- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: How to get Form 2555 Foreign Wages Earned outside of US for Form W2 issued by US Company with NYS/NYC Tax Withheld to show up on Form IT-2 and Form IT-201 Line 72

How to get Form 2555 Foreign Wages Earned outside of US for Form W2 issued by US Company with NYS/NYC Tax Withheld to show up on Form IT-2 and Form IT-201 Line 72

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

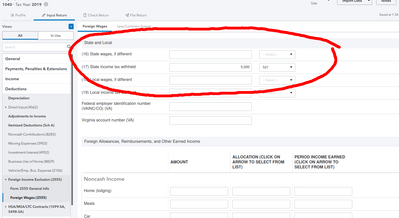

You must not be looking at the right place. See attached for the input line for SIT, which is there regardless of whether you file IT-201 or IT-203.

For NYS residency, you need to be sure your client satisfies all the conditions, especially if you are taking an inconsistent position from previous years'. IT-203 has questions there to catch taxpayers who are off guard. Beware of NYC tax residency if your client maintains a home that remains available for use.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Did you code the SIT to NY? If you did, PTO will flow the number correctly to both IT-2 and IT-201.

To e-file the state return with SIT, you'll also need to fill out at least the State and State EIN under Electronic Filing (W-2 State/Local).

If this is an outbound assignee and it's a not repatriate year, my question would be whether you have considered breaking NY state tax residency at least during the assignment period even though a bit of low level planning may be necessary.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I completed the Form 2555 Foreign Wages screen with Electronic Filing Section completed as NY.

Have been away from NYC since 2017 to date. Only went back to NYC for 2 weeks or so for visit. The wages amount and withholding taxes amounts are not carrying over to IT-2 and IT-201 Line 72,73

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I changed the tax return to IT-203, and it can allow state coding of wages and withholding to NYS.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

SIT must be entered on the separate line for SIT in order for TO to flow the withholding to the correct state return. What you complete under the electronic filing section is merely for e-filing.

For a presence of only 2 weeks, you should really consider his residency status in NY.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@bnptax wrote:I changed the tax return to IT-203, and it can allow state coding of wages and withholding to NYS.

The coding for IT-201 and IT-203 works exactly the same way. The line entry for SIT does not differentiate between these two forms.

Still an AllStar

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Good point. Basically away from USA and NY since 2017, only back to NY to visit parents, to date there is no plan or intention to go back to NY for permanent residence.

If I select IT-201 Form 2555 Foreign wages screen does NOT allow state coding. But if IT-203 Form 2555 Foreign wages screen allows state coding

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You must not be looking at the right place. See attached for the input line for SIT, which is there regardless of whether you file IT-201 or IT-203.

For NYS residency, you need to be sure your client satisfies all the conditions, especially if you are taking an inconsistent position from previous years'. IT-203 has questions there to catch taxpayers who are off guard. Beware of NYC tax residency if your client maintains a home that remains available for use.

Still an AllStar