- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProSeries Tax

- :

- ProSeries Tax Discussions

- :

- 1041 Living Trust Tax Return

1041 Living Trust Tax Return

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Working on my first Trust tax return. It has two beneficiaries( Co-Trustees), I assume I am creating two K-1's, which I have done. I can not seem to find the area to put in the 50/50 percentage. In the trust there will be some interest income, dividend income and a home. Where do I enter the Home that was left to the estate.

Thank you

Best Answer Click here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I "think" you can still deduct the real estate taxes being paid on the house before it sells (on the front page of the 1041 in that smart worksheet where you can deduct the accounting/atty fees)

I "think" everything else gets added to basis for when its sold.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

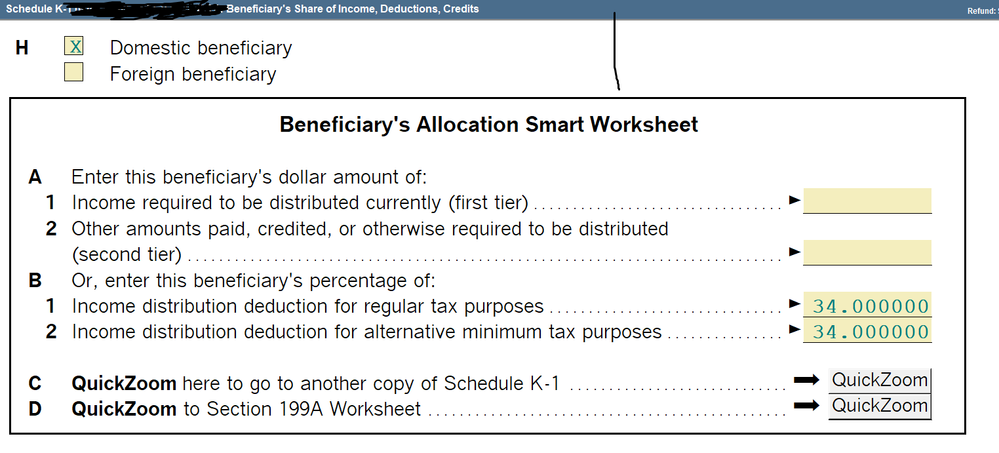

In the K-1 worksheet for each bene... this one if for one that has 3 benes 34-33-33%s

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

If the home was sold, I just enter directly on the Sch D, like a stock sale.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Perfect, Thank you!!!!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Home has not sold. DOD was 2023 and it is just now being listed. I thought I would put the home in as an asset for expense purposes????

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I "think" you can still deduct the real estate taxes being paid on the house before it sells (on the front page of the 1041 in that smart worksheet where you can deduct the accounting/atty fees)

I "think" everything else gets added to basis for when its sold.

♪♫•*¨*•.¸¸♥Lisa♥¸¸.•*¨*•♫♪

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Okay, I see that tooooooo. Thank you!!!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Is this a trust or estate return?

"my first Trust tax return"

"Where do I enter the Home that was left to the estate"

The house is an asset, a Balance Sheet item. 1041 tax Sofware does not provide for a Balance Sheet/full accounting for estates and trusts.

Was it a Joint Living Trust? Are both Grantors/Beneficiaries still alive?

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

1041, Living Trust.

Yes, both Beneficiaries are still alive.

Mother died 7/5/2023 and the two siblings are the beneficiaries in the Living Trust paperwork.

We set up an EIN for the Trust and it does have interest income and Dividend income. I was thinking the home (that neither siblings wants) would be an Asset on the return until it sells.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm glad I found this post. I hope someone can help me too. I too am about to do my first trust return. Can someone tell me what all I need from the client to prepare the return? I know I'll need any income, assets etc., but do they provide a copy of the trust document with that information as well as other paperwork? All replies appreciated.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, real estate tax deduction on the 1041.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

So i found out it is a master trust for a farm. I would assume the same income information is required to file this type of trust return as is for a complex trust. Would i need a copy of the trust document as well?