- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- Do not generate form 8949 when not required

Do not generate form 8949 when not required

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How do I stop form 8949 from generating when not required?

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you enter the details (description, dates, etc.) on the Sch D Wks, they automatically flow to the 8949. My understanding is that Lacerte has a checkbox (or some sort of coding) that tells the software not to report on 8949 but ProSeries has no such option. For ProSeries, you just don't enter the details. Only enter the totals for short-term and long-term (proceeds & basis) in the boxes for Sch D box 1a and box 8a. Then it flows directly to Sch D without generating an 8949.

Rick

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If the 8949 has any entries on it, then it will be included...are you saying all the 8949 pages are blank it its still printing out?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What I am saying is: The 8949 is not required but ProSeries is still creating it and printing it. I am sure there is a setting that I must have checked at one time that indicated to create the form even if not required. I am trying to locate that setting so I can turn it off. If that makes sense.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

When would the 8949 NOT be required?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Schedule D is required. Form 8949 is not required when basis is reported to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"If all Forms 1099-B (or all substitute statements) you received show basis was reported to the IRS and no correction or adjustment is needed, you may not need to file Form 8949."

I never even noticed this before....but I usually see multiple 1099B's with various types of sales, so it generally wouldn't apply to my clients.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I just spent about an hour on the phone with ProSeries and it appears that ProSeries generates the form in all cases (even when it is not needed). There is no option to stop the form from generating. Very frustrating. I even checked the "if required" under the print options and it still prints. Very frustrating.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Lisa I think this is relatively new - this year or last yr.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is it the wasted paper thats frustrating you or.....Im not sure I understand why this is so horrible.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You wasted an hour of your time on the phone over this? 😕

Personally I only call support if it is a life or death situation and I'm guessing we will all pull through this one without having to get one ventilator fired up.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Personally I like having Sch B and Sch D print out even when not required, so I can see the details of what that line on the 1040 corresponds to...I'll probably set the 8949 to print if any data if they make the change that Donna is looking for.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What frustrates me is it is not correct. We should be able to have the option of the form printing or not. I a agree that it is nice for checking your work. My concern is: if we just let the software generate forms and not verify the instructions, what else are we missing? I do not like having to explain to a client that I missed something because I relied on the software. And yes, there are far worse things going on in the world then my not being able to turn off the generating of a form. However, my clients rely on my work and my knowledge. Therefore, I want to be accurate and thorough. That is what I get paid to do.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did not know I would be on the phone with support that long. Would not have called had I know. Sure did not want to hang up on her.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If you enter the details (description, dates, etc.) on the Sch D Wks, they automatically flow to the 8949. My understanding is that Lacerte has a checkbox (or some sort of coding) that tells the software not to report on 8949 but ProSeries has no such option. For ProSeries, you just don't enter the details. Only enter the totals for short-term and long-term (proceeds & basis) in the boxes for Sch D box 1a and box 8a. Then it flows directly to Sch D without generating an 8949.

Rick

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@rbynaker wrote:

If you enter the details (description, dates, etc.) on the Sch D Wks, they automatically flow to the 8949. My understanding is that Lacerte has a checkbox (or some sort of coding) that tells the software not to report on 8949 but ProSeries has no such option. For ProSeries, you just don't enter the details. Only enter the totals for short-term and long-term (proceeds & basis) in the boxes for Sch D box 1a and box 8a. Then it flows directly to Sch D without generating an 8949.

Rick

In all these decades, I have never entered anything directly into those lines...I still learn new things all the time!

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I have entered the transactions as you suggested. They always flow to the 8949.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Lisa, I don't have the current software, can you give Donna a screenshot of the boxes to go directly to Sch D?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Rick,

I think I understand what you are saying. I should have looked closer to your answer before responding. I was entering the information on in the Capital Gains(Losses) Detailed Entry Worksheet. I believe you are instructing to enter it directly in the lines below the worksheet QuickZoom. Thank you for the great in put!!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@rbynaker wrote:

Lisa, I don't have the current software, can you give Donna a screenshot of the boxes to go directly to Sch D?

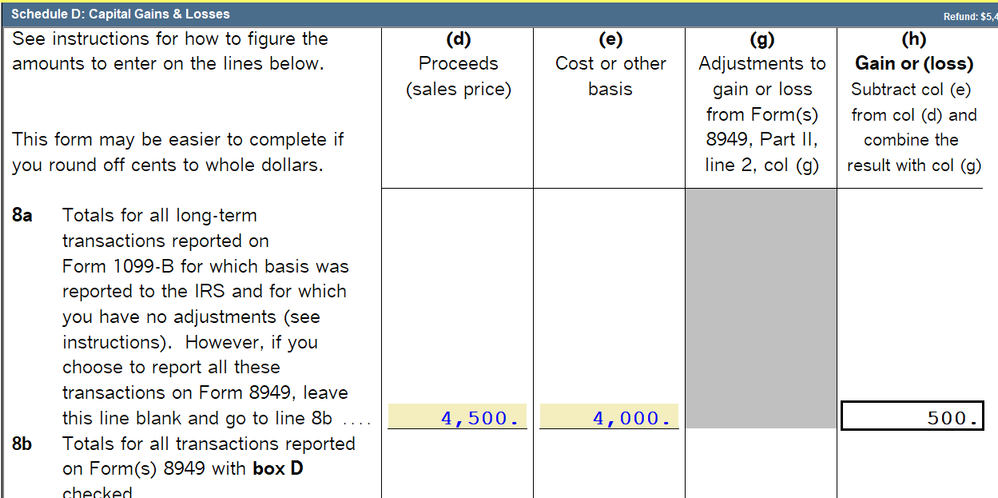

I double checked....NO 8949 is generated when I enter the figures here:

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Actually I just tried entering it directly on the schedule D and the Form 8949 was generated.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ahhh!! OMG! So simple and yet so complicated. I super apologize if I have wasted anyone's time today. I just am not comfortable going with the status quo and thought that my phone call with ProSeries would have been quick and would have resolved the issue in a matter of minutes. Once again, thank you!!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

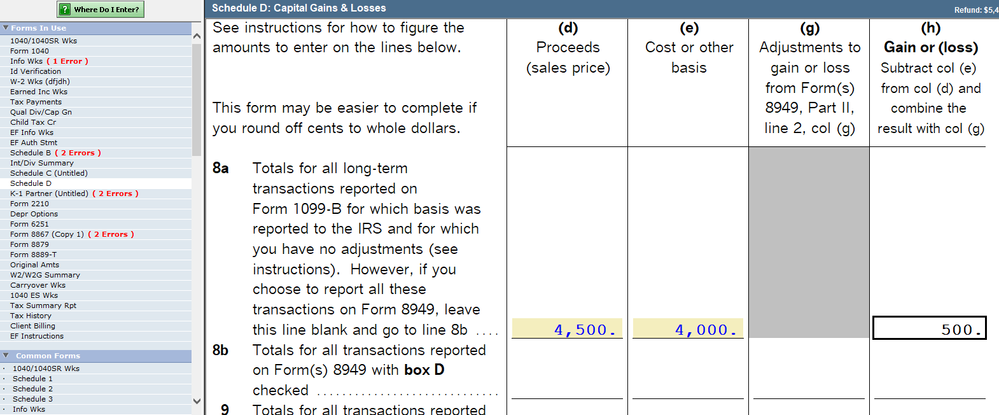

I entered here and No 8949 was generated...see my list of forms in use?

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

My pleasure. A lot of us come here because we like helping people (clearly we must be crazy, so if you know a good psychiatrist...)

It would be great if ProSeries would come up with a 1099-B Wks (like they have for INT and DIV) where you could enter details by broker. With just one broker it's easy enough to enter directly in 1a/8a but I have a lot of clients with multiple brokers and you have to add everything together before you dump it into 1a/8a (or make four different detail lists for LT/ST Proceeds/Basis). Then when I find I've transposed something in review I'm hunting around to see which box it was in. It gets more complicated when you have some T, some S and some J!

Rick