- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: State Income Tax Refund

State Income Tax Refund

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hello,

The state income tax refund always confuses me.

In 2022, I had $10,453 in state income taxes that was limited to $10,000 due to the SALT cap.

I had $7,476 in interest expense and $600 in charitable contributions.

Therefore, all in all, I had $18,076 in charitable deductions.

This year, I received a 1099-G for $691. Is that $691 refund taxable?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Last year? Yes, 2022 info below:

Real Estate Taxes: $1,917

State income taxes: $8,536

Total State Taxes = $10,453

Refund listed on 2022 1099-G: $691

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

This line is wrong:

<<Therefore, all in all, I had $18,076 in charitable deductions.>>

(Maybe 18076 in itemized?)

The refund worksheet will calculate that only X% of the income taxes paid were really deducted (10000 / 10453 = 95.6%) and since 8536 /10453 was the income tax piece of the total, x 95.6% was deducted, depending on the Std Deduction for your TP, only 81.67% X 95.6% of the $691 refund is taxable income.

I think?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, $18,076 in itemized; sorry - I was multi-tasking.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

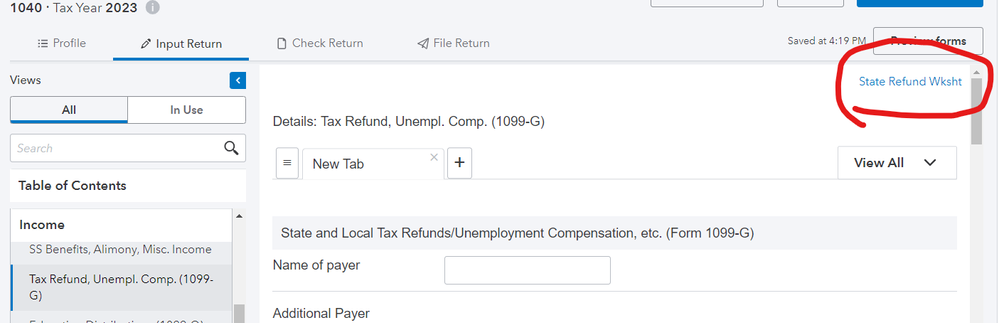

Use the resources of the program. Did you complete the State Refund Wksht?

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm actually using a different software; I just love the feedback from thsi community.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Then use Google to work it out.

https://apps.irs.gov/app/vita/content/globalmedia/state_and_local_refund_worksheet_4012.pdf

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Then use the worksheet in your software.

The more I know the more I don’t know.