- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- 3 W2's with box 1-11 empty same company. how to fix error?

3 W2's with box 1-11 empty same company. how to fix error?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Has anyone encountered this issue:

3 -w2's from same employer

1st w2 has all boxes fill-in (1-20) State CA

2nd w2 has 1-11 boxes empty and 12, 16, 17 fill-in State MA

3rd w2 has 1-11 boxes empty and 12, 16, 17 fill-in State RI

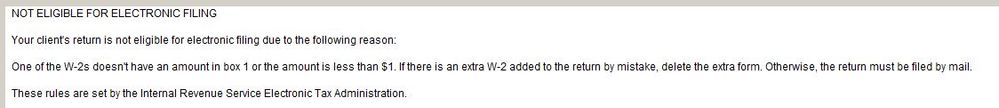

Any help appreciated. What to do? Should I put all the information from 2nd (w2) and 3rd (w2)on the 1st (w2) because it gives me an error when i input the 3 w2 individually

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sounds like it’s one W2 with taxable income in 3 states.

on the w2 worksheet complete the form like you normally would. Enter the other 2 states under the Cali entries..that should clear your errors…

However, it sounds like there are a couple of non resident returns in your future. you’ll also have to add the other states to the info worksheet to get them to efile.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Sounds like it’s one W2 with taxable income in 3 states.

on the w2 worksheet complete the form like you normally would. Enter the other 2 states under the Cali entries..that should clear your errors…

However, it sounds like there are a couple of non resident returns in your future. you’ll also have to add the other states to the info worksheet to get them to efile.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

1st W2 has the Fed info, then.

You never add the State info together. Each State has different reporting requirements. Some want the full Fed info and some want only the State info. The "empty" forms are not subsets, but specific reporting.

Don't yell at us; we're volunteers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

"If at first you don’t succeed…..find a workaround"

that's what I do