- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Entering 1099-DIV Section 897 Capital Gains

Entering 1099-DIV Section 897 Capital Gains

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

On 1099-DIV, Line 2f, I see Section 897 Capital Gains. There is no detail in the report on where those came from. How is that line entered? I assume they go on Schedule D, but the client has no idea what they are and no idea of basis.

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

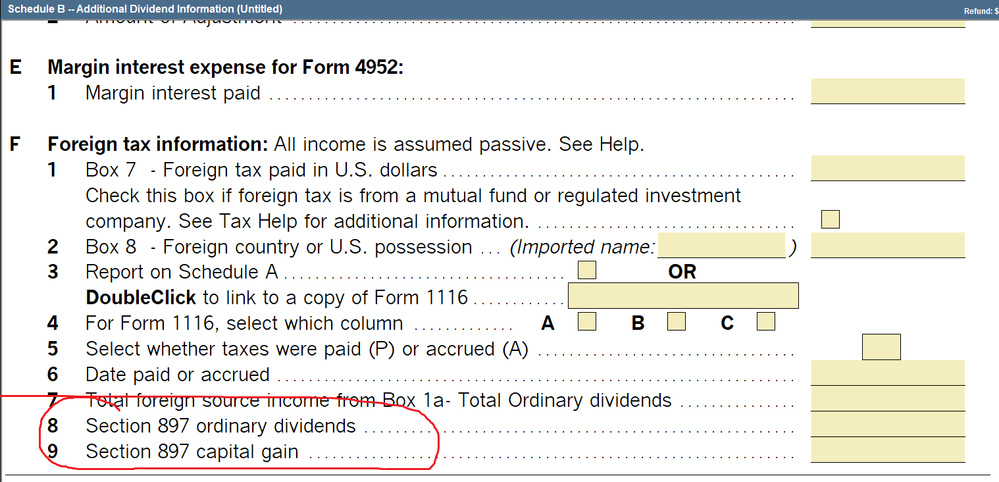

Double click on the Dividend entry line, in the additional window that opens, scroll all the way to the bottom, under the foreign tax credit, and you'll find the entry line for that.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Double click on the Dividend entry line, in the additional window that opens, scroll all the way to the bottom, under the foreign tax credit, and you'll find the entry line for that.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I do not find any additional entry area below the Foreign tax input that includes this.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you, Lisa. This looks nothing like my input screen, so I looked again, and you weren't asked about Lacerte. I thought that's what I had seen. Must be the heat of tax season...seeing things again. More coffee!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Go to section F Foreign tax information Line 8

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for this information

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can you tell me what form this Schedule B is taken from? I am working on the form 5227 and do not see a Schedule B (Additional Dividend Information.) Each of my custodial 1099's issued this year has an amount for Box 2f Section 897 Capital Gains. Need to know where to enter in the tax program.

Thanks!

Cheryl

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

On the Schedule B worksheet, go to the Dividend Income Smart Worksheet. Double click in the line where the Payer's name is entered. That will open the Dividend Income Worksheet. Scroll to the bottom to see section F. On line 8 you will enter Section 897 ordinary dividends and on line 9 Section 897 capital gains.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

thank you