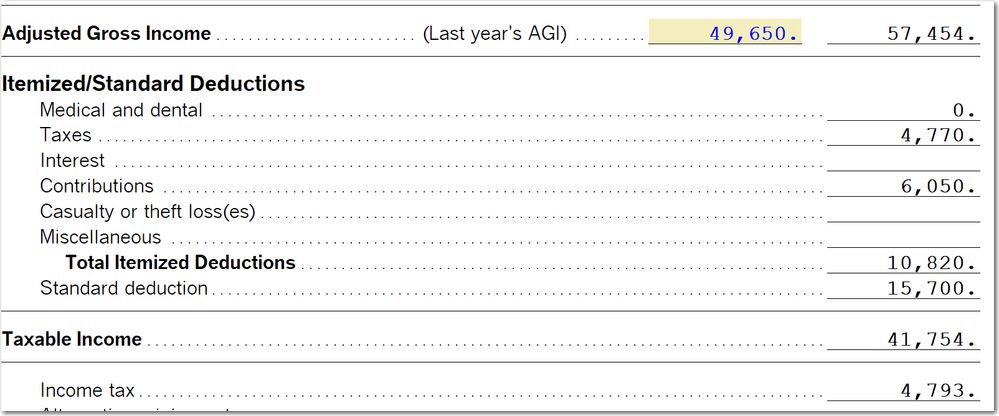

At this point in tax season, I certainly have other more pressing issues. With that said, I'm hoping someone can provide some insight. Single taxpayer with taxable income of $41,754. A quick manual calculation shows tax of $4,790. The program is showing $4,793. Yes, it's only $3 but wondering why the difference?

Manual Tax Calc:

| Up To: | Up To: | ||||

| Your Taxable Income | 41,754 | 11,000 | 44,726 | ||

| 30,754 | 30,754 | ||||

| Single Taxpayer Tax Rate | 10% | 12% | |||

| Tax | 1,100.00 | 3,690.48 | 4,790.48 |

I'm also attaching a screenshot of the ProSeries Tax Summary showing the $4,793

Best Answer Click here

Labels

1 Best Answer

Accepted Solutions

sjrcpa

Level 15

02-23-2024

06:23 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The tax tables use a range of taxable income vs. the tax rate schedule using exact taxable income.

The more I know the more I don’t know.

7 Comments 7

IRonMaN

Level 15

02-23-2024

06:42 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@GodFather - you are never going to keep pace with Jim if you spend that much time analyzing your tax returns 😜

Slava Ukraini!