- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- 1099-G Worksheet ProSeries Professional

1099-G Worksheet ProSeries Professional

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

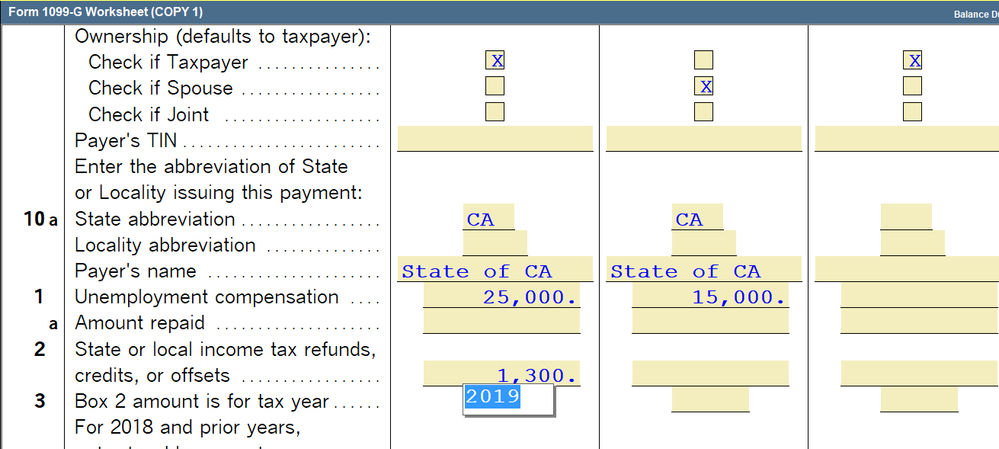

Client had 2019 FTB refund. ProSeries automatically adds 1099-G Worksheet. Client has CA unemployment this year. Instead of opening a new worksheet I added the unemployment information to the as payer 2. The numbers did not carry to schedule 1 and form 1040. Anyone had the the same problem?

I opened a new Sheet and added the unemployment and it carried it where I expected to see it.

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

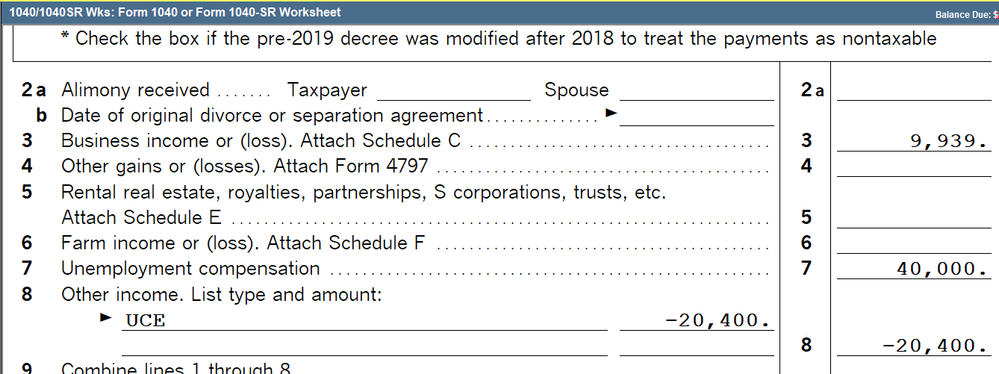

works in either column for me. 40k flows to Line 7 of Sch 1 and 20400 flows to Line 8

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I appreciate your reply. Mine is filing single. From the screen it looks like MFJ on yours. It did not work for me. It is either a user error or software error. I am having to add a second worksheet as a work around.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Interesting, youre right, on a Single return if you put UI in that second column, it doesnt recognize it.

I usually just add UI to the first column along with the state refund, I only use the second column if theres a spouse, so I havent noticed this.

Nice catch! Not sure how much luck we'll have getting anyone to fix it though!

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you for confirming. By the time Intuit catches this error, many returns will be filed wrong. I was using ATX for many years and they are much better in listening to their customers and quickly correcting errors. Intuit makes if very hard to communicate back to them. I am thinking of going back to ATX next year or some other company.