- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

2210

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

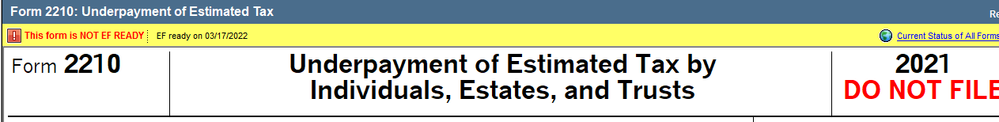

Has anyone noticed on the 2021 2210 that the quarterly payment dates are wrong? I have put in the quarterly tax estimates on the tax payment worksheet, however those payments are not flowing through to the 2210 properly, missing the 6/15/21 quarterly payment and is now calculating a penalty due. Will this form be updated before 1/24/22 to correct the flow through problem?

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Kinda scary that it is the middle of January and something that basic still isn't up and running. It's going to be a long tax season.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Doesn't it show at the top of the form the date they plan to have it finalized?

My screen shows mid March for finalization of the 2210. Seriously doubt it will be ready to go when EF opens.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Looks like March 17th - that should make a lot of people really happy 😬

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Most of my clients who Owe tax and might have a 2210 penalty are not filing that early in the season anyway.

Just check the box to have the IRS figure it. They might get around to it about the time I retire.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

People with 2210s get to sit in the fermenting stack until its ready!

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Looks like tax season is going to be shortened to one month for a number of folks.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

One of my first clients every year knows they will owe the 2210 penalty and want to file the return and pay the tax as soon as possible to prevent a higher amount. (Half their income is from CGD's in December, so the penalty using the annualized method is minimal and tax during the year is difficult to estimate.) One year I did a manual 2210 and filed it with a paper return -- IRS ignored it and it took months to straighten the mess out.

The problem is that Intuit programmers (like IRS programmers) are not return preparers. They never have to consider the needs of real people.

The 2210 and 2210 instructions are final, from IRS. The delay is Intuit's choice.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@BobKamman 👍 you hit the nail on the head Bob....

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Maybe everyone can start going to the Intuit wishing well and wish for the form to be ready this month 😃

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Iron Man, I do not know how to do that with this wack phone, so maybe you can volunteer for that?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I’m going to put my mind reading abilities to work and predict that it is going to start getting loud in here once more people find out about that March date.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@IRonMaN I file extensions for business entities that I can, which is many of them, , so by the time it is due, if any issues, should be straightened out....If someone doesn't like it, then they can go to another. My office is not Mister Rogers Neighborhood.😉😀🐕

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

My office is on Sesame Street. Oscar the Grouch here, "how can I not help you today?"

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@IRonMaN You're Elmo, and Intuit is a pet rock.

https://www.goodmorningamerica.com/culture/story/elmos-feud-pet-rock-captivates-internet-82132965

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This place continues to be a wealth of information.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I quit. It's only Jan 14th, haven't done my first return yet (close to being done 1099's and payroll) but just watching this board, I don't have the stomach for it again.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Just another day in paradise 🌄

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Anonymous

Can you relay to the team in charge of arranging release of forms, that you are going to have a lot of folks up in arms if Intuit really is planning on delaying form 2210 for that length of time. Tax season is short enough the way it is and that really compresses tax season for a lot of folks needing form 2210.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

When the going gets tough, the tough get going! (Out the door, sometimes.)

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I saw both of you had posted today so I know you are still stuck working with us and since I don't give up easy, what about that goofy 3/17 date?

@Anonymous

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

As a side note, for those of you that are relatively new here, I can be a tad stubborn --------- especially this time of year. 😬

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi @IRonMaN ,

We are definitely both here 🙂 Let me check with @Anonymous to see if she has any updates / info on this item and we will get back to you asap. Hopefully before the long weekend (cough, cough, we will be taking MLK day off)

-Betty Jo

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks!

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What I usually do, is print a 4th quarter estimated voucher for the amount due, and have the client pay it online or by mail. That will stop the penalty and will show up as an estimated payment.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

stubborn...with a side order of sarcasm possibly?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Nope. The main dish is sarcasm. If you got a side order of sarcasm, that would just mean that you got extra sarcasm on the side --------- no extra charge.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Looks like we have a meeting with the team to discuss this on Tuesday 01/18. I will update you with my findings as soon as I get more info.

-Betty Jo

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Like I mentioned earlier, it will make a lot of folks happier to move that date up, including Intuit support folks. Once folks start realizing they are going to have to wait until 3/17, Intuit support phones are going to start ringing off the hook with irate customers ------- not to mention the feedback you are going to see here.

Thanks!

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The availability date is subject to change but as of right now Form 2210 is set to be final on 3/17. If we hear that it changes we'll be sure to notify this thread.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Anonymous

If that is the official line, can I ask what the reasoning is behind that decision? That is really going to put the hurt on a lot of preparers if that is the case.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I agree that waiting to efile until 3/17/22 because of Form 2210 will annoy a lot of clients who are thus obliged to pay an additional months of interest. I will have an enormous pile of ready-to-efile-except-for Form 2210 or 8895 (for all self-employed folks). That's half of my clients. Just on the date that corps and partnerships are due, and all brokerage 1099s arrive. That leaves one month to do it all.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I second the complaint.

It's not like it's a new form (i.e. 7203). IRS has it out already and it affects a majority of our clients. Forcing us to wait SERIOUSLY affects our business. Please have this handled or give a really darn good explanation as to why not.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

It's my understanding that the timing of all forms avail has been prioritized according to tax payer habits, including some aren't filing early in the season (in the instance of 2210).... however... I can see how this can cause disruption if that's not the case for some of you.

I'll keep my eyes on this for tax season, and if you see someone mention it feel free to tag me in case I miss it.

In the meantime, feel free to add suggestions and feedback here.

[post edited]

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm not sure about taxpayer habits in general, but for a lot of the folks here, client habits require the form long before 3/17.

Thanks for the info.

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Some clients are in the habit of completing their return in February so they will know how much they owe, then filing it in April when they have the funds. Some preparers are not in the habit of telling clients, "If you ain't gonna file till April, I ain't gonna work on it till then."

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

To anyone that commented or voted on the Idea Exchange thread that I posted "Finalize 2210 before 3/17", it was removed.

The availability date is subject to change but as of right now Form 2210 is set to be final on 3/17. If we hear that it changes we'll be sure to notify this thread.

We have our eyes on this for tax season.

In the meantime, feel free to add suggestions and feedback here and link them on this conversation if they are related.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Or go here:

https://proconnect.intuit.com/community/proseries-tax-idea-exchange/2210-release-date/idi-p/188699

Slava Ukraini!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@IRonMaN wrote:

Or go here:

https://proconnect.intuit.com/community/proseries-tax-idea-exchange/2210-release-date/idi-p/188699

Or go here:

https://www.drakesoftware.com/

https://www.wolterskluwer.com/en/solutions/atx

https://www.taxact.com/professional/

https://tax.thomsonreuters.com/us/en/cs-professional-suite/ultratax-cs

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@Anonymous wrote:

We have our eyes on this for tax season.

It is too bad the Developers don't have their eye on it. Or for that matter, it is too bad the developers think that tax season starts in March.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you all for your feedback!

Continue to view ProSeries Forms Availability for updates on specific forms.