Welcome back! Ask questions, get answers, and join our large community of tax professionals.

- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

11/17 Filing deadline for Form 990 is now closed—perfection period now in progress! Check out Hot Topics here.

11/17 Filing deadline for Form 990 is now closed—perfection period now in progress! Check out Hot Topics here.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: IRS Transcripts Retrieval Can't Download Quarterly 941s

IRS Transcripts Retrieval Can't Download Quarterly 941s

Options

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

jaygar

Level 3

09-19-2023

05:11 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

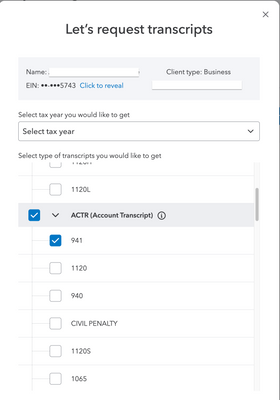

I'm trying to pull 941 account transcripts for a client and when I used Proconnect, it allows me to select a tax year, but not individual quarters. When I download a year, it only provides the 4th quarter 941 and is missing Q1-Q3. Is this a bug in the new PTO interface with the IRS transcript delivery system? Is there a work around?

Labels

6 Comments 6

jaygar

Level 3

09-20-2023

08:33 AM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, PTO now has a IRS Transcript interface and Yes, I can get these transcripts through the IRS TDS. Getting them through PTO is slightly easier because I don't have to go through the login process with the IRS. I just have to be logged into PTO.

George4Tacks

Level 15

09-20-2023

05:17 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What types of IRS transcripts are there?

- Tax Return Transcript: This transcript shows most line items from an original Form 1040-series tax return as filed, along with any forms and schedules. It does not show changes made after the original return was filed. This transcript is available for the current and three prior tax years. It is often used by lending institutions offering mortgages.

- Tax Account Transcript: This transcript shows basic data such as filing status, taxable income, and payment types. It also shows changes made after the original return was filed. This transcript is available for the current and nine prior tax years.

- Note: If estimated tax payments were made and/or an overpayment from a prior year return was applied, this transcript type can be requested a few weeks after the beginning of the calendar year to confirm the payments prior to filing a tax return.

- Record of Account Transcript: This transcript combines the tax return and tax account transcripts into one complete transcript. It is available for the current and three prior tax years.

- Wage and Income Transcript: This transcript shows data from information returns received by the IRS, such as Forms W-2, 1098, 1099, and 5498. The transcript is limited to approximately 85 income documents. If there are more documents than that, the transcript will not generate. This transcript is available for the current and nine prior tax years.

- Note: If you receive a message of “No Record of return filed” for the current tax year, it means information has not populated to the transcript yet. Check back in late May.

- Verification of Non-filing Letter: This letter states that the IRS has no record of a processed Form 1040-series tax return as of the date of the request. It does not indicate whether a return is required for that year. This letter is available after June 15 for the current tax year or anytime for the prior three tax years.

941 would not be included in the above

Answers are easy. Questions are hard!

trm1001

Level 1

09-09-2024

03:43 PM

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

have anyone been able to get all the quarterly 941?

it is only showing Q4 941