- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- I don't need 59 copies

I don't need 59 copies

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It seems this year more than in years past, clients are printing off tax documents from their accounts online. But if you are going to do it, you don't need to print 59 copies of the W-2, 1099R, 1099INT, etc. One copy works just fine for me. But if you do feel the need to print all 59 copies, can you at least keep all of the copies together rather than playing 52 card pickup with all of your tax documents. I don't know how many times this year I have been digging through piles of paper, finding another 1099 only having to compare account numbers to make sure it is just a duplicate instead of another account with the same dollar amount of income. I have to admit, Jim has to be a lot more proficient than I am at spotting those duplicates 😁

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I get often when flipping through the docs with regards to 1099 DIVs. I see a lot where they print one out on the computer and they bring the mailed one in also.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Tons of duplicates this year, and why oh why do we still need the W2s and 1099Rs in triplicate?

Are there still that many people mailing returns in with the docs attached to the front?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@PATAX wrote:

And then there are those at the other end of the spectrum that only bring in one W-2.

the one little square they ripped off the full page, yea, love keeping track of those!

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In Pennsylvania we have to prepare the local earned income tax return and attach a W-2 to that. I don't think you have that in California. Some states have it and some don't.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I remember the first PA return I did several years ago. I was trying to figure out if sending a tax form to some outfit named Joe's Tax Collections was legit or what in the world they were smoking in PA 😁

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Nope, no local taxes here and even CA on a paper filed return, they have their own W2 worksheet that gets included, they dont want the form stapled to the front.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@IRonMaN you are exactly right Iron Man. Years ago every Township had its own tax collector, and some of those Tax Collectors also had their own tax preparation business. Now there is just one collector for the whole County, except the more populous counties that have a few. But that system was better than the County Wide tax collectors we have now.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In Minnesota, the locals rely on property taxes and some kickbacks from the state ------ and there are some that hang on to some local sales taxes. I watch in a cold sweat as folks in states like OH and PA fight battles with Intuit dealing with local income taxes.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

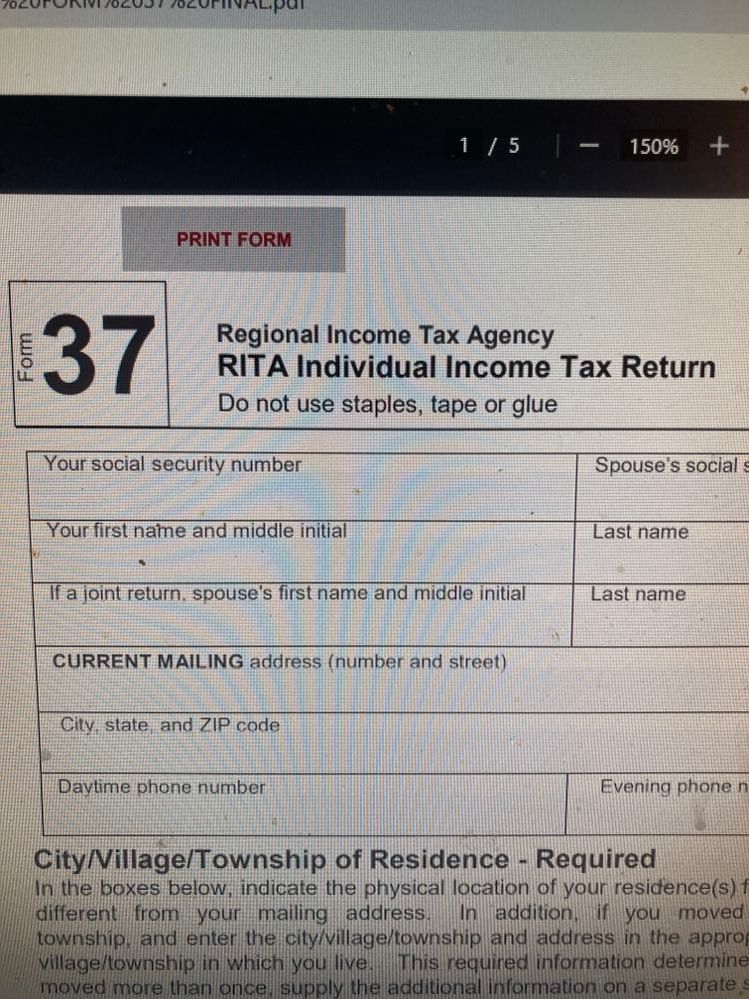

On the dreaded local, RITA return which ProSeries does not efile, it says on top, "Do not use staple, tape or glue." So what do I do? I still staple it and the W-2s to it. My question is who in their right mind would glue the W-2s to the form.