- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: ESPP

ESPP

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Hello,

I have a client that in 2019 sold stock through ESPP. TP hasn't worked for employer for years. She lives overseas thus has no W-2s. It's listed on the 1099-B on the informational page, but not part of the 1099-B that goes to the IRS, it gives an amount for ordinary income. I've normally added this amount to the wages line, but where should it be placed when there is no W-2?

Thanks

Best Answer Click here

![]() This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

This discussion has been locked.

No new contributions can be made. You may start a new discussion

here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

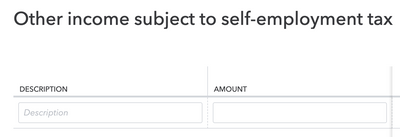

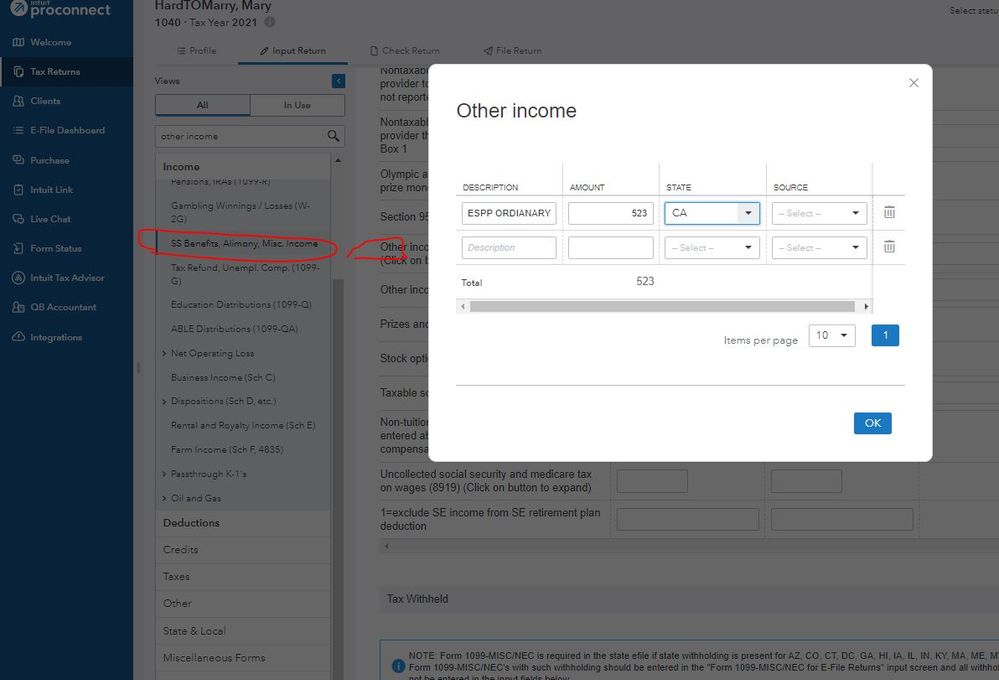

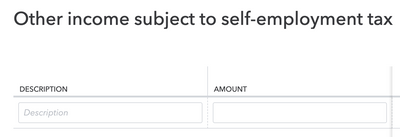

I think the input field should be "Other income subject to self-employment tax" as shown in the image below not just "Other income" without paying social security and medicare tax. You circled the first one, but you were showing the second one, so which one do you mean?

I think it is the first one because if the income were added to the w-2, it is subject to social security and medicare tax which is pretty much the same as self-employment tax.

However without that, the predefined input field "Excess salary deferrals" and excess dependent care benefit (w-2 box 10) treatment just add to the income with paying social security and medicare taxes, so I do not know why, do you?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think you may find what you want here

https://turbotax.intuit.com/tax-tips/investments-and-taxes/employee-stock-purchase-plans/L8NgMFpFX

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for the information.

I’ll have to call PTO to find out how to enter it as ordinary income.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

There is a search box at the top of the 1st column. Search Other Income (all of which is Ordinary) 1st with alimony.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I disagree with adding the ordinary income as an additional other income, on the contrary, this income should be entered as an adjustment as the cost basis of the stock which reduces the capital again.

the ordinary income means the difference between the ESPP employee price and market price has been already reported on the w-2 when the employee bought it. For example,

The market price for company X's stock is 100, an employee bought it for 85, the 15 dollars difference is the ordinary income which would be added to the employee's W-2 in the year she bought it.

Then the employee sells the stock for 120, the 1099-B will report the cost basis as 85, she should adjust it upward to 100.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

In this case the employee did not get a W-2. The ordinary income still needs to be reported.

The more I know the more I don’t know.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Also, the 1099-B says it’s Ordinary Income.

I’ve added the ord income to basis, plus added it to income as previously described.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I misspoke. The bargain element (the difference between the ESPP employee price and market price) is added to the W-2 on sale, not on purchase. Your treatment is correct.

It is the RSU that bargain element (the difference between the purchase price which is 0 and market price) is added to the W-2 on purchase.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I think the input field should be "Other income subject to self-employment tax" as shown in the image below not just "Other income" without paying social security and medicare tax. You circled the first one, but you were showing the second one, so which one do you mean?

I think it is the first one because if the income were added to the w-2, it is subject to social security and medicare tax which is pretty much the same as self-employment tax.

However without that, the predefined input field "Excess salary deferrals" and excess dependent care benefit (w-2 box 10) treatment just add to the income with paying social security and medicare taxes, so I do not know why, do you?