- Topics

- Training

- Community

- Product Help

- Industry Discussions

- User Groups

- Discover

- Resources

- Intuit Accountants Community

- :

- ProConnect Tax

- :

- ProConnect Tax Discussions

- :

- Re: Amount paid with 2022 federal extension Form 4868 filed manually.

Amount paid with 2022 federal extension Form 4868 filed manually.

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

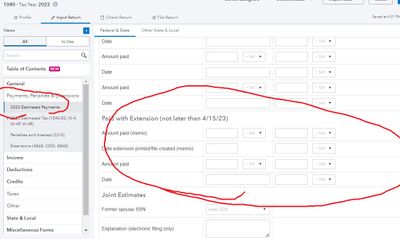

Where do I input the amount I paid in with my 2022 manually filed extension request Form 4868, so that it shows as a credit on my Form 1040?

Best Answer Click here

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ignore the grump. ProConnect is difficult to navigate. One point - If you know where you want the number to go. Check Return. Find the Form. Click on the box or line and it will jump to the input point (USUALLY)

Good Luck.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

You’ve come to an Intuit site supporting tax professionals, and you may be looking for support as an individual taxpayer. Please visit the TurboTax Help site for support.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Ignore the grump. ProConnect is difficult to navigate. One point - If you know where you want the number to go. Check Return. Find the Form. Click on the box or line and it will jump to the input point (USUALLY)

Good Luck.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Will do. Thank you very much.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@George4Tacks what you did helping him was Noble, but if everybody did their own tax returns then we wouldn't have much work. As it stands now, most of the work that we have are the complex returns, because those individuals or businesses cannot do it on their own, because they don't know how.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

IRS relies on voluntary compliance, but they audit a few returns with the hope that one person audited will tell ten friends that bad things happen when you cheat on taxes. Likewise, if one DIYer gets help here, not only will he come back for answers to more questions, perhaps having achieved Level 1 or Level 2 from the time spent already, but he will tell ten friends that it's much friendlier here than at the TurboTax forum.

Practitioners who like to answer questions for DIYers are, as far a I know, not prohibited from visiting the TurboTax site.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@BobKamman yeah and to top it off, some of them are sneaky, masquerading as paid tax professionals.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@PATAX wrote:

@BobKamman yeah and to top it off, some of them are sneaky, masquerading as paid tax professionals.

As in, "I have a client who sold his house that had an office I used for my consulting business, I mean my client's consulting business..."

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@edwardw posted a first question about software that is very hard to navigate. The official stance of Intuit is to send those users here, rather than point them to support. The question seems very legitimate for a tax professional. i did what either of the critics here should have done. I presented an easy to follow answer.

PATAX and @BobKamman - Have either of you tried to use ProConnect Tax Online? You can use it for FREE, up to, but not including PRINT or E-FILE. I have never completely used the software, but I enjoy challenges, so I go through all but the final steps to see HOW IT WORKS. Users have a tough road figgering it out, so I am happy to help. I am not noble in what I did here. I am simply doing what I offered to do. Help other users of the software. I also have a macro for the TT users, but I firmly relieve that this is not one. It was not the type of question Bob shared.

Answers are easy. Questions are hard!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

With the barn door open we have no way of knowing whether the OP is in the wrong place or even whether the respondents are in the wrong place. I've given a ProSeries answer to a ProConnect question before. Oops. I think like most folks here, I just follow the "main" feed which mixes ProSeries, Lacerte, ProConnect, TaxTalk, Ideas, and whatever else is out there. With that in mind I make a conscious effort to pay attention to the specific forum where the question was posted but even then sometimes I fail. This question in particular was a "where do I enter" question indicating ProConnect as the software. So I ignored it because I have no idea where to enter stuff in PTO. Without Jensen here on a regular basis, that leaves George to answer these things (or Intuit staff, or a Lacertian making a reasonable guess).

I'm not going to go through the myriad of possibilities but the two most likely ones are 1) The OP is using PTO and really can't figure out where to enter an extension payment, and 2) The OP is using TT and posted in the wrong place to get TT support.

If 1) then George's response was perfectly on target. If 2) then George's response yields little or no help to a TTer.

On the flip side, if 1) then Bob's response was inappropriate. If 2) then Bob's response was perfectly on target. I can't fault Bob for making an assumption that a Level 1 poster asking a very basic question is posting in the wrong place. Most of the time he'd be right.

Every one of us here was a first-time tax software user at some point, that doesn't mean we're not tax professionals. For most of us that was before there were Internet forums where we could ask questions. I no longer have to go ask my boss a question that makes me look like an idiot, now I can post my question online (and remove all doubt?)

Since I switched to Drake most of my questions have been of the "where do I enter" variety. There's nothing intuitive about it (pun intended) and I usually start my conversation with support as "this is probably the dumbest question you'll get all day but how do I get a number to show up on Form x Line y?" Or, in this case, Schedule 3 Line 10.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

@rbynaker wrote:

Since I switched to Drake most of my questions have been of the "where do I enter" variety.

how do I get a number to show up on Form x Line y?"

That's what I don't like about worksheet-based software. I want to be able to click the actual line on the form, and either enter it directly or it bring me to somewhere to enter it.