- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- J5 Asset Type in Proseries Schedule C-Qualified Improvement Property

J5 Asset Type in Proseries Schedule C-Qualified Improvement Property

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The qualified improvement property was changed to 15 years depreciation under CARES act. Yet in the proseries asset type J5 it still has 39 years for schedule C filer. There is no box for me to check to change this asset type to 15 years. Also, I tried to change it to J4 which is qualified leasehold improvement to get 15 years but Proseries has error message stated that "if the asset placed in service after 12/2017 cannot use asset type J2,J3 and J4". This is the law before the CARES act, not after the CARES act. Just wonder is that anyway to work around it or Proseries need to change the software to fix the asset type J5.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

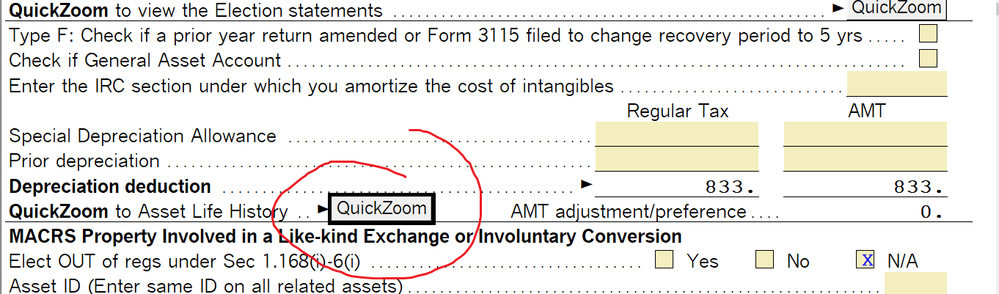

The J5 description appears to just be a typo in the drop down menu, if you look at the Asset Life History, it only does it for 15 years, not 39. I reported this to Intuit yesterday.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

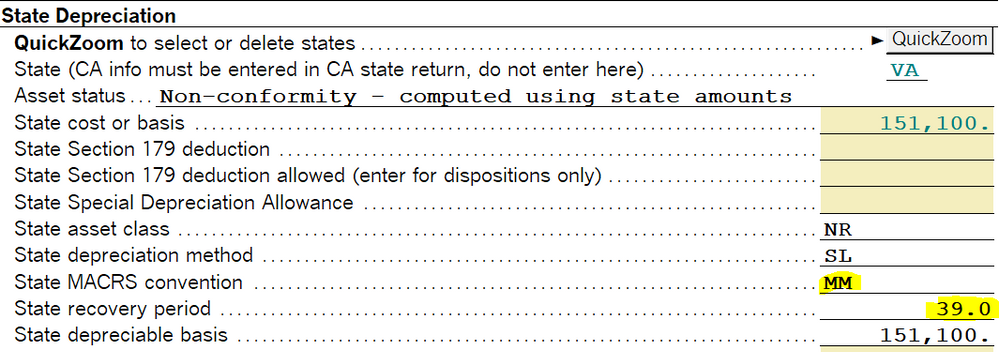

Yes, when I click on the quickzoom. I saw it is for 15 years which is good. Yet under state depreciation in the same screen of the same form if you look down the screen a bit. It is still list at 39 years, midmonth convention and NOT 15 years, half year convention. My state is VA. The state depreciation should be as same as federal 15 years too.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is that anyway to fix the state issue in the same asset worksheet form?