- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Early disabled Roth IRA distribution

Early disabled Roth IRA distribution

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi,

My client recieved a 1099R, code J for an early distribution he made last year. According to publication 590-B, the distibution is not subject to tax or penalty. Does anyone know how to notate this in Proseries?

Thanks

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

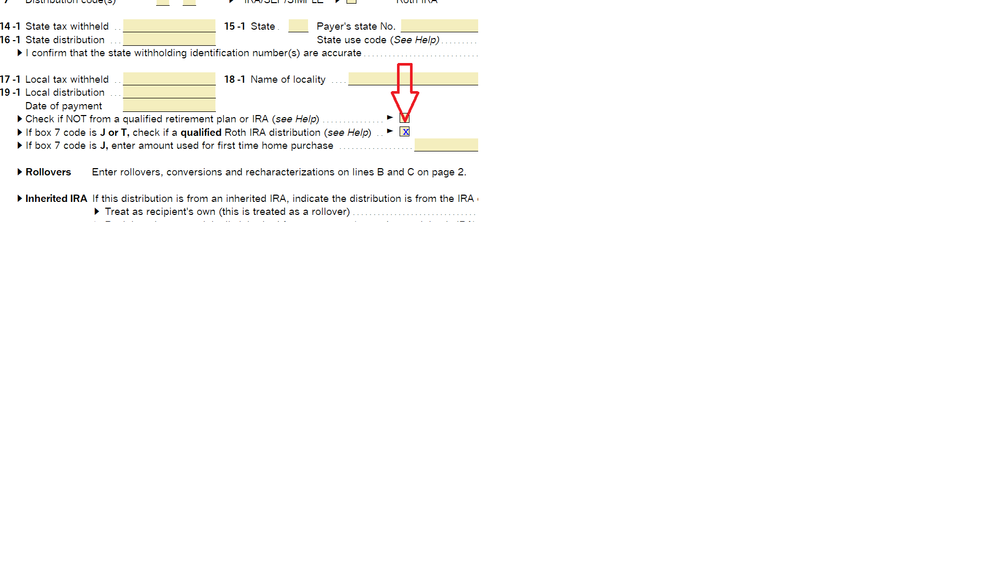

Sorry I missed in the title that it said disabled. Disregard what I said before. I think you have to go to the 1099-R worksheet and check the box that is below 19-1 that says to check if Qualified.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It is subject to penalty unless they had basis. You want to find out the cumulative basis and enter it on the IRA Info worksheet.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

30K distribution with 10K in basis.

Am I missing something in the IRS publication 590-B where it says that if you're disabled, than an early distribution from a Roth IRA pays no tax or penalty?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Does entering the exempt amount in Question 1, column a line c of form 5329 work?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That takes care of the penalty but it's still taxing the 30K. I'm not too concerned about the basis at this point because it's only 10k.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sorry I missed in the title that it said disabled. Disregard what I said before. I think you have to go to the 1099-R worksheet and check the box that is below 19-1 that says to check if Qualified.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Tried that but it doesn't do anything

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Actually, that did do it. I just had to check the box that he openned the IRA account before 2018.

Thanks for your help!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yay! I'm glad that was the answer.