- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: Report sales of primary home once used one year as rental had depreciation

Report sales of primary home once used one year as rental had depreciation

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi,

I have a client purchased home in 2018 at $560000, used as rental for about one year. Reported on Sch E and depreciated for 2018-2019 tax year

Then she lived up till middle of 2022 due to job relocation.

She sold the home at $570000 (paid commission ($28500).

My question is how to spilit the sales between rental (form 4797) and sales of home (Schd)?

Even thought it is loss,

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Don't split it. The home sale worksheet should have a place to enter Depreciation

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi sjrcpa,

How do you access the home sale worksheet ?

I used the asset quick entry; Depreciation disposition.

Should I select Property Code 2 - Sale by individual personal use of property?

thanks!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

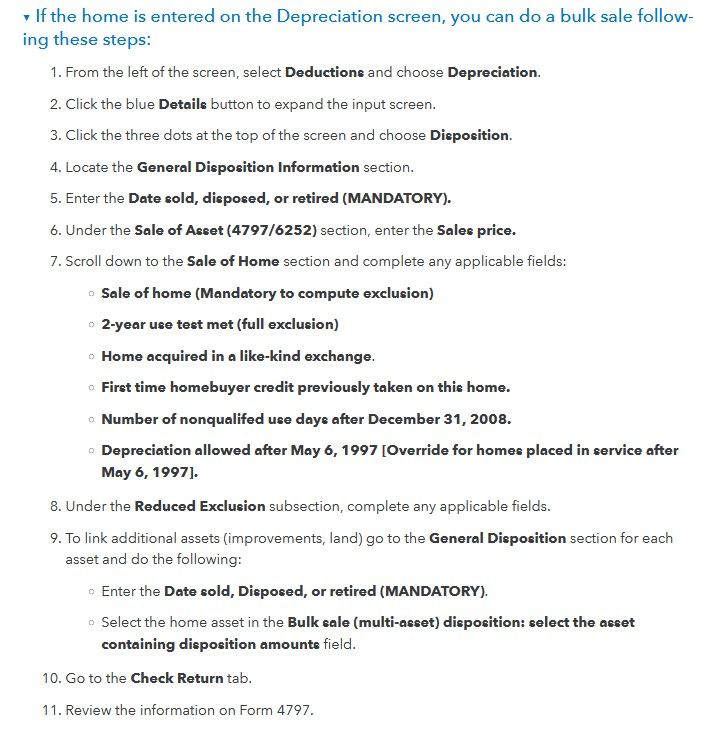

Check out this article: https://proconnect.intuit.com/support/en-us/help-article/form-8949/reporting-sale-home-individual-re...

If there is no existing depreciation schedule, the article explains how to enter the sale of home via the Schedule D screens.

If there is a depreciation schedule, the article explains how to enter the sale from the disposition screen:

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hi JMP,

Thanks, I was able to follow the below instruction.

But the form 4797 was not generated due to the sales is loss.

I purposely added another $5k on top of the sales receipts so the 4797 showed, I can see 4797 Part I box (e) the depreciation allowed or allowable since acquisition populated with the depreciation taken.

Thanks!