- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: E-file support for bona fide residents of Puerto Rico who must file 1040 or 1040-SR.

E-file support for bona fide residents of Puerto Rico who must file 1040 or 1040-SR.

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need to make an adjustment to the standard deduction for a bona fide Puerto Rican resident on form 1040, but I don't see the option on the ProConnect software. Does ProConnect support an e-file option for bona fide residents of Puerto Rico who must file a 1040 or 1040-SR?

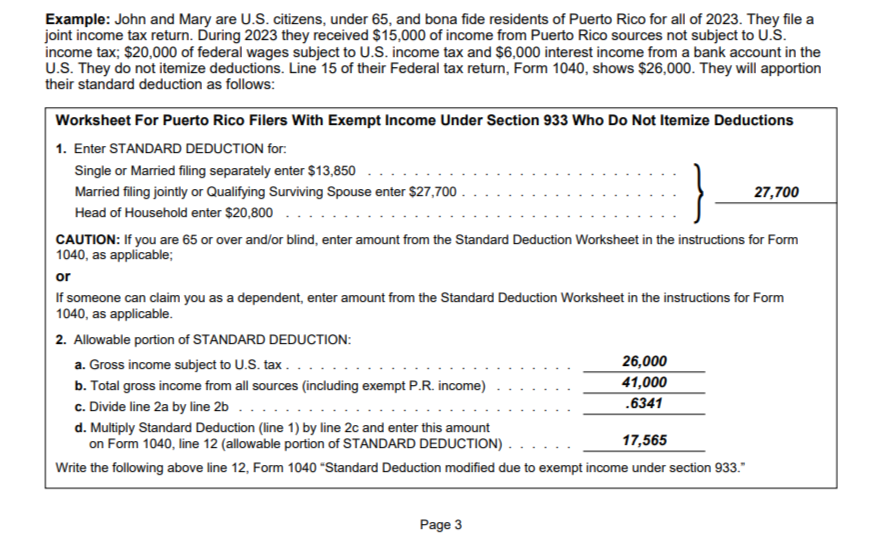

I've done my research, and my potential client would have to file a 1040 as he lived and worked a partial time in the continental U.S (Wisconsin), but then moved back to Puerto Rico. He received W-2 wages, so that income was subject to federal and state income taxes, so it makes sense to file as federal and state withholding were withheld from his paycheck and he could claim some of that money back. I have referenced Publication 570 and Publication 1321. Both publications are specific to Puerto Rican residents, but I don't quite see how I can apply the standard deduction adjustment on the software. I'm attaching a cropped picture of a Publication 1321 worksheet that references the adjustment. Any help on the topic would be appreciated. Thank in advance.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

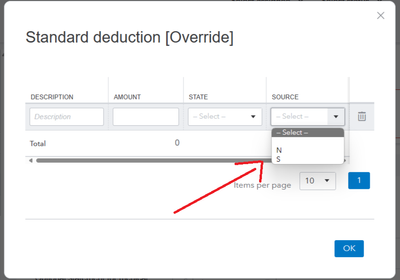

I think I found the solution to my problem. I noticed that I am able to override the standard deduction under Itemized Deductions (Schedule A), Less Common Scenarios and then under Standard Deduction [Override], but that kicks in a critical diagnostic error saying an override to the standard deduction does not let me e-file. I can unclick the e-file option on the Profile tab and then the software will let me proceed (but I guess that means that I will have to paper file instead of e-file). Another question that popped up while looking this up. What does N and S mean under SOURCE under the Standard deduction [Override] box? Here's a cropped picture for your reference.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Here explanation for N and S, not applicable here https://accountants.intuit.com/support/en-us/help-article/state-taxes/using-source-column-understand...

What is the filing status?

You cannot take the standard deduction if:

- You are a married individual filing as married filing separately whose spouse itemizes deductions.

- You are an individual who files a tax return for a period of less than 12 months because of a change in your annual accounting period.

- You were a nonresident alien or a dual-status alien during the year. However, nonresident aliens who are married to a U.S. citizen or resident alien at the end of the year and who choose to be treated as U.S. residents for tax purposes can take the standard deduction. For additional information, refer to Publication 519, U.S. Tax Guide for Aliens.

- You are filing as an estate or trust, common trust fund, or partnership.

Did you somehow make them a non resident alien? In Client information - State PR and Check the box for Full Year Resident and NOT check the Multi-State?

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Thanks for the article.

No, I didn't put them as a non-resident alien. I did put their residence as PR on the residence as 12/31 box, but that didn't seem to do much to the return.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Try US as the state.

Answers are easy. Questions are hard!