- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: NJ K1 Disregarded Information Flipped

NJ K1 Disregarded Information Flipped

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

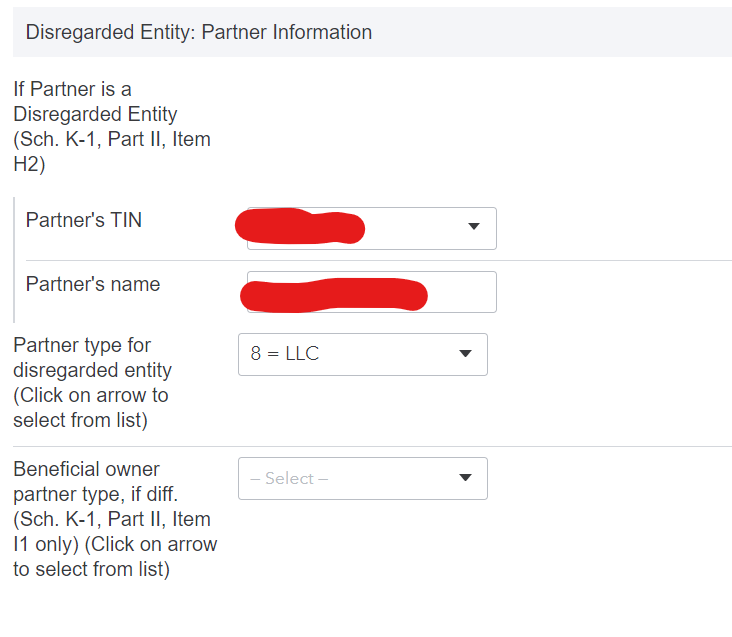

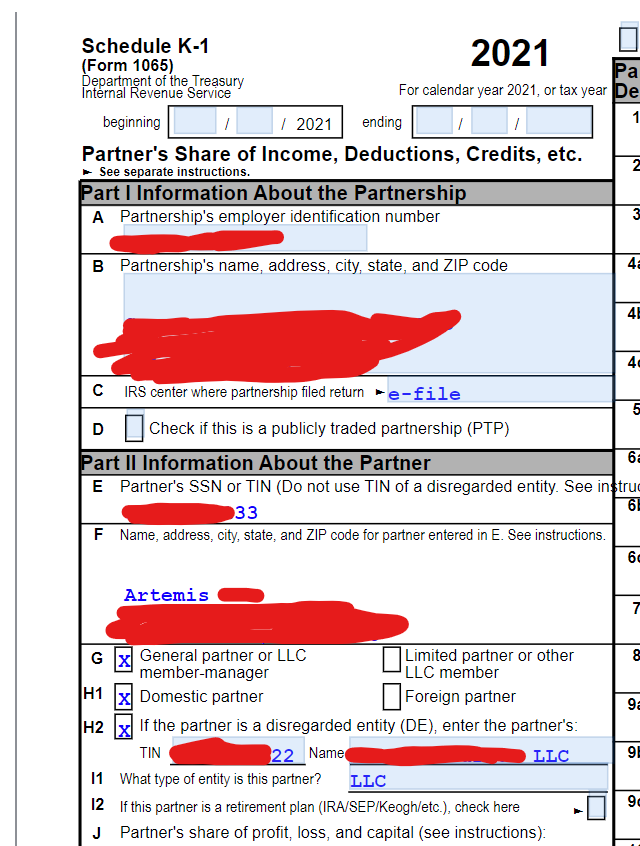

I'm currently facing an issue with the "Partner Information" flowing correctly to the NJ K1 for a partner that's a disregarded entity (single member LLC). This is causing an e-file rejection for NJ.

For the federal K1, the individual's SSN and name/address are correctly populating partner information in boxes E & F. The disregarded entity information is correctly populating in H2.

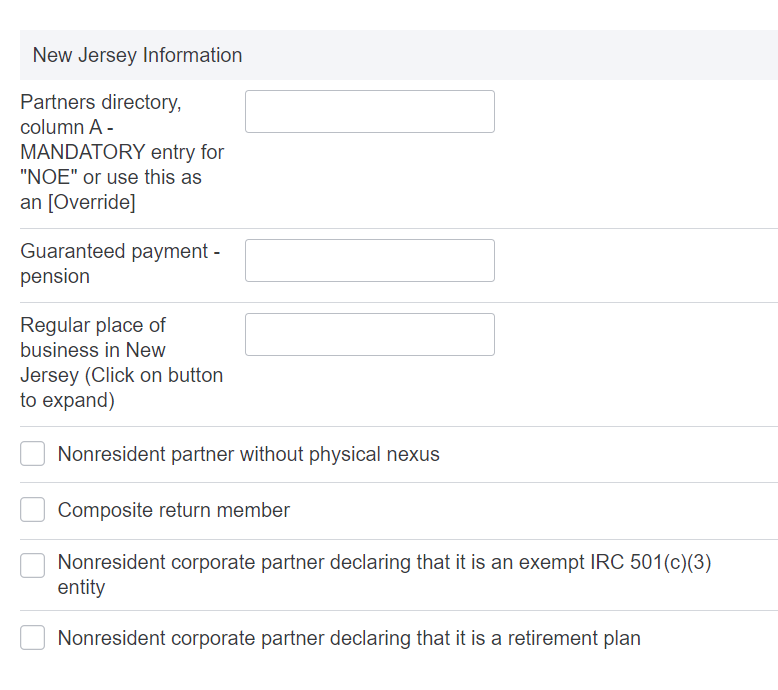

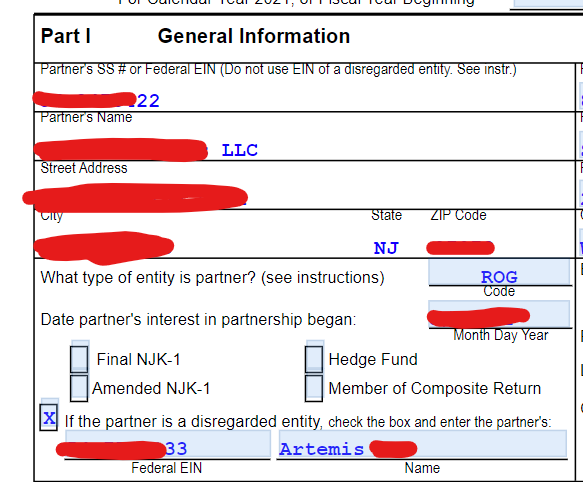

However, for NJ the disregarded entity information is populating the partner information while the individual's SSN and name are populating under the disregarded entity boxes. There is no option to override these inputs. It appears that ProConnect is not handling the disregarded entity information correctly when flowing to the NJ K1. This is causing an e-file reject for NJ for a partner mismatch as the partner's SSN needs to be reported under partner information rather than the single member LLC EIN.

Anyone know a workaround or to raise this issue with Intuit?

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Repeat the taxpayer SSN and name for the LLC

Answers are easy. Questions are hard!