- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: How do I enter second year car depreciation (used for business) for a new client?

How do I enter second year car depreciation (used for business) for a new client?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

The client started depreciating the car in tax year 2020 and took the special depreciation ($18,100) with another accountant. I have now taken on this client and am trying to make sure the depreciation is entered correctly in form 4562. Can someone guide which fields need to be entered in ProConnect. The cost basis of the car for tax year was $41,149.

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

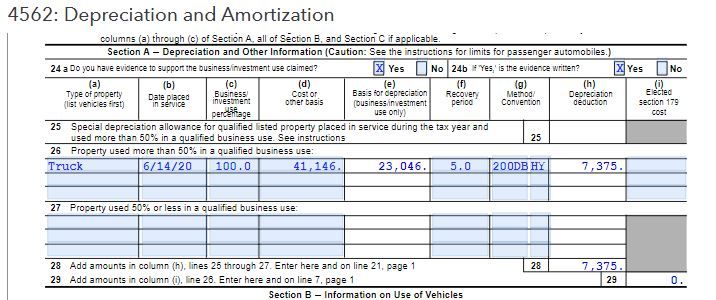

My input for this is Cost or other Basis 41,146, Method 43, Prior Special Depreciation 18,100 (I used 6/14/2020 as date in service) and what I get is

The table for 5 year is 32% of remaining basis, which is 7,374.72 or $7,375

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Click the Details instead of the Quick Entry and scroll through the entries. You should be able to find the Prior Year Special Depreciation and Prior Depreciation. Select the depreciation method from the drop down for the type of car being depreciated.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I did go into details and this is where I'm confused. According to IRS instruction for 4562 and Table 2 in there and client's situation, the limit on depreciation would be $16,100. Which fields in ProConnect do I need to fill out to generate this $16,100 depreciation. I selected the method and added $18,100 in "Prior special depreciation allowance". Do I need to fill out "life or class life (recovery period automatic)", "1-HY, 2=MQ (1st year automatic)" or any other fields to get this done right.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Tell me the numbers from last year and I will see what I can do.

Cost

Bonus

depreciation

General type of vehicle - car/truck over/under 6,000 lbs

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think input would look something like this

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks so much! Vehicle type is SUV above 6,000 lb used >50% for a qualified business.

This is what I see on last year's tax return which was the first year of depreciation:

Line 25, column h: 18,100

Line 26, column 😧 41,149

Line 26, column E: 23,049

Line 26, column F: 5.00

Line 26, column g: 200 DB-HY

Line 26, column h: 0

Line 28: 18,100

Cost: 41,149

Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

My input for this is Cost or other Basis 41,146, Method 43, Prior Special Depreciation 18,100 (I used 6/14/2020 as date in service) and what I get is

The table for 5 year is 32% of remaining basis, which is 7,374.72 or $7,375

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yeah I got this too. I guess where I am confused is that the IRS instructions has this Table 2 which lists that the limit on depreciation for a car placed in service in 2020 and has been in service for 2 tax year is 16,100 and I'm understanding this as that this taxpayer should get 16,100 in deduction and not 7,375 as it's calculated to be. I guess 16,100 is the max possible not what everyone gets.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes, that is the max and not what you get. Notice last year the max was 18,800. That was taken as bonus depreciation (I assume) and not 179, so they got a good boost the first year and it reduces every succeeding year.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thank you sir! You've been very helpful.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I'm having a similar issue. I inherited a client who placed a new car in service last year. They took the special depreciation of $10,190 plus an additional $3,368 of special allowance. Cost is $26,632 and when I enter these with method 54 nothing appears on form 4562. When I look at the Depreciation Schedule I can see a current year amount of $2,697. What am I doing wrong?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Do they need to have a Form 4562?

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Yes this is for Schedule C.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

What shows on that Sch C as depreciation?

F 4562 may not be required...

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@krismyh Why did you use method 54? Did you look at https://proconnect.intuit.com/support/en-us/help-article/fixed-assets/depreciation-methods/L7qfgF8FA... before deciding?

I think this may be the source of your difficulty.

New Car ≠ Code 54

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

i am confused with this as well. i did the clients tax return last year. $50000 car took bonus depreciation of 18100. from what i'm reading in the irs instructions, it says the second year you can take the $18000. i have a left over basis of $31,900. why can't i take the 2nd year bonus deduction as outlined below:

The maximum deduction amounts for most passenger automobiles are shown in the following table.

Maximum Depreciation Deduction for Passenger Automobiles (Including Trucks and Vans) Acquired After September 27, 2017, and Placed in Service Before

2024

Date Placed in service

1st. 2nd 3rd. 4th & Later

2023 $20,200 1 $19,500 $11,700 $6,960

2022 $19,2002 $18,000 $10,800 $6,460

2021 $18,2003 $16,400 $9,800 $5,860

2020 $18,1004 $16,100 $9,700 $5,760

2019 $18,1004 $16,100 $9,700 $5,760

2018 $18,0005 $16,000 $9,600 $5,76

Thanks for your input.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

$18,000 is the max. If the calculated amount is less, you get the lesser amount.

The calculated 2nd year amount on a $50K car is not $18,000.

The more I know the more I don’t know.