- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: If a taxpayer filed their own extension (form 4868) ... do I need to note this on their return?

If a taxpayer filed their own extension (form 4868) ... do I need to note this on their return?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

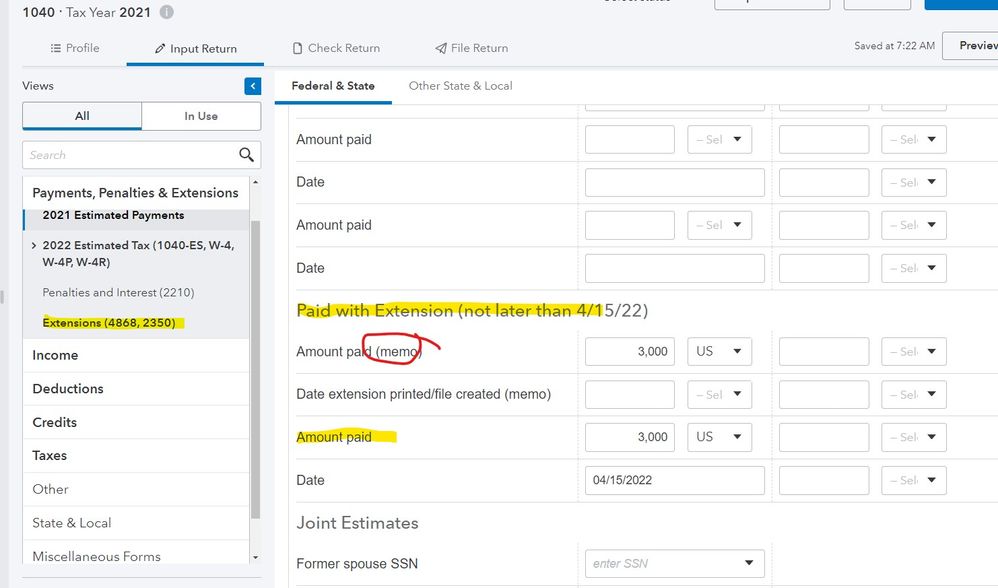

There was no payment with the extension - simply that the extension was filed on time by someone else - how and where is this noted in ProConnect.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There is no need to enter it anywhere.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

First entry in Extensions is 1=automatic extension - Put a 1 there and that will do it.

For the amounts paid use a -1 to indicate a zero payment.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

But if there is a balance due, having the extension in the file will change/eliminate late filing/late payment penalty. That is, if the software computes it and if you choose to have it computed. I always indicate if an extension has been filed.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

That makes sense. I guess I never have the program calculate the penalties and interest (I just tell the taxpayer a rough amount, and tell them the IRS will send them a bill).

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I assume you ment if and amount was due on the extension. Extension is an extension of time to file and not to pay,