- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- IRS rejection acknowledge for 2021 TAXES

IRS rejection acknowledge for 2021 TAXES

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I e-filed Form 1040 for 2021 on January 24,2022 - I got the submission number that says "Sent to the IRS" but after 3 days I haven't received any confirmation about being accepted or rejected. I contacted the IRS and they told me that they have rejected the tax due to a mistake in form 8962 - I contacted Proseires technical support but nobody could solve this problem

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

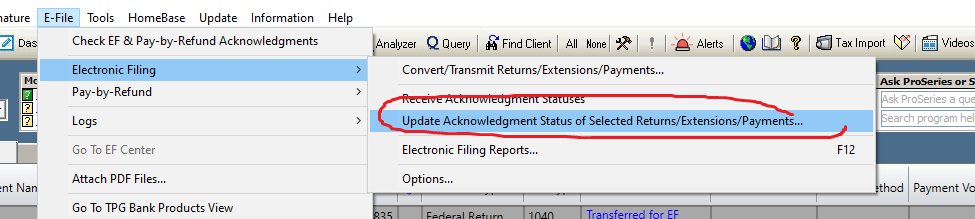

Highlight the return in the Pending Tab of the EFCenter, then choose this....see if that pulls the rejection in. Then call your client and tell them they're missing the 1095A form for their health insurance.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Your clients have market place insurance or IRS is stating they have it.

This rejection must be new, normally IRS kicks a letter back.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Really @Just-Lisa-Now- 9 secs before I answered?! 🤣

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you Lisa, I already tried to update the acknowledgment status and nothing. I did enter the form 1095 and no errors were detected before e-filing

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

that is messed up.

Let us know what happens with customer support.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you! Now I got the rejection after 4 calls to the IRS and Costumer Service :

Return Rejected 01/28/2022

Code: F8962-006-01

Form: 0(00) Form Copy:

Line #:

Description: 94(/efile:Return/efile:ReturnData/efile:IRS8962/efile:FederalPovertyLevelPct)

Error Detail:

If Form 8962, Line 1 'TotalExemptionsCnt' has a non-zero value, then Line 5

'FederalPovertyLevelPct' must be equal to Line 3 'HouseholdIncomeAmt' divided by Line 4

'PovertyLevelAmt'.

Error Resolution:

This return cannot be electronically filed at this time due to a processing error that will be

corrected on February 3, 2022. On or after February 3, 2022 open the rejected return,

review it for errors, and resubmit the return for electronic filing

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you! Now I got the rejection after 4 calls to the IRS and Costumer Service :

Return Rejected 01/28/2022

Code: F8962-006-01

Form: 0(00) Form Copy:

Line #:

Description: 94(/efile:Return/efile:ReturnData/efile:IRS8962/efile:FederalPovertyLevelPct)

Error Detail:

If Form 8962, Line 1 'TotalExemptionsCnt' has a non-zero value, then Line 5

'FederalPovertyLevelPct' must be equal to Line 3 'HouseholdIncomeAmt' divided by Line 4

'PovertyLevelAmt'.

Error Resolution:

This return cannot be electronically filed at this time due to a processing error that will be

corrected on February 3, 2022. On or after February 3, 2022 open the rejected return,

review it for errors, and resubmit the return for electronic filing

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have same rejection for a couple of clients even though form 1095-A is attached and form 8962 filled.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hello, received this same error today F8962-006. Tried updating the program. Has anyone gotten any guidance on this error? I have included the Form 1095-A in my preparation.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Same error here. F8962-006-01

Confirmed all data is entered correctly, no errors in Proseries and program up-to-date. What is the fix? What is a workaround?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi,

I just received the error listed below and discovered that the Instructions for form 8962 had the incorrect Federal Poverty amount listed for 2023. So the issue isn't the math, it's using the correct amount on line 4. Hope that is helpful!

Issue : Business Rule F8962-006-01 - If Form 8962, Line 1 `TotalExemptionsCnt` has a non-zero value, then Line 5 `FederalPovertyLevelPct` must be equal to Line 3 `HouseholdIncomeAmt` divided by Line 4 `PovertyLevelAmt`.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ah. My mistake. I rounded the percentage in line 5 instead of just dropping what was after the decimal.