- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- AMT on Asset Entry Worksheet

AMT on Asset Entry Worksheet

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Please excuse my ignorance, but almost none of my clients (since the AMT reform in 2017) is now subject to the AMT: I don't know how to calculate the AMT prior depreciation on the Asset Entry Worksheet. Now a client has sold rental property and seems subject to the AMT. How is it calculated?

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

For the real estate itself, AMT Depreciation = Regular Depreciation.

Check the 6251 instructions. I think they explain how to calculate AMT depreciation which you may need for 5, 7, 15 yr, etc. property.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

For the real estate itself, AMT Depreciation = Regular Depreciation.

Check the 6251 instructions. I think they explain how to calculate AMT depreciation which you may need for 5, 7, 15 yr, etc. property.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you! Yes, it's real estate. I've always put the same as regular depreciation because the clients were not high income ones anyway, but it seems it was correct 🙂

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

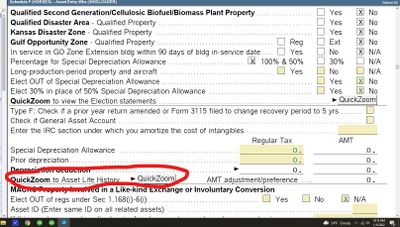

Greta - if you use this Quickzoom in the Asset Entry Worksheet it will give you the detail of AMT depreciation